- XRP’s $2.16 support holds as buyers defend short-term levels amid rising volatility.

- Futures open interest nears $4B, signaling stronger volatility and leveraged positioning.

- Exchange outflows persist, showing cautious market sentiment near $2.23 consolidation.

XRP continues to stabilize near $2.23 after recovering sharply from the recent $1.82 low. The market is now watching a tightening structure that reflects rising volatility, shifting liquidity, and increasing leveraged exposure. XRP trades inside a narrow band where buyers defend short-term supports while futures activity builds ahead of a possible breakout.

This compression signals a decisive move as traders react to broader risk conditions and fluctuating flows. The latest chart behavior shows price holding short-term strength, yet the overall trend still reflects weakness from earlier losses. Hence, the next major direction will depend on whether buyers can sustain control above key Fibonacci levels.

Price Structure and Key Technical Barriers

XRP holds above the $2.16 area, which continues to act as dynamic support. The 9 EMA slopes higher and keeps the short-term trend aligned with buyers. Price also trades above the Bollinger mid-band, showing steady momentum.

Besides, the rebound from the $2.02 region reinforces a strong base. A deeper decline toward $1.82 remains possible if momentum fades.

Related: Pi Price Prediction: Market Watches Pullback as Supply Unlock Approaches

Resistance sits at $2.28 and $2.29, where XRP struggles to break higher. A move above this range opens space toward $2.36. That level aligns with the 0.618 Fibonacci zone and marks a decisive hurdle.

Additionally, the $2.50 region remains the stronger barrier where several rallies stalled earlier this month. A push through $2.51 would shift the broader trend toward $2.69.

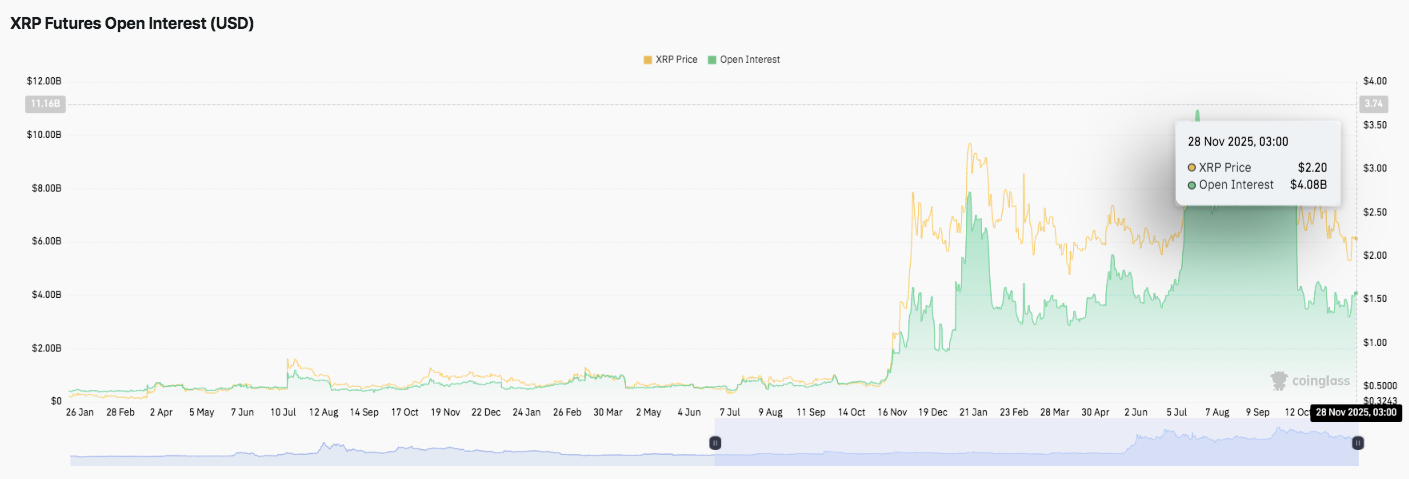

Rising Open Interest Signals Stronger Volatility Ahead

XRP futures open interest climbed toward the $4 billion mark on November 28. This increase shows heavier speculative activity. Traders appear to build leveraged positions during the current compression.

Moreover, open interest growth often precedes high-volatility moves as liquidity tightens. Both long and short exposures now influence price reactions. Consequently, sustained open interest at current levels could amplify the next move.

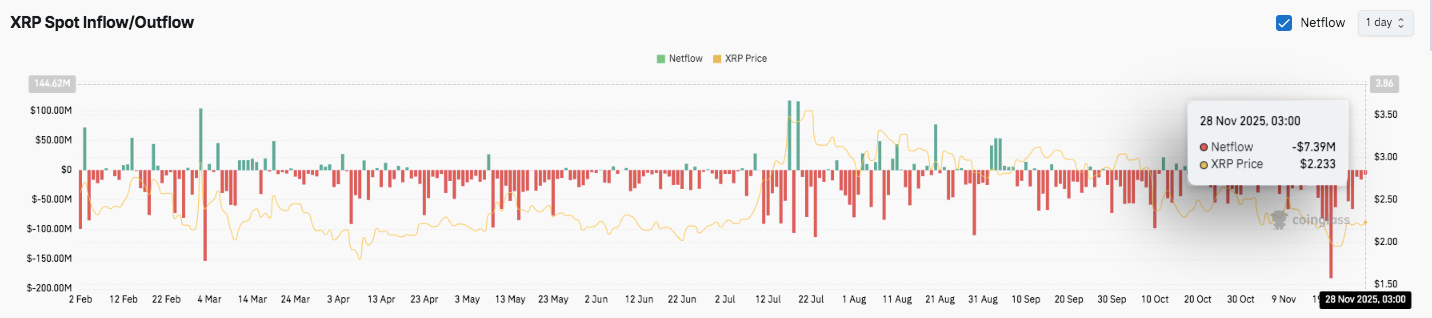

Spot Flows Reveal Cautious Market Sentiment

Exchange flows show consistent outflows through late November. Most sessions record withdrawals between $50 million and $150 million. This behavior signals cautious positioning as traders reduce exposure.

Sporadic inflow spikes appear during brief rallies, yet they remain smaller. Hence, accumulation pressure looks weak. The latest reading shows a net outflow near $7.39 million as price holds near $2.23.

Related: Ethereum Price Prediction: Rising Channel Hints at Ethereum Recovery

Moreover, the imbalance between inflows and outflows reinforces defensive sentiment. Traders now focus on the $2.03 support and $2.28 resistance. A break from this band will guide the next direction.

Technical Outlook for XRP Price

Key levels remain well-defined as XRP trades inside a tightening range heading into December.

Upside levels sit at $2.28, $2.36, and $2.50 as the immediate hurdles. A breakout above $2.50 could extend toward $2.69 and later $2.85 if momentum strengthens.

Downside levels remain at $2.16 as short-term support, followed by $2.03 and the cycle low at $1.82. The resistance ceiling at $2.36 (0.618 Fib) remains the critical level to flip for a broader bullish shift.

The technical picture shows XRP compressing between the 0.382 and 0.5 Fibonacci bands, creating a narrowing structure that usually precedes a sharp expansion in volatility. The market now waits for a decisive break as futures open interest climbs and spot flows lean defensive.

Will XRP Break Out Soon?

XRP’s short-term direction depends on whether buyers can defend the $2.16–$2.03 support cluster long enough to challenge the $2.28–$2.36 band. Persistent compression and rising leverage point toward a larger move ahead. If inflows increase alongside a clean close above $2.36, XRP could retest $2.50 and later $2.69.

However, failure to protect the $2.03 pivot risks exposing XRP to $1.90 and possibly $1.82, where the latest rally began. For now, XRP remains in a pivotal zone where volatility could expand in either direction. Traders continue to watch whether improving structure can align with stronger conviction flows to drive the next major leg.

Related: Solana (SOL) Price Prediction: Can Buyers Hold the Line Above $140?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.