- XRP consolidates near $2.54 as $560M whale accumulation contrasts with soft retail flows.

- ETF optimism rises after Bitwise CIO calls XRP fund a potential “billion-dollar product.”

- Key support sits at $2.42 with resistance at $2.70–$2.94 ahead of SEC decision.

XRP price today trades near $2.54, consolidating below key moving averages as traders weigh renewed optimism around potential ETF approval. The token remains squeezed inside a long-term symmetrical triangle, with price nearing its apex as volatility tightens.

ETF Optimism Sparks Debate Among Traders

Market sentiment toward XRP shifted sharply this week after Bitwise CIO Matt Hougan predicted that an XRP exchange-traded fund could “easily become a billion-dollar product within months” of launch. His comments revived interest among retail holders and large investors, particularly as 20 XRP ETF filings await U.S. Securities and Exchange Commission clearance.

Santiment data shows whale wallets added roughly $560 million worth of XRP in the past week, a move that suggests confidence in the asset’s longer-term narrative. This renewed accumulation contrasts with a broader decline across altcoins following the Federal Reserve’s rate guidance and fading liquidity in high-beta tokens.

XRP Price Faces Tight Range As Momentum Cools

On the daily chart, XRP price sits below the 20-day EMA at $2.55 and remains capped by the 50-day EMA near $2.67. The 100- and 200-day EMAs cluster around $2.72 and $2.61 respectively, forming a dense resistance zone that aligns with the upper boundary of the descending triangle pattern.

Related: Dogecoin Price Prediction: DOGE Consolidates as Open Interest Climbs

The lower support trendline near $2.42 has held since early June, marking a critical level that defines the broader structure. A decisive close below that area could trigger a retest of $2.20, where the 200-day average converges with prior breakout zones.

Momentum signals lean neutral to slightly bearish. The Supertrend indicator sits overhead at $2.89, confirming that sellers remain in short-term control. RSI readings hover near midrange levels, reflecting hesitation rather than capitulation.

Exchange Flows Reflect Mixed Sentiment

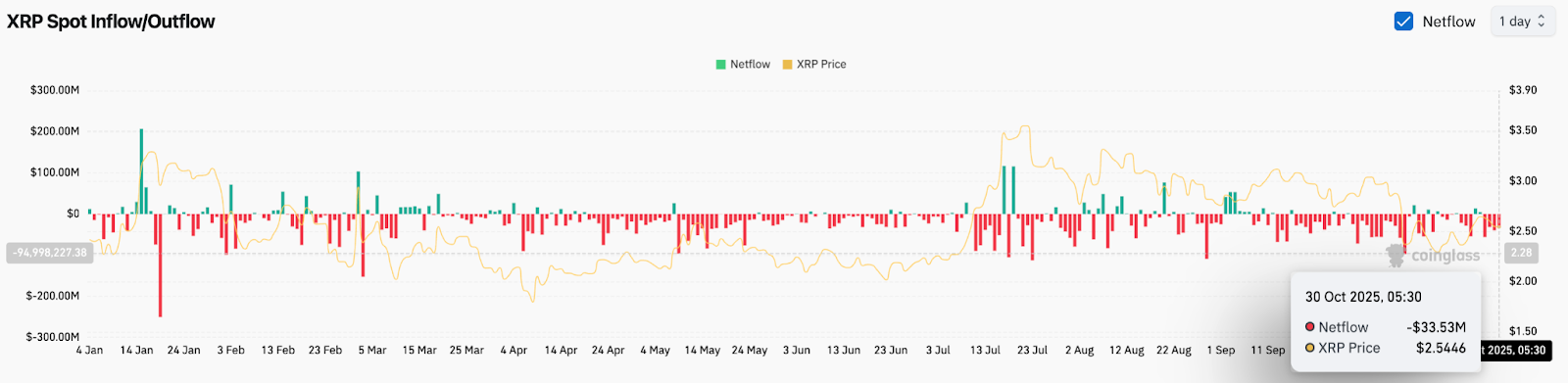

Data from Coinglass shows net outflows of roughly $33.5 million from centralized exchanges over the past 24 hours, signaling mild accumulation but not yet large-scale rotation into cold wallets. Historically, stronger inflows have accompanied short-term tops, while consistent outflows tend to mark base-building phases.

Related: Bitcoin Price Prediction: Analysts Warn Of Deeper Pullback as BlackRock Sells $2B BTC

Over the past month, XRP spot netflows have largely stayed negative, underscoring the caution among retail participants even as whale wallets accumulate. Traders continue to track this divergence closely, as it often precedes volatile swings in price direction.

Derivatives Data Points To Repositioning

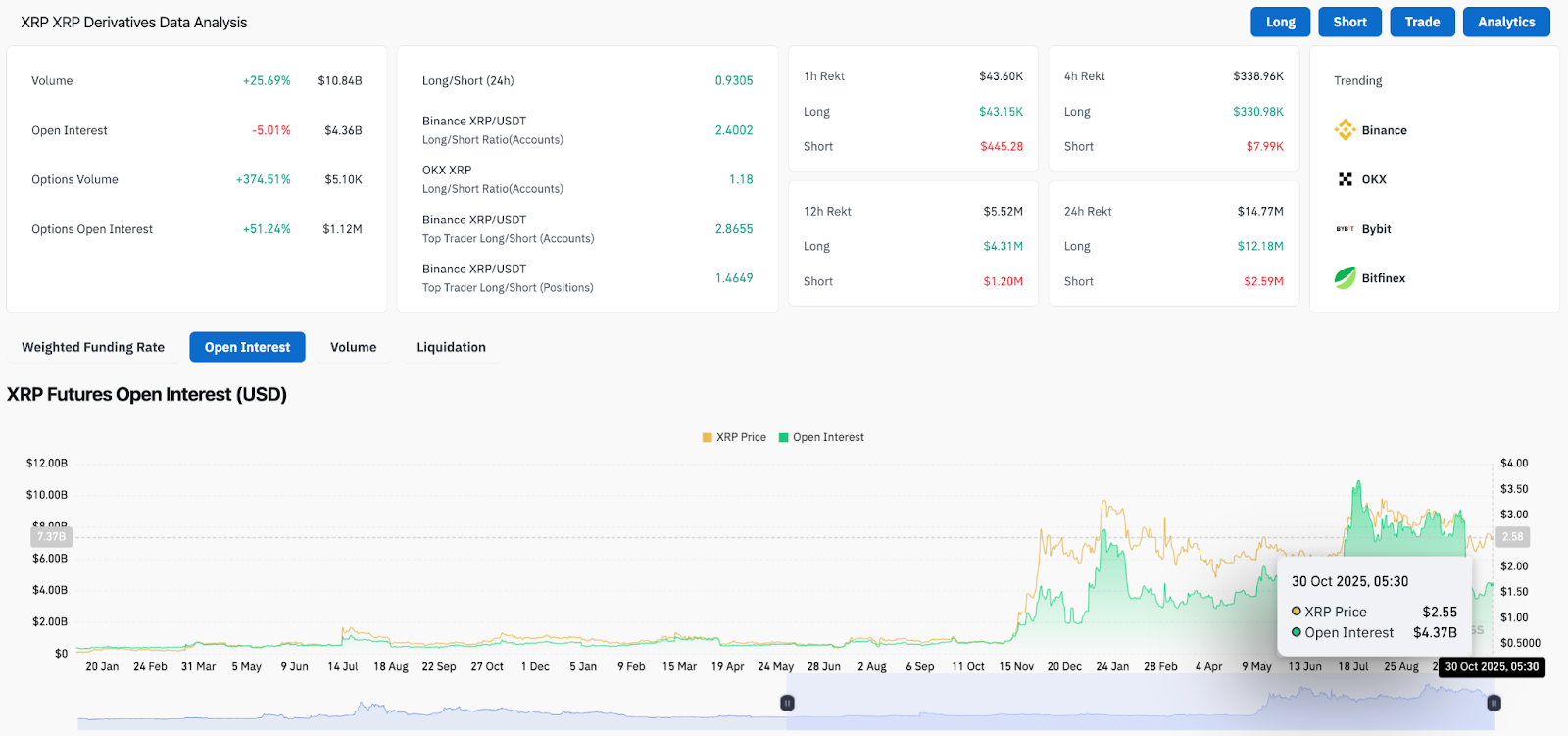

Derivatives metrics paint a more active picture. Open interest dropped by 5% to $4.36 billion even as trading volume surged 25% to $10.8 billion, suggesting profit-taking among leveraged traders. Options activity jumped sharply, with open interest up more than 50% in a single session, pointing to hedging behavior ahead of potential ETF headlines.

Long/short ratios remain elevated, with Binance showing 2.86 among top traders and 2.4 across all accounts. That imbalance increases the risk of a short-term flush if price fails to reclaim the $2.60–$2.70 range. Funding rates remain stable, implying that the market has yet to lean aggressively bullish.

Outlook: Will XRP Go Up?

For now, the XRP price prediction remains balanced between technical compression and growing speculative interest. A breakout above $2.70 would confirm renewed bullish momentum and expose targets near $2.91 and $3.10. Sustained volume above those levels could extend toward the $3.40 area, where prior highs align with the top of the long-term structure.

On the downside, failure to hold $2.42 would shift focus to $2.20, and a deeper flush could revisit $1.95 before any meaningful rebound.

Related: Zcash Price Prediction: Zcash Rally Builds as Open Interest Hits Yearly High

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.