- XRP price today holds $2.54 within a long-term triangle, with resistance tightening near $2.74–$2.80.

- Ripple Prime acquisition boosts institutional reach, embedding RLUSD and XRP Ledger in a $10B flow network.

- On-chain outflows and rising futures activity signal cautious bullish momentum ahead of a potential $2.90 breakout.

XRP price today trades near $2.54, posting mild gains as buyers defend key support within a long-term symmetrical triangle. The token has shown resilience this week, drawing confidence from Ripple’s expanding institutional footprint and steady derivatives activity.

XRP Holds Within Symmetrical Triangle

On the daily chart, XRP is consolidating inside a symmetrical triangle, with support near $2.53 and resistance tightening around $2.74–$2.80. The structure has been forming since July, compressing volatility and building tension ahead of a breakout.

The 20-EMA at $2.53 and 50-EMA at $2.69 currently act as the immediate pivot zone. The 100-EMA near $2.73 overlaps with the descending trendline, reinforcing resistance that must be cleared for upside confirmation.

A breakout above $2.80–$2.90 would signal a shift toward the prior highs above $3.20, while failure to hold above the 200-EMA at $2.61 could drag the price back toward $2.30.

The Supertrend indicator remains bearish at $2.89, but a close above that level would flip momentum in favor of buyers.

Ripple Prime Acquisition Adds Institutional Depth

Ripple’s acquisition of Hidden Road, now rebranded as Ripple Prime, is driving renewed optimism in the ecosystem.

The prime brokerage platform processes over $10 billion in daily transactions, offering Ripple a direct channel into global institutional liquidity.

Through this integration, Ripple plans to embed the XRP Ledger and the RLUSD stablecoin within Ripple Prime’s network.

The move will allow clients to transact using RLUSD and access on-chain settlement options tied to XRP’s infrastructure.

This expansion follows Ripple’s recent GTreasury buyout valued at over $1 billion, which brings enterprise cash-management clients into Ripple’s ecosystem. Combined with the Rail acquisition, Ripple now controls a vertically integrated flow between stablecoins, treasury operations, and prime services — positioning XRP as the liquidity bridge connecting them.

On-Chain Flows and Futures Positioning Signal Strength

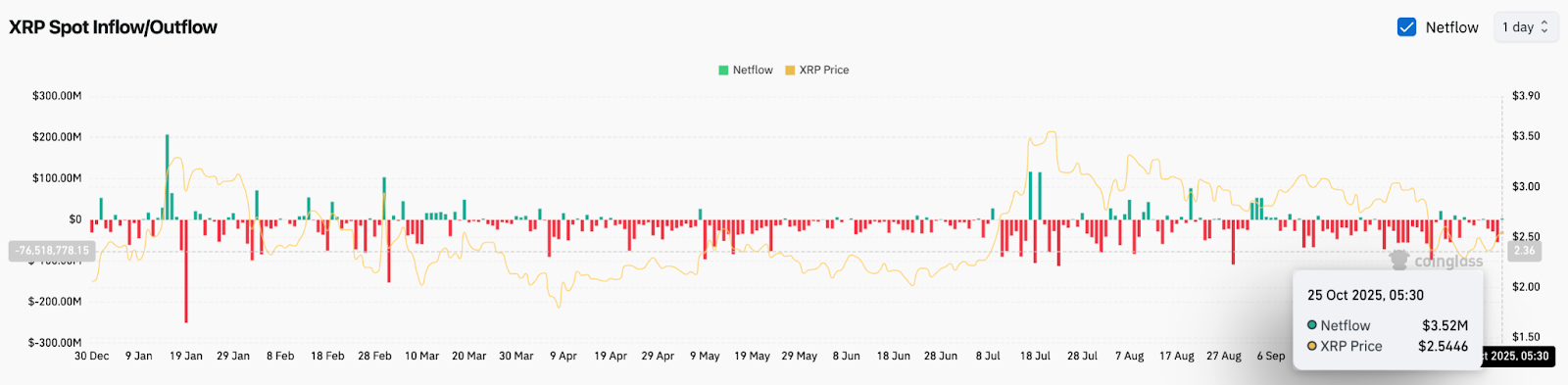

Coinglass data shows XRP recorded $3.5 million in net outflows on October 25, reflecting modest accumulation as tokens moved off exchanges. The negative netflow pattern, visible throughout October, suggests reduced supply pressure and restrained short-term selling.

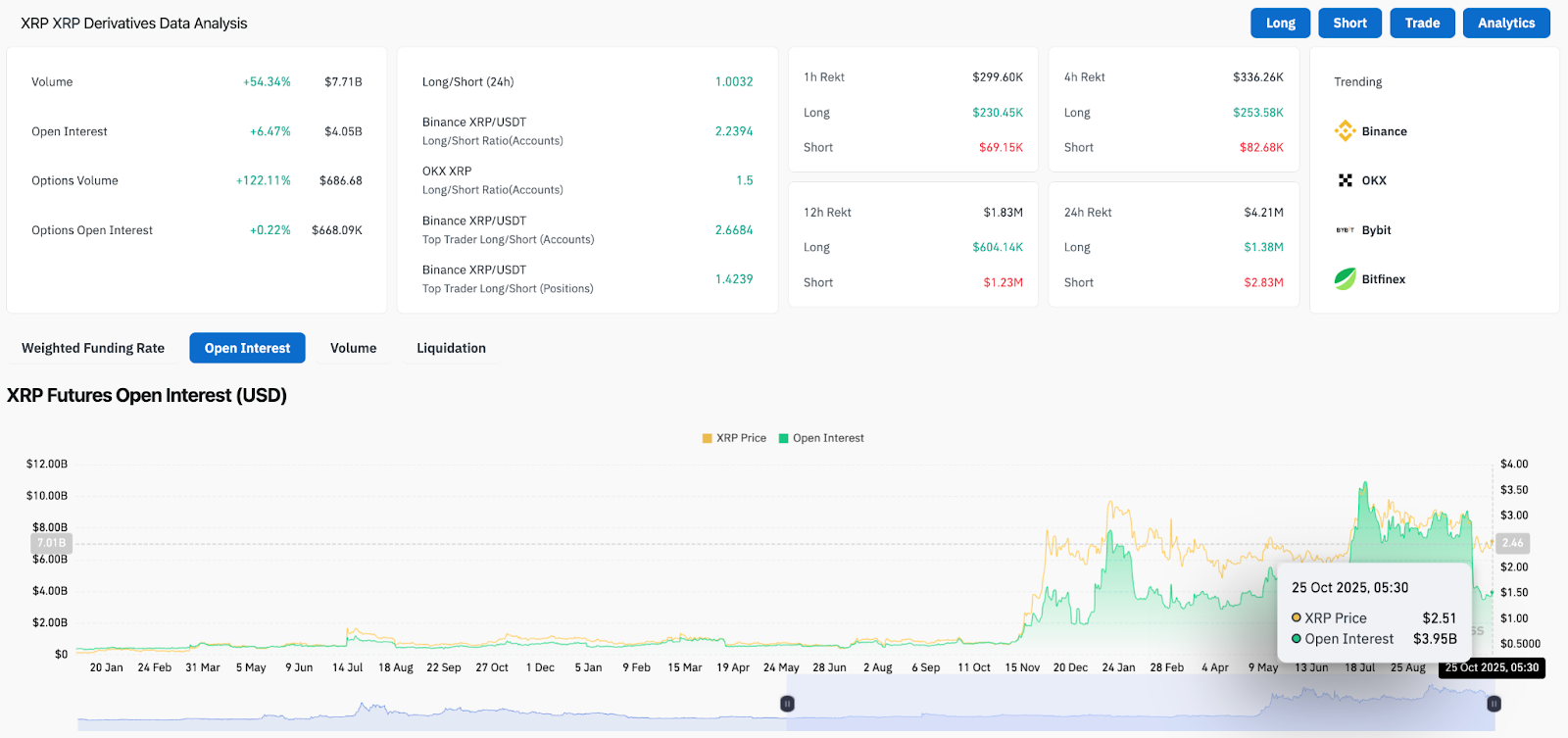

Derivatives metrics reinforce that institutional traders remain active. Open interest stands near $4.05 billion, up 6.5% over 24 hours, while daily futures volume has jumped 54% to $7.7 billion. Options volume has more than doubled, up 122%, indicating rising demand for leveraged exposure ahead of a potential breakout.

The long/short ratio across major venues like Binance and OKX remains positive at 1.42–2.23, showing a bias toward long positioning. Combined with steady outflows, the data point to a cautiously bullish structure beneath the surface of XRP price action.

Outlook: Will XRP Go Up?

XRP price remains at a pivotal stage. A decisive close above $2.80 would confirm a breakout from the multi-month triangle, targeting $2.95 and later $3.20–$3.25. Sustained buying above the Supertrend at $2.89 could validate this bullish scenario.

Failure to clear the resistance cluster, or a break below $2.50, would keep the pair trapped within consolidation and possibly invite a retest of $2.30.

XRP Forecast Table (26th October 2025)

| Technical Level | Zone / Indicator | Outlook |

| Key Support | $2.50–$2.30 | Structural base |

| Immediate Resistance | $2.74–$2.80 | Breakout zone |

| Next Upside Target | $2.95–$3.25 | Bullish continuation |

| Downside Risk | Below $2.50 | Range extension lower |

| Market Bias | Neutral-Bullish | Awaiting breakout confirmation |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.