- XRP price today trades near $2.42, up 2% as Ripple pushes deeper into traditional finance through new acquisitions and capital raises.

- $24.8 million in net inflows mark a shift toward accumulation, though low volume suggests cautious buyer participation.

- A breakout above $2.50 and the 200-EMA could trigger a run toward $2.70, while failure to hold $2.28 risks a pullback to $2.10.

XRP price today trades near $2.42, up 2% in the past 24 hours, as Ripple’s renewed push into traditional finance revives optimism around long-term adoption. The token remains inside a narrowing consolidation pattern, with technicals suggesting a potential breakout if momentum builds above key exponential moving averages.

Ripple’s Expansion Into Finance Lifts Sentiment

Ripple Labs is accelerating efforts to bridge digital assets with traditional finance, a strategy that could strengthen XRP’s utility.

At the Ripple Swell 2025 conference, CEO Brad Garlinghouse said the firm is investing heavily to integrate blockchain infrastructure into mainstream finance. Ripple’s acquisitions of Hidden Road and GTreasury, valued at over $2.3 billion, underscore its ambition to create a blockchain-based financial powerhouse.

The company also launched an over-the-counter trading service for institutions and raised $500 million in fresh capital, bringing its valuation to $40 billion. These moves position Ripple to leverage relaxed U.S. crypto regulations under President Trump’s administration and align with growing institutional adoption from banks like JPMorgan, Citi, and Bank of America.

Despite these developments, Ripple’s CEO cautioned that a lack of clear U.S. legislation remains a hurdle for full institutional integration, adding that “banks are waiting for that clarity before leaning in.”

Spot Flows Turn Positive But Volume Stays Light

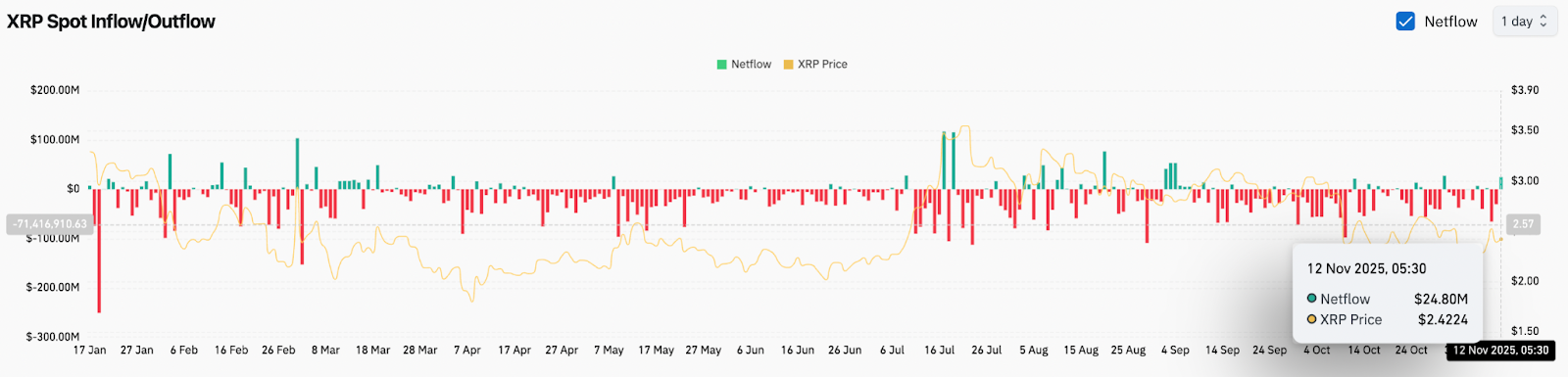

On-chain data from Coinglass shows $24.8 million in net inflows on November 12, marking a short-term shift from weeks of persistent outflows. This hints that traders are gradually moving XRP off exchanges, signaling a tilt toward accumulation.

However, volume remains relatively low, implying that the inflows are not yet strong enough to confirm broad institutional buying. Sustained inflows above $50 million per day would be needed to build momentum behind a meaningful price breakout.

Technicals Show Converging Structure Ahead Of Breakout

On the 4-hour chart, XRP trades within a symmetrical triangle that has tightened since early October. The token faces resistance at the 200-EMA ($2.49), which has capped every major rebound this month. A break and close above this level would likely attract fresh buyers.

The 20-, 50-, and 100-EMAs currently align between $2.38 and $2.41, forming a strong short-term support cluster. Holding this base keeps the bias neutral-to-bullish as long as price does not close below the ascending trendline near $2.28.

The RSI hovers around 59, suggesting mild bullish momentum but no signs of overextension. If buyers maintain control, a push through the triangle’s upper boundary could set up a test of the $2.60–$2.70 zone.

Outlook: Will XRP Go Up?

XRP is approaching a decisive point technically and fundamentally.

- Bullish case: A breakout above $2.50, confirmed by strong volume and positive netflows, opens the door toward $2.70 and later $3.00. Renewed optimism from Ripple’s traditional finance expansion could reinforce this upside.

- Bearish case: Failure to hold $2.28–$2.30 would invalidate the ascending support trendline, exposing the token to a correction toward $2.10 or even $1.95.

For now, the structure remains coiled, and the next move will depend on whether buyers can sustain pressure above the EMA cluster. A daily close above $2.49 would confirm a shift in momentum in favor of bulls heading into mid-November.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.