- XRP trades near $2.31 after rejecting the descending trendline, keeping upside capped below the EMA cluster.

- Rising open interest and volume signal fresh leveraged positions, hinting at renewed market activity.

- A close below $2.20 exposes $2.10 and $1.95, while reclaiming $2.42–$2.66 is needed to flip the structure bullish.

XRP trades near $2.31 at press time, hovering just above the critical demand zone between $2.20 and $2.25. The market shows weak buying momentum, with persistent lower highs on the daily chart as sellers continue to defend key moving averages.

Derivatives Activity Rises, But Bias Remains Mixed

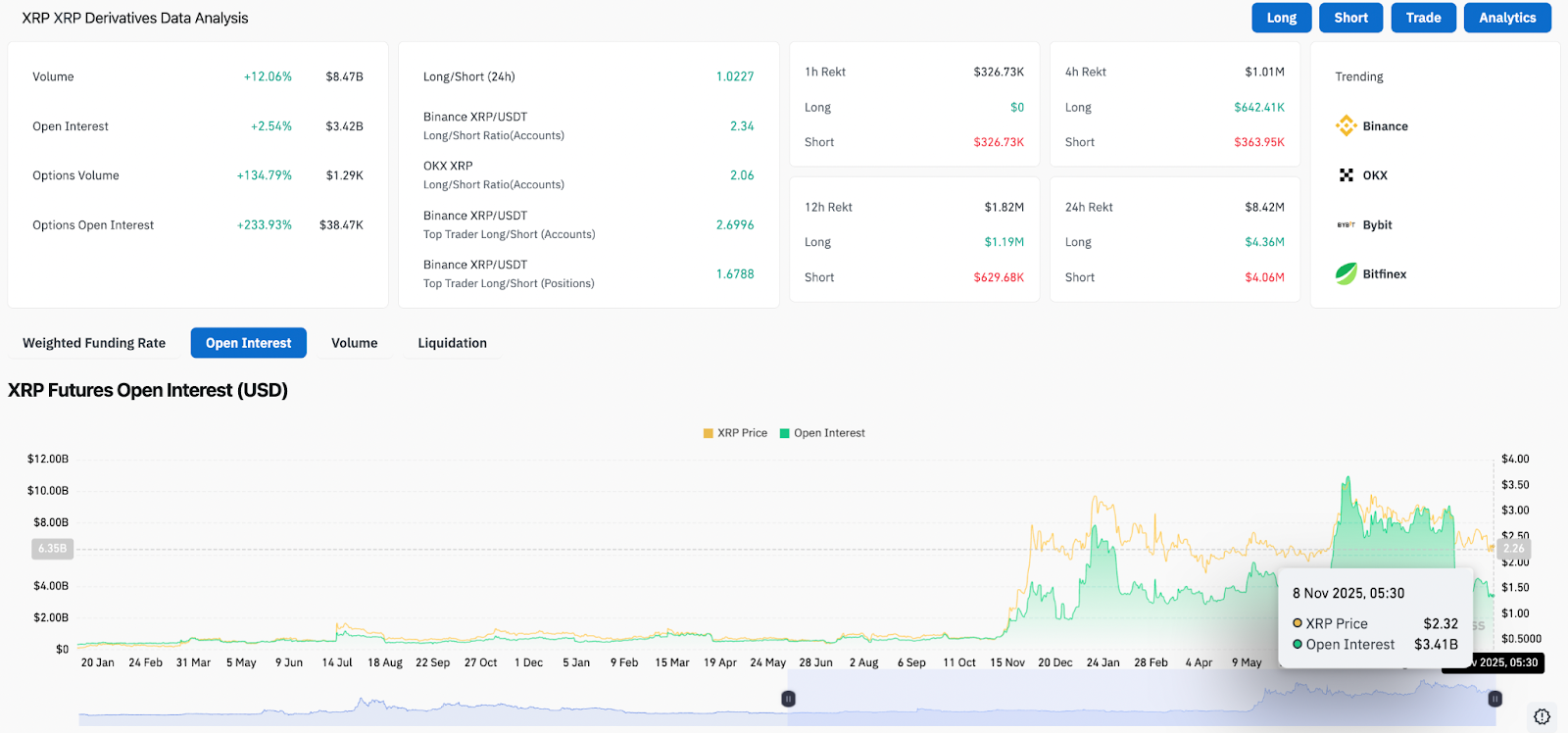

Futures open interest increased 2.54 percent to $3.42 billion. Volume also rose more than 12 percent. The increase in open interest indicates new positions are being built rather than old positions being unwound.

Options activity jumped sharply. Options volume rose nearly 135 percent during the last session, and options open interest increased 233 percent. The growth in options positioning reflects traders building exposure around upcoming volatility. However, it does not show a firm directional bias.

On top trader accounts, long positions are still higher than shorts across Binance and OKX. The Binance XRP USDT long-to-short ratio sits at 2.34, showing some traders are attempting to catch a reversal from support. Even with that, the price continues to struggle to move past resistance, which suggests buyers are using leverage but not spot demand.

Trendline Rejection Keeps Structure Weak

The daily chart shows XRP remains capped by the descending trendline. Multiple rejection points confirm this trendline as an active resistance.

Key observations on the current structure:

- XRP trades below the 20, 50, 100, and 200-day EMAs

- The EMA cluster between $2.42 and $2.66 forms a ceiling

- MACD remains below the signal line, with momentum weakening

Buyers attempted a rebound earlier this week but failed to reclaim the 20-day EMA at $2.42. That rejection pushed the price back toward the demand zone at $2.20 and $2.25. Losing this shelf would expose the deeper liquidity zone near $2.10, followed by the July breakout origin at $2.01.

Until XRP clears $2.48 on strong volume, momentum stays limited. Rejection at the EMAs suggests the path of least resistance is still lower.

Will XRP Go Up?

XRP trades at a crossroads. The trendline rejection shows sellers maintain control. Yet derivatives positioning shows interest from traders attempting to catch a reversal.

- Bullish case: XRP rebounds from $2.20 and clears $2.42, then $2.66. Reclaiming the EMA cluster would confirm the first structural shift. That breakout targets $2.85, then $3.10.

- Bearish case: A daily close below $2.20 confirms loss of the demand block and exposes $2.10. If that level fails, the structure opens deeper downside toward $1.95.

Related: https://coinedition.com/xrp-price-faces-deeper-correction-analyst-warns-of-1-9-retest-ahead/

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.