- XRP consolidates inside a triangle with support at $2.85 and resistance near $3.20.

- Trump’s pro-crypto comments fuel speculation of Ripple’s role in U.S. financial modernization.

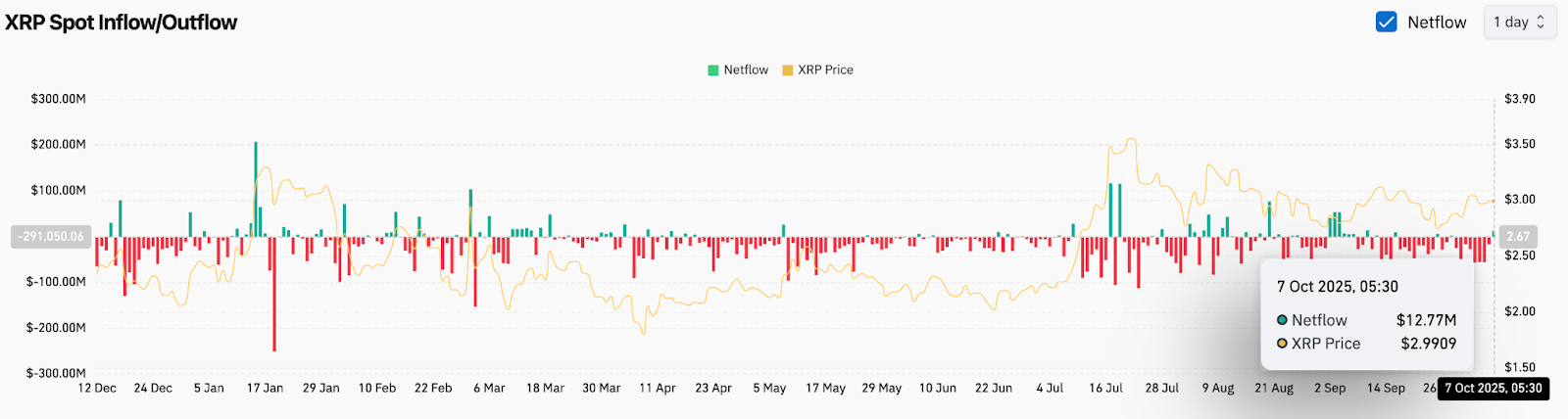

- On-chain data shows $12.7M inflow, marking first accumulation after a week of outflows.

XRP (CRYPTO: XRP) price today is trading near $2.98, consolidating within a tightening symmetrical triangle pattern as shown on the daily chart. The token continues to hold above key support around $2.85–$2.88, while resistance remains capped near $3.10–$3.20. Traders are watching closely as technical compression aligns with renewed on-chain inflows and political signals that have injected fresh optimism into the market.

XRP Price Consolidates In Symmetrical Triangle

XRP’s chart structure highlights a narrowing range between the $2.85 base and the upper trendline near $3.20, signaling a potential breakout phase. The 20-day EMA sits around $2.94, with the 50-day EMA at $2.93 and 100-day EMA at $2.85, all converging tightly—a classic sign of a high-volatility move ahead.

As long as XRP remains above the ascending trendline from June lows, the broader uptrend remains intact. A breakout above $3.20 could open the door toward $3.35 and $3.60, while losing $2.85 could expose deeper downside toward the 200-day EMA near $2.63.

Related: Bitcoin Price Prediction: Strategy’s $3.9B Gain Boosts Sentiment

Momentum remains neutral but constructive, as the OBV (On-Balance Volume) line trends higher, indicating that accumulation persists despite short-term price stagnation.

Trump’s Crypto Remarks Ignite XRP Speculation

Social media activity spiked on October 6 after a speech by Donald Trump referenced plans to “upgrade the ancient U.S. financial system using state-of-the-art crypto technology.” The clip, shared by community member JackTheRippler, drew over 180,000 views in hours and triggered a surge in XRP-related discussions.

The timing of Trump’s remarks, which was just after a meeting reportedly involving Ripple executives, has amplified speculation that Ripple (XRP) could play a role in broader U.S. financial modernization efforts. Though no official partnership has been confirmed, traders view the rhetoric as a signal of pro-crypto policy momentum, a theme that could strengthen institutional interest in XRP.

On-Chain Data Shows Return Of Positive Flows

On-chain metrics from Coinglass indicate a $12.77 million net inflow into XRP markets on October 7, marking the first positive reading after nearly a week of outflows exceeding $22 million. While modest, this reversal reflects early signs of renewed accumulation following Trump’s comments.

Related: Pi Price Prediction: Bearish Channel Persists as Pi Struggles Near $0.26

Historically, sustained inflows of this scale have preceded short-term bullish reversals for XRP, especially when combined with tightening volatility bands. Analysts caution, however, that the market still needs consistent inflows above $25 million per day to confirm conviction from larger participants.

Technical Outlook For XRP Price

| Direction | Key Levels |

| Upside targets | $3.20, $3.35, $3.60 |

| Downside supports | $2.85, $2.63, $2.40 |

| Trend bias | Neutral-to-bullish within triangle |

| Momentum signal | Accumulation continuing, breakout likely near-term |

Outlook: Will XRP Go Up?

XRP’s short-term trajectory hinges on whether bulls can capitalize on improving sentiment and reclaim the $3.20 resistance line. The alignment of political interest, technical compression, and mild on-chain inflows creates a balanced but constructive backdrop.

As long as XRP price today stays above $2.85, analysts remain cautiously optimistic that the next move could favor the upside. A confirmed close above $3.20 would validate a bullish continuation toward $3.35–$3.60, while failure to hold current support could delay momentum and drag price back toward $2.63.

Related: Litecoin Price Prediction: Bulls Hold Ground Above $118 Despite ETF Delay

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.