- XRP price today trades at $2.87, struggling below $2.95 resistance as sellers dominate.

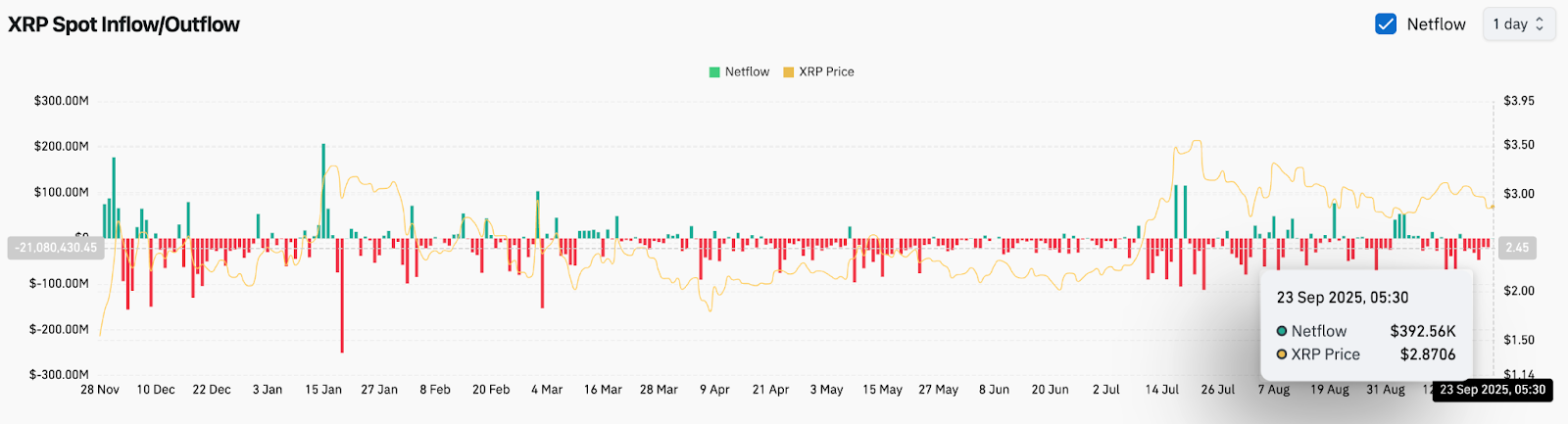

- On-chain flows show modest $392K inflows, but overall sentiment remains tilted bearish.

- Macro headwinds from Fed caution and dollar strength add pressure on crypto markets.

XRP price today is trading at $2.87, struggling to recover after slipping below the $2.95 resistance zone. Sellers forced a retest of $2.84 earlier in the session, extending a week-long downtrend that has left the token at its weakest levels since late August. The question now is whether XRP can hold support near $2.83 or risk another leg lower toward $2.60.

XRP Price Breaks Below Key EMAs

The daily chart shows XRP trapped within a falling wedge pattern since July, with price repeatedly rejected at descending trendline resistance. Yesterday’s rejection near $2.95 coincided with the 20-day EMA, which remains aligned with the 50-day EMA at $2.95, keeping sellers in control.

Support now rests at $2.83, with deeper protection at the 200-day EMA near $2.59. Losing this area would expose price to the $2.40–$2.20 zone, unwinding gains from June. The On-Balance Volume line has trended lower since mid-August, showing a lack of accumulation behind the recent bounce attempts.

Related: Avalanche (AVAX) Price Prediction: Will AVAX Hit $50 Soon?

Momentum signals echo the bearish tilt. RSI has slipped below neutral levels, and the MACD histogram continues to print red bars, reflecting sustained downside pressure.

Macro Factors Pressure XRP

XRP price action has mirrored the broader crypto selloff driven by macro headwinds. While the Federal Reserve cut its policy rate to 4.00–4.25% last week, Chair Powell’s cautious remarks on inflation signaled that rapid easing is unlikely. The stronger U.S. dollar and profit-taking across bitcoin and ethereum have further dampened sentiment.

Joel Kruger, strategist at LMAX Group, explained that investors are waiting for upcoming PCE inflation data and a wave of Fed commentary before extending risk positions. “Any near-term dips should be well-supported,” he said, noting that crypto could still benefit from a strong Q4 if macro conditions align. For now, traders remain defensive, and XRP has not escaped the wave of red across the crypto heatmap.

On-Chain Flows Show Modest Inflows

Exchange data offers some relief. XRP recorded $392,000 in net inflows on September 23, suggesting selective accumulation despite weak price action. This figure is relatively small compared to the $100 million–plus outflows seen earlier this year, but it signals that some traders are positioning ahead of potential catalysts.

Still, the overall balance of flows remains negative, with persistent outflows dominating September. Without stronger and sustained inflows, XRP price volatility is likely to remain tilted to the downside in the short term.

U.S. Treasury Payment Modernization Adds Speculation

Adding intrigue, the U.S. Treasury has scheduled September 30 for a modernization of its payment infrastructure, sparking speculation about potential use cases for XRP. While no official confirmation links the initiative to Ripple, the timing has captured attention across social media.

Analysts caution that speculation alone may not sustain price action in the face of current technical weakness. However, if institutional or regulatory clarity emerges alongside the Treasury event, it could act as a short-term catalyst.

Technical Outlook For XRP Price

The technical setup for XRP highlights critical support and resistance levels in the days ahead.

- Upside levels: $2.95, $3.10, and $3.35

- Downside levels: $2.83, $2.60, and $2.40

- Trend support: $2.59 (200-day EMA)

Outlook: Will XRP Go Up?

The outlook for XRP depends on whether buyers can defend the $2.83 zone and reclaim $2.95 resistance. Macro conditions remain heavy, with the U.S. dollar strength and Fed caution limiting upside momentum. On-chain flows provide mild optimism, but not enough to counter broad selling pressure.

If XRP holds above $2.83 and attracts stronger inflows, a rebound toward $3.10 is possible. Failure here, however, would likely extend losses toward $2.60. For now, XRP remains under pressure, with investors watching September 30 as the next potential catalyst.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.