- XRP stabilizes near $2.20 as buyers slowly regain control after heavy November selling

- Key resistance zones between $2.25–$2.35 now determine whether momentum can sustain

- Futures and spot flows show cautious sentiment as outflows dominate most sessions

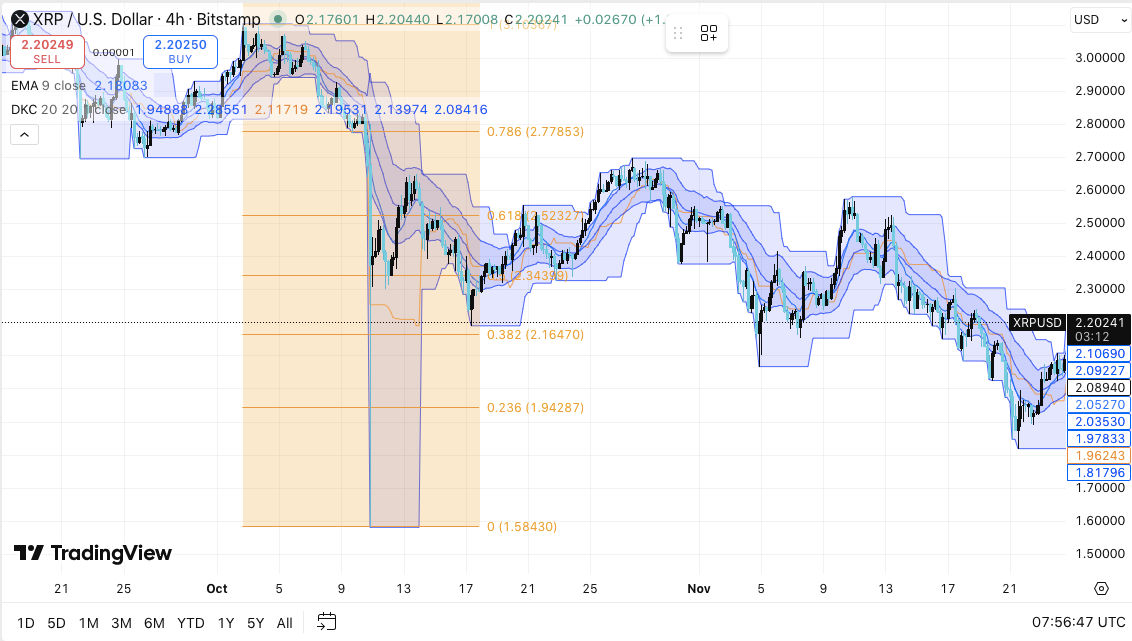

XRP is trying to regain bullish momentum after a sharp multi-week decline that pushed the token toward a $1.82 low. The asset now trades near $2.20, where price action shows early signs of stabilization following heavy sell-side pressure across November.

Traders are watching this zone closely because it sits between critical resistance overhead and renewed support developing on lower timeframes. The market remains cautious, yet the latest structure suggests that buyers are slowly attempting to rebuild confidence. This development comes at a time when leverage activity, spot flows, and volatility expectations continue to shift across the broader market.

Short-Term Structure Shows Signs of Improvement

XRP’s 4-hour chart shows persistent lower highs and lower lows since early November. However, the structure is beginning to change as price rebounds from the $1.82 level and retests short-term support.

The Dynamic Keltner Channels now show price climbing back above the mid-band for the first time in several days. Moreover, XRP trades above the EMA 9, which sits near $2.10, and this area remains important for sustaining momentum. A steady hold above this level could attract additional buyers and strengthen the recovery attempt.

Related: Ethereum Price Prediction: ETH Stalls Near $3,000 as Spot Outflows Crush ETF Bid Support

Resistance remains heavy between $2.25 and $2.28, where the 0.382 retracement aligns with the mid-channel barrier. Additionally, the $2.34–$2.35 cluster marks the 0.5 retracement area from the October decline. A breakout above this zone could open the path toward $2.52 and $2.53, where the 0.618 level historically capped rallies. Hence, the current range requires decisive movement before the trend confirms a clear direction.

Leverage and Spot Flows Point to Cautious Engagement

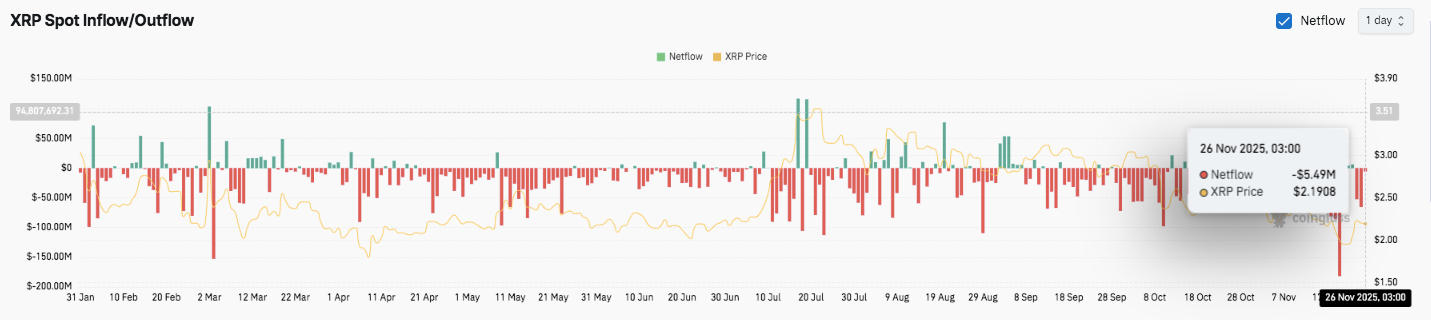

XRP futures open interest shows a notable shift in behavior through 2025. It expanded rapidly during the rally toward $3.50 and peaked near $10 billion in early August.

Open interest has since eased, although it still holds around $3.9 billion as of November 26. This level signals steady market participation as traders wait for a new volatility phase. The leverage structure now appears more balanced, reflecting caution after the earlier cycle peak.

Spot inflows and outflows provide another critical signal. Most sessions show heavier outflows, indicating that distribution remains the dominant theme. On November 26, the market recorded a net outflow near $5.49 million.

Additionally, inflow spikes remain brief and smaller than the sustained sell-side periods. Consequently, market participants continue reducing exposure during rallies.

Technical Outlook for XRP Price

Key levels remain clearly defined as XRP navigates an important recovery phase near $2.20. Upside levels sit at $2.25, $2.34, and $2.52, which form the immediate hurdles for buyers. A breakout beyond the $2.52–$2.53 region could open the path toward $2.77 if momentum strengthens.

Related: Pi Price Prediction: Pi Nears Breakout Amid Scams, Speculation, and Utility

Downside levels start at $2.10, which aligns with the reclaimed short-term support zone. The next critical area stands at $1.98, sitting along the lower band of the Dynamic Keltner Channels. The major downside invalidation remains at $1.82, which marked the recent swing low.

The resistance ceiling sits at $2.35, aligned with the 0.5 Fibonacci zone. This level is the key threshold buyers must flip to establish medium-term bullish momentum.

The technical picture shows XRP compressing between rising short-term support and layered Fibonacci resistance. This structure often precedes a decisive volatility expansion in either direction. The price now trades inside a tightening mid-channel zone, where reclaiming control above the EMA 9 guides near-term bias.

Will XRP Break Higher?

XRP’s next move depends on whether buyers can defend the $2.10 support long enough to mount pressure against the $2.25–$2.28 cluster. A strong push through that range may allow a retest of $2.34 and eventually $2.52. Market conditions also point toward increasing volatility as open interest remains elevated and price stabilizes into a narrow structure.

If bullish momentum strengthens with improving flows, XRP could revisit the higher retracement zones that define the broader recovery path. Failure to hold $2.10, however, risks exposing the asset to deeper tests toward $1.98 and possibly the $1.82 base.

Related: World Liberty Financial Price Prediction: Strategic Buys and Inflows Fuel Fresh Uptrend

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.