- XRP stays range-bound as sellers cap rallies near $2.16 while volatility compresses.

- Cooling open interest near $4B signals reduced leverage as failed breakouts ease demand.

- Ripple’s Singapore approval boosts regional adoption prospects despite cautious flows.

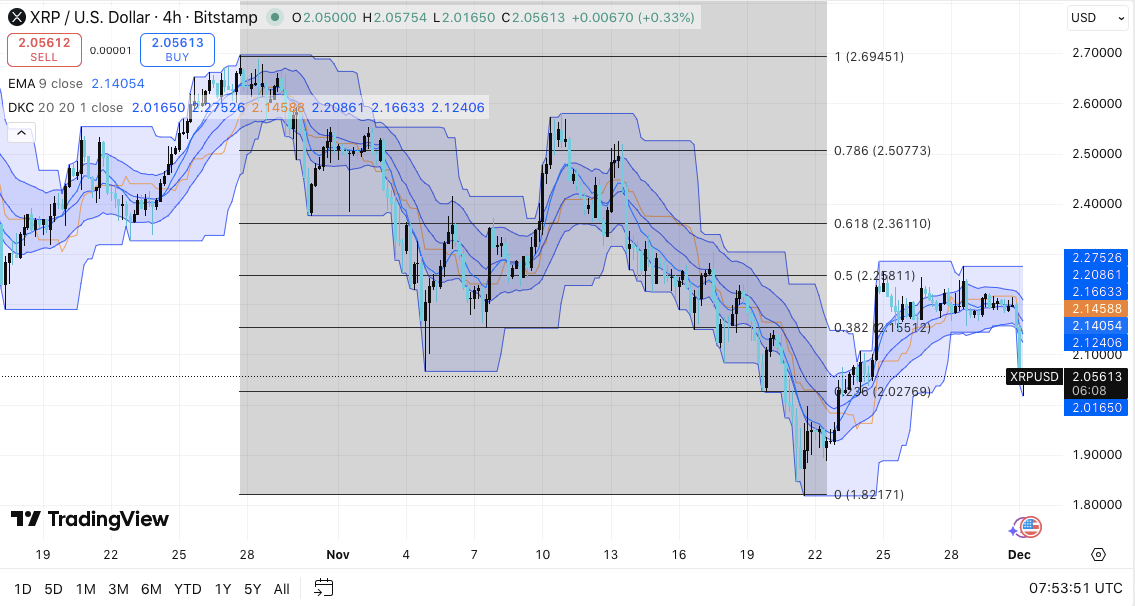

XRP traded near $2.05 on Monday as buyers tried to hold the range floor after several failed attempts to break through the mid-range barrier. The market showed heavy volatility across November, yet XRP kept moving within a defined structure that continues to guide short-term expectations.

Many traders focused on the price reaction around $2.02 and $2.16 because these levels shaped every move during the past week. Moreover, Ripple’s expanded regulatory clearance in Singapore added a new layer of interest for regional adoption, creating a broader backdrop for XRP’s long-term utility.

Price Structure Stays Capped by Mid-Range Barriers

XRP attempted to push above $2.15 several times in recent days. Sellers rejected every attempt, keeping the price under the 38.2% retracement zone. This zone has acted as a supply wall and limited momentum throughout the week.

Besides this rejection, the 4-hour chart showed price trading below short-term EMAs. That shift reduced bullish confidence and signaled weaker intraday demand.

The broader range now stretches between $2.02 and $2.28. XRP keeps oscillating inside this band. Moreover, both Donchian and Keltner channels show continued compression, which often precedes a decisive breakout.

A hold above $2.02 keeps the structure intact. A break below $2.00 opens the lower supports near $1.98 and $1.90. However, a move above $2.16 could trigger a run toward $2.28 and $2.36.

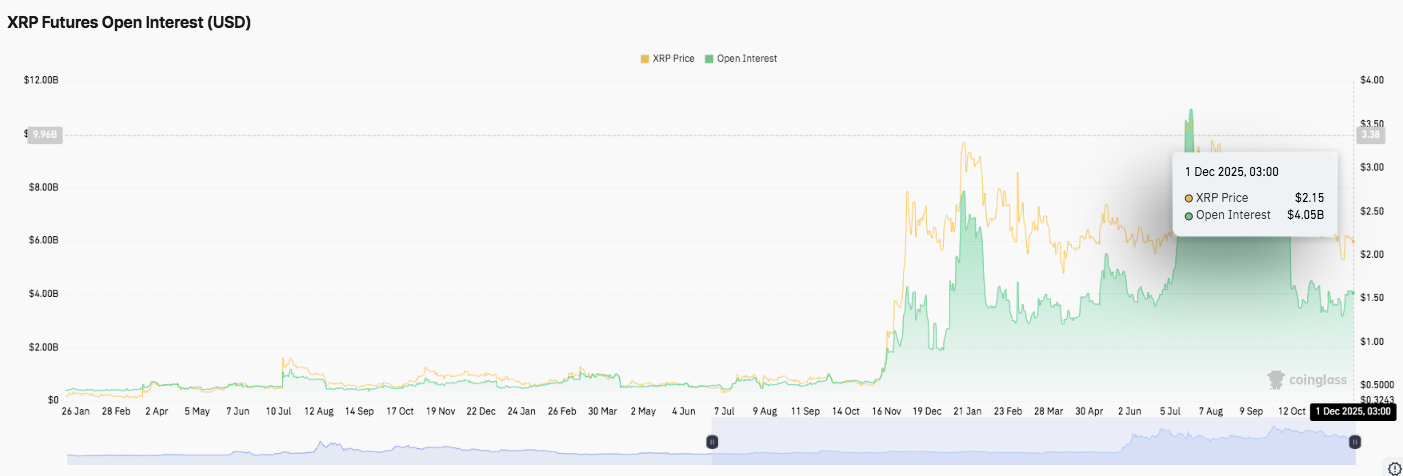

Leverage Cools After Months of Intense Activity

XRP’s open interest climbed through mid-year as traders added significant leverage during every rally attempt. Open interest surged above $4 billion during periods of strong volatility. Every spike ended with sharp pullbacks, which highlighted unstable long exposure.

By December 1, the figure eased to almost $4.05 billion. The cooldown reflected reduced risk appetite after repeated failures to break major resistance. Moreover, the reduction aligned with the tightening volatility bands on the price chart.

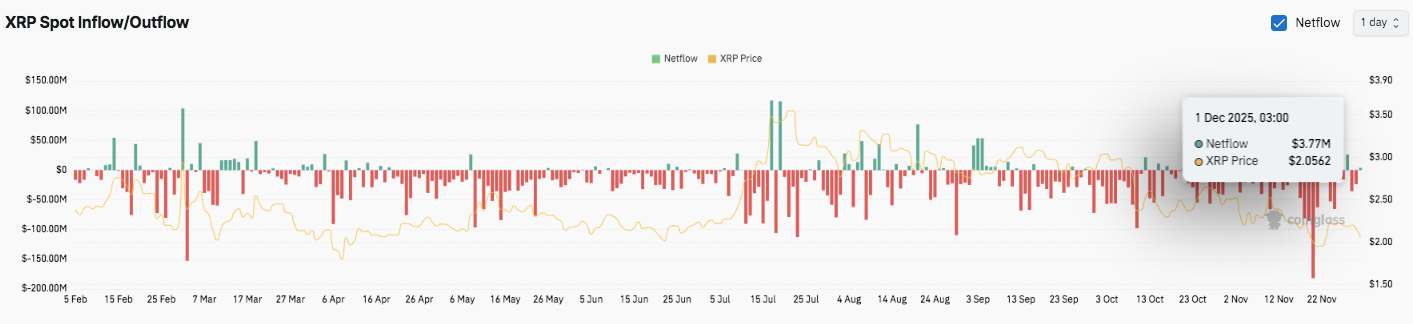

Flow Data Shows Heavy Outflows Despite Short-Term Stability

Exchange flows leaned negative for months. Many sessions recorded persistent outflows that matched the price weakness between July and November. However, small inflow bursts appeared at times. These bursts never changed the broader trend.

December opened with a rare positive inflow near $3.7 million. That move suggested early accumulation, although market sentiment still looked cautious.

Ripple Gains Wider Regulatory Clearance in Singapore

Ripple received approval to broaden its payment offerings under its Major Payment Institution license in Singapore. The expansion supports the firm’s push to strengthen regulated payment infrastructure and widen coverage for services linked to XRP and RLUSD. Additionally, the decision aligns with regional demand for faster settlement tools and builds on Singapore’s wider digital-asset strategy.

Ripple now plans to scale payment solutions for institutions that seek quicker settlement rails across Asia. The expansion also strengthens long-term interest in XRP’s role within regulated financial environments.

Technical Outlook for XRP Price

Key levels remain well-defined as XRP trades inside a tightening structure near the mid-range.

Upside hurdles sit at $2.16, $2.28, and $2.36, each aligning with key Fib retracements on the 4-hour chart. A breakout above $2.16 opens the path toward the $2.28–$2.30 pivot, while sustained strength could extend the move toward $2.36 and the $2.50 resistance cluster.

Downside levels include the $2.02 support zone, followed by the $1.98–$2.00 consolidation shelf. Losing that shelf exposes the broader range floor near $1.82, which remains the final support protecting XRP’s medium-term structure. The $2.16 ceiling remains the key level to flip for buyers aiming to regain momentum and challenge the mid-range.

The technical picture shows XRP compressing inside the Keltner and Donchian channels, which signals volatility tightening ahead of a decisive move. Price continues to hold inside a horizontal range, but momentum weakens each time XRP fails to reclaim the short-term EMAs.

Will XRP Go Up?

XRP’s next directional move hinges on whether buyers can defend $2.02 long enough to push another test of $2.16. Sustained inflows and stronger spot demand would increase the likelihood of a breakout toward $2.28 and $2.36. A breakout above the $2.30 midpoint would shift sentiment toward a bullish continuation phase.

Failure to hold $2.02, however, risks breaking the short-term structure and pulling XRP toward $1.98, with an extended decline opening the door to $1.90 and even $1.82. For now, XRP remains in a pivotal zone. The tightening volatility bands point toward a large move, but confirmation from price and flows remains essential before the next leg develops.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.