- XRP consolidates near $2.04, signaling digestion after late-2025 rally gains.

- Key resistance at $2.09–$2.11 must break to restore bullish momentum.

- Cardano’s Midnight protocol may enable cross-chain DeFi with XRP and BTC.

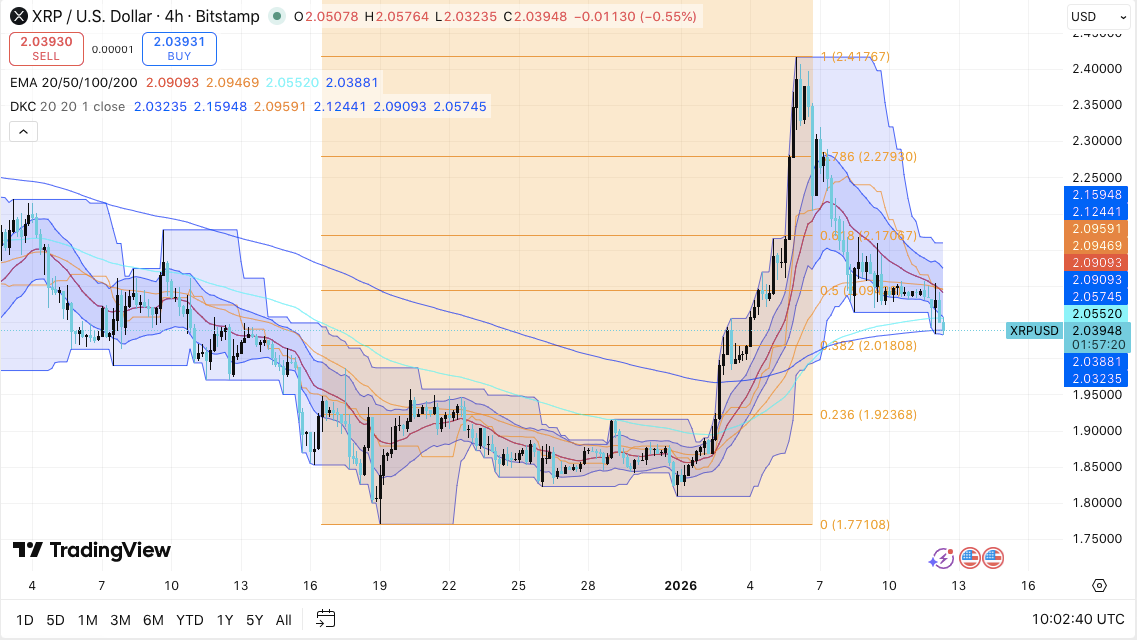

XRP continued to trade in a consolidation phase after a strong late-year rally, with price stabilizing near the $2.04 area on the 4-hour Bitstamp chart. The market appeared to pause rather than reverse, as traders assessed prior gains and adjusted leverage exposure.

Consequently, short-term volatility compressed while the broader structure remained constructive. Higher-timeframe trends still reflected higher highs and higher lows, suggesting the recent pullback acted as digestion, not distribution. However, near-term direction increasingly depended on whether buyers could reclaim nearby resistance zones.

XRP Technical Levels Shape Near-Term Direction

On the 4-hour timeframe, XRP hovered just below key moving averages, signaling cooling momentum. Besides that, narrowing price ranges pointed toward an upcoming expansion phase.

Immediate resistance clustered between $2.09 and $2.11, where the 50-period EMA aligned with the 0.5 Fibonacci retracement. A decisive break above this band would likely restore bullish momentum. Additionally, $2.17 emerged as the next upside trigger, followed by the $2.28 to $2.30 supply zone.

Related: Render Price Prediction 2026: AI Compute Pivot and Enterprise GPUs Target $5-$8

Support remained equally defined. The $2.02 to $2.01 region provided the first defense, reinforced by the 0.382 Fibonacci level. Hence, holding above the $2.00 psychological mark remained critical. A failure there could extend the retracement toward $1.92 to $1.93, where buyers previously defended structure.

Derivatives and Spot Flows Signal Market Reset

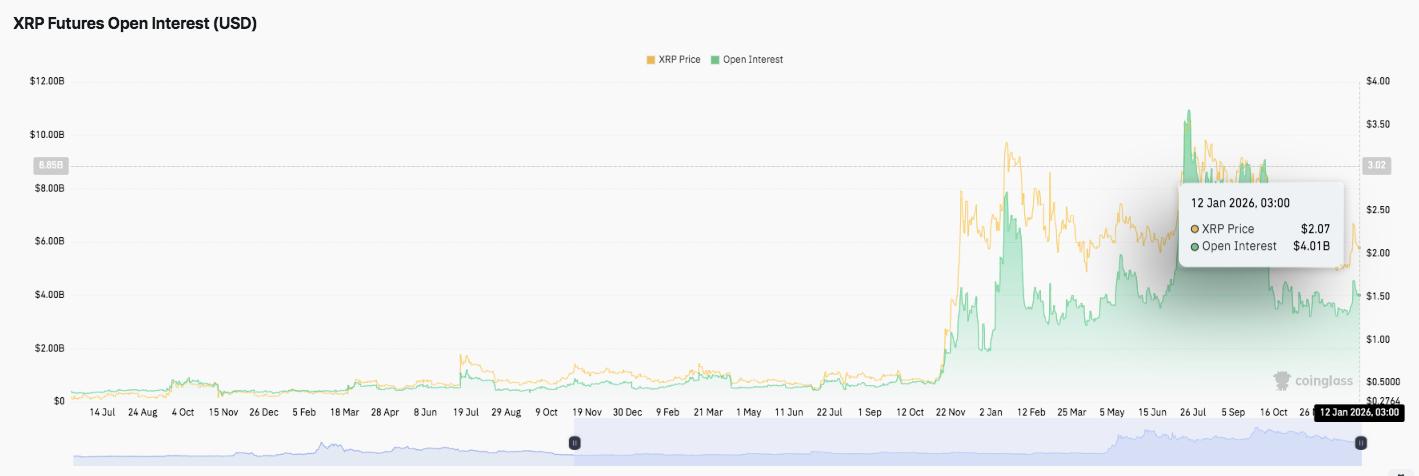

XRP futures data showed open interest expanding sharply during the late-2025 rally, confirming fresh leveraged participation. However, after peaking, open interest cooled while price consolidated.

Consequently, partial deleveraging reduced speculative excess without erasing market interest. Open interest stabilized near the $4.0 billion zone, remaining elevated compared with historical norms.

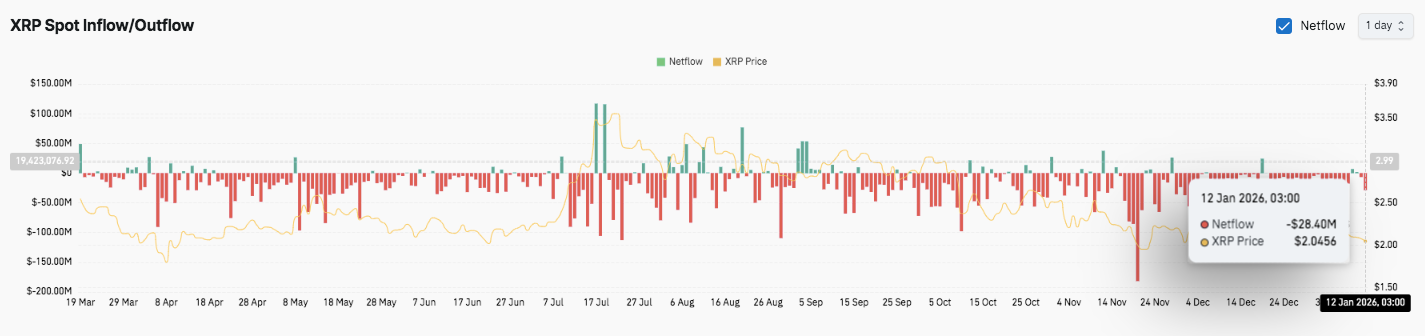

Spot flow data painted a more cautious picture. Netflows stayed largely negative, reflecting ongoing exchange outflows and seller dominance. Moreover, sharp outflow spikes often aligned with local price weakness. Although brief inflow bursts appeared, they lacked follow-through. Toward recent sessions, netflows remained negative near $28 million, while price hovered near $2.05.

Cardano Signals Cross-Chain DeFi Opportunity

Beyond price action, broader ecosystem developments influenced sentiment. In a recent discussion, Charles Hoskinson stated that Cardano aimed to support Bitcoin and XRP-based DeFi through its Midnight protocol.

He explained that the architecture allowed assets from other networks to interact with smart contracts privately. Additionally, he expressed interest in collaborating with Ripple following a successful airdrop initiative. He also confirmed upcoming support through Lace Wallet.

Related: Ethereum Price Prediction: ETH Consolidates as Open Interest and Staking…

Technical Outlook for XRP Price

Key levels remain clearly defined for XRP as price consolidates after its recent rally.

Upside levels include $2.09–$2.11 as the first resistance cluster. A sustained break above this zone could open a move toward $2.17, followed by $2.28–$2.30 as the next major supply area.

On the downside, immediate support sits at $2.02–$2.01. This zone aligns with short-term Fibonacci support and remains critical. Below that, $2.00 stands as a psychological level. Failure there could expose XRP to $1.92–$1.93.

The technical structure suggests XRP is compressing inside a post-impulse consolidation range. Volatility has narrowed, often preceding range expansion. Momentum has cooled on lower timeframes, yet higher-timeframe structure still favors higher highs.

Will XRP Go Up?

XRP price outlook hinges on whether buyers can defend the $2.00–$2.02 region. A reclaim of $2.11 would likely trigger renewed upside momentum toward $2.17 and higher.

However, losing $2.00 could deepen the retracement toward $1.92. For now, XRP remains at a pivotal inflection zone. Directional conviction and volume expansion will define the next leg.

Related: Story Price Prediction: IP Extends Rally After Key Breakout Signals Strong Bullish Continuation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.