- XRP’s tight range reflects cautious traders awaiting a decisive break from compression

- Futures positioning cools as leverage resets and traders shift toward balanced exposure

- Persistent spot outflows signal ongoing distribution pressure despite brief inflow spikes

XRP continues to trade in a narrow band as its price hovers near $2.06, reflecting a market that remains cautious after repeated attempts to break higher. The token’s recent rejection at the $2.15–$2.16 resistance cluster has kept momentum muted, even as traders monitor tightening support levels that could define the next major move.

Compression Holds Price Between Key Boundaries

XRP has struggled to break above the $2.15–$2.16 zone, which aligns with the 4H EMA ribbon and the 38.2% Fibonacci retracement. Buyers attempted several recoveries; however, each push met renewed selling pressure.

The broader trend remains downward as XRP stays under the 200 EMA. Moreover, the market structure continues to show lower highs, reinforcing the need for a strong breakout to shift sentiment.

Support sits at $2.03–$2.06 and has held through recent pullbacks. However, losing this zone could invite a move toward $1.99 or even $1.95. These levels carry weight due to past consolidation and dynamic support interaction. A break below them would significantly weaken the short-term outlook. Additionally, $1.82 remains a major trend-defining support that anchors the broader structure.

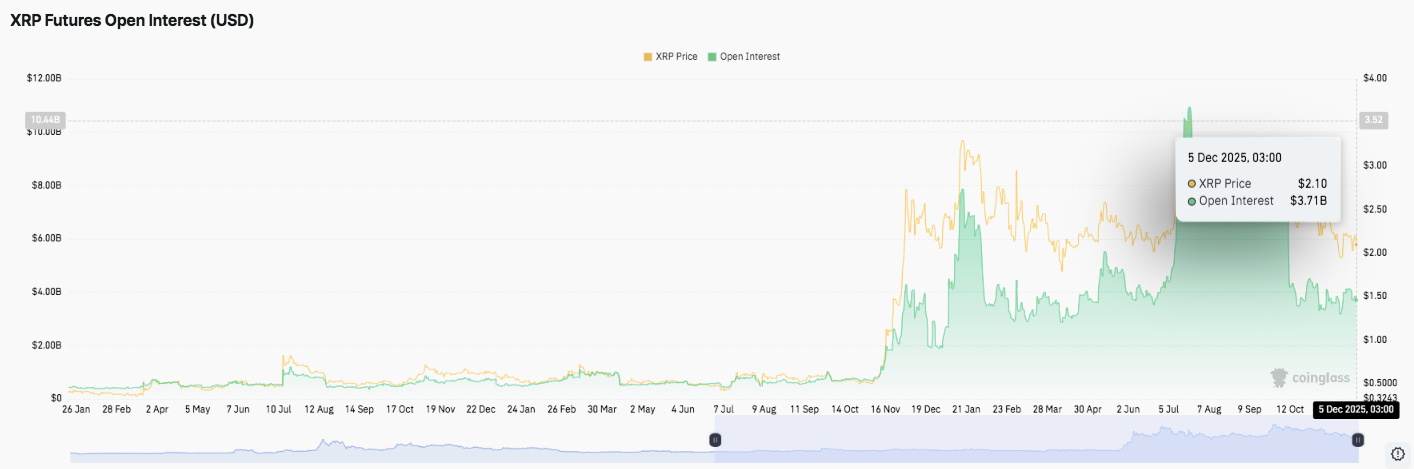

Futures Positioning Moderates After a Strong Summer Surge

Open interest trends suggest traders remain engaged, though enthusiasm has cooled since mid-year. Futures open interest rose steadily through early 2025 and accelerated sharply during June and July. It peaked above $8 billion in August as XRP approached $2.30. However, open interest later eased as the broader market corrected.

Related: Bitcoin Price Prediction: BTC Attempts a Recovery as Futures Interest Climbs

As of December 5, it stands near $3.71 billion. This level signals reduced leverage, yet still reflects active participation. Hence, positioning now appears more balanced with price settling into a controlled range.

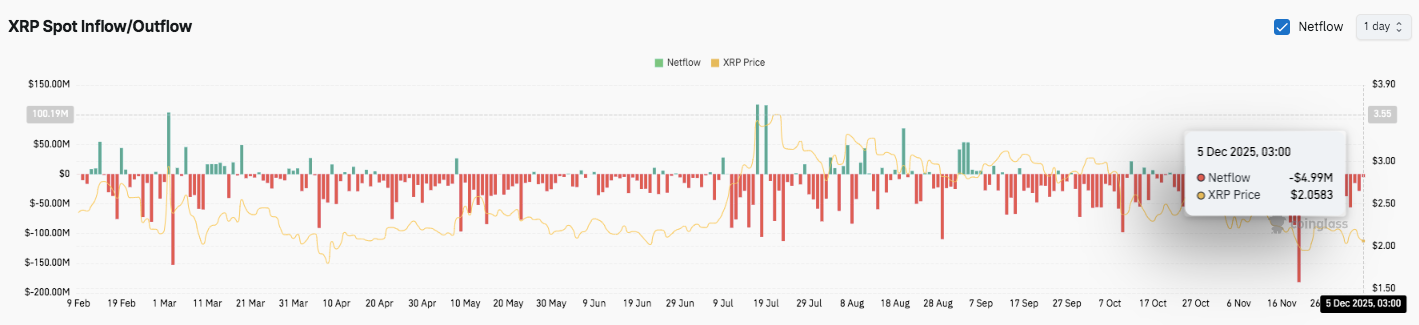

Spot Flows Reveal Ongoing Distribution Pressure

Spot flows show continued dominance of outflows through the year, which underscores persistent selling pressure. Outflows intensified in July and November as withdrawals exceeded $100 million on several occasions.

Brief inflow spikes appeared in March and July but faded quickly. By December 5, XRP recorded a $5 million outflow while trading near $2.06. Moreover, this trend highlights cautious sentiment that persists even during price rebounds.

Technical Outlook for XRP Price

Key levels remain well-defined as XRP trades inside a tightening structure.

Upside levels appear at $2.15, $2.25, and $2.36 as immediate hurdles. A clean breakout above these zones could extend toward $2.50 and $2.69.

Related: Ethereum Price Prediction: ETH Reversal Awaits a Critical Bullish Breakout

Downside levels sit at $2.03 trendline support, followed by $1.99 and $1.95. The major resistance ceiling at $2.16, near the 4H EMA cluster, is the key level to flip for medium-term bullish momentum.

The technical picture shows XRP compressing between $2.03 and $2.16. This range has tightened for several sessions, suggesting a volatility expansion is forming. A decisive close beyond either boundary may set the direction for the next leg.

Will XRP Break Higher?

XRP’s next move depends on buyers defending $2.03 long enough to pressure the $2.15–$2.16 cluster. Strong inflows and firmer momentum could open a path toward $2.25 and later $2.36. A continuation above those levels increases the chance of retesting $2.50 and possibly $2.69.

Failure to hold $2.03, however, risks breaking the current base and exposing $1.99 and $1.95. For now, XRP sits in a pivotal zone. Traders wait for confirmation as compressed structure, futures positioning, and spot flows all hint at a larger move ahead.

Related: Terra Classic Price Prediction: LUNC Recovery Slows as Outflows Pressure Market

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.