- XRP’s rebound from $1.58 shows early stabilization amid improving market confidence

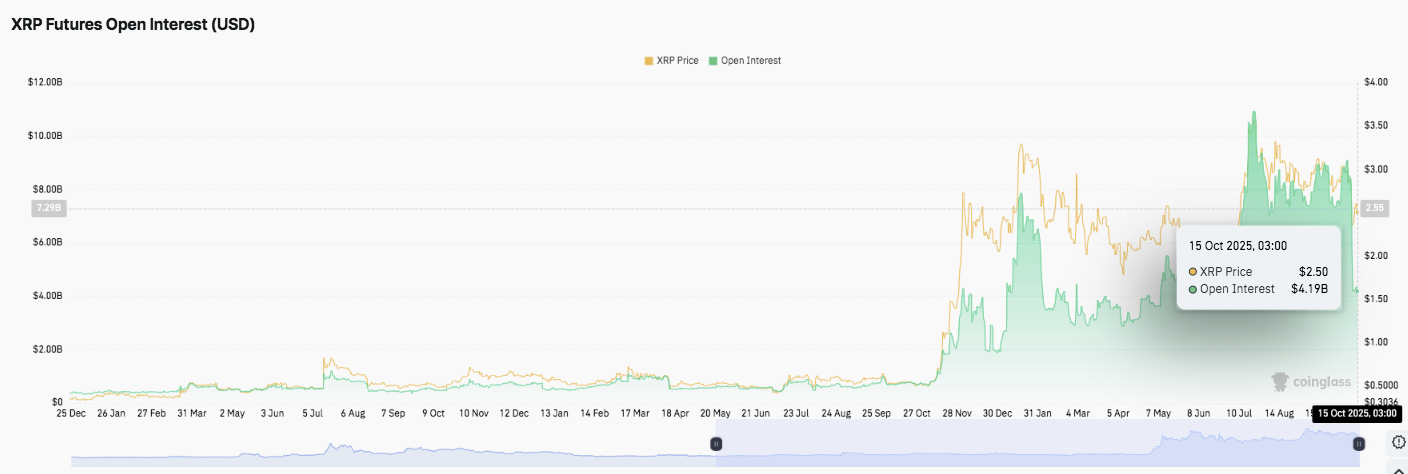

- Rising open interest above $4.19B signals renewed speculative and institutional activity

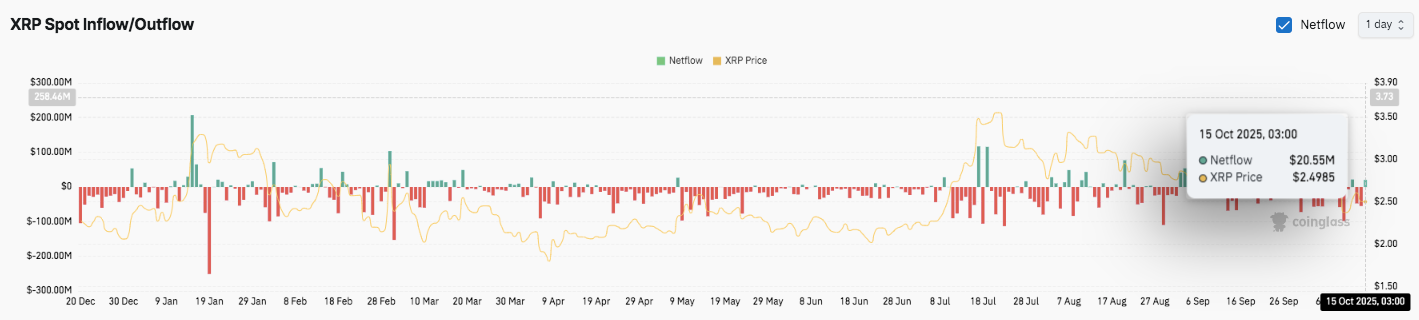

- Positive $20.55M netflow indicates cautious accumulation and strengthening investor sentiment

XRP is showing early signs of stabilization after a steep correction that erased nearly half of its recent gains. The cryptocurrency, which previously peaked around $3.10, has since rebounded from a low near $1.58, with current trading near $2.50.

This recovery suggests buyers are cautiously re-entering the market despite broader weakness in momentum indicators. The ongoing rebound has coincided with rising futures interest and renewed inflows, signaling an improving risk appetite among traders.

Price Structure Shows Gradual Rebound Effort

XRP’s latest price structure reveals a controlled recovery phase, supported by a firm defense near the $2.34 zone. This level, corresponding to the 0.5 Fibonacci retracement, remains a vital short-term anchor.

Besides, a bounce from this region suggests the presence of active buyers attempting to re-establish control. However, XRP continues to trade below its key exponential moving averages (20-EMA through 200-EMA), indicating that momentum remains limited.

Significantly, the next resistance cluster lies between $2.52 and $2.56, where both the 20-EMA and 50-EMA converge. A breakout above this zone could signal renewed strength, potentially opening the path toward $2.73.

Related: Shiba Inu Price Prediction: SHIB’s Recovery Stalls As Momentum Weakens

That level aligns with the 100-EMA and 0.786 Fibonacci retracement, which often attract profit-taking. Consequently, reclaiming the 200-EMA near $2.81 would confirm a structural recovery, reviving prospects for a retest of $3.10.

Derivatives Market Reflects Renewed Speculative Confidence

Moreover, XRP’s futures market is signaling a notable rise in participation. Open interest has climbed sharply since mid-2025, moving from below $1 billion to more than $4.19 billion by mid-October.

This consistent growth mirrors the recent price recovery and underscores renewed trader confidence. The expansion in open interest also indicates that speculative positioning is increasing, particularly as volatility returns to the broader crypto market.

Hence, this dynamic suggests institutional and retail investors are becoming more active, using leverage to capitalize on short-term movements. Sustained growth in open interest could support liquidity and price stability in the near term.

Related: Ethereum Price Prediction: ETH Attempts Recovery as Open Interest Hits $46.8B

Inflow Data Points to Cautious Accumulation

Additionally, XRP’s netflow data highlights a balanced but improving sentiment. Large outflows dominated much of the previous quarter as investors took profits. However, recent inflow spikes show renewed accumulation near the $2.50 mark. On October 15, XRP recorded a $20.55 million positive netflow, reflecting increased buying interest.

Technical Outlook for XRP Price

Key levels remain well-defined as XRP enters the mid-October trading phase. The token trades near $2.50, maintaining short-term support above the 0.5 Fibonacci retracement at $2.34. This level has acted as a crucial pivot in recent sessions, with buyers defending it to sustain market stability.

- Upside levels: $2.56 (20-EMA/50-EMA confluence), $2.73 (100-EMA and 0.786 Fibonacci), and $2.81 (200-EMA) represent the main resistance zones to watch. A clear breakout above $2.73 could open the path toward the $3.10 peak, signaling renewed bullish strength.

- Downside levels: Immediate support sits at $2.34, followed by $2.16 (0.382 Fibonacci) and $1.94 (0.236 Fibonacci). Breaching these could expose XRP to a deeper pullback toward the $1.58 swing low the level that marked the last strong rally.

- Resistance ceiling: The 200-EMA near $2.81 remains the key level to flip for medium-term bullish continuation. Sustained closes above this threshold would indicate that buyers have regained trend control.

The technical picture suggests XRP is consolidating within a mid-range compression pattern, where tightening momentum could precede a breakout in either direction. Open interest data supports this scenario, showing a sharp rise in derivatives exposure since July, signaling active speculative participation.

Will XRP Rebound Toward $3?

XRP’s price outlook depends on how long buyers can defend the $2.34 support while attempting to reclaim $2.73. If momentum builds with higher inflows and stronger futures activity, XRP could retest the $3.10 resistance level and potentially extend toward new highs later in the quarter. However, failure to sustain support near $2.34 would likely invite renewed selling pressure, pulling the price back toward $2.16 and $1.94.

For now, XRP remains at a pivotal stage. Stabilizing above $2.34 keeps short-term sentiment constructive, but a decisive move above $2.73 will be crucial to confirm a breakout and re-establish the broader bullish structure.

Related: Dogecoin Price Prediction: Institutional Merger Fuels Bullish Momentum

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.