- XRP price consolidates near $3.02, with bulls eyeing a $3.20 breakout above the descending triangle.

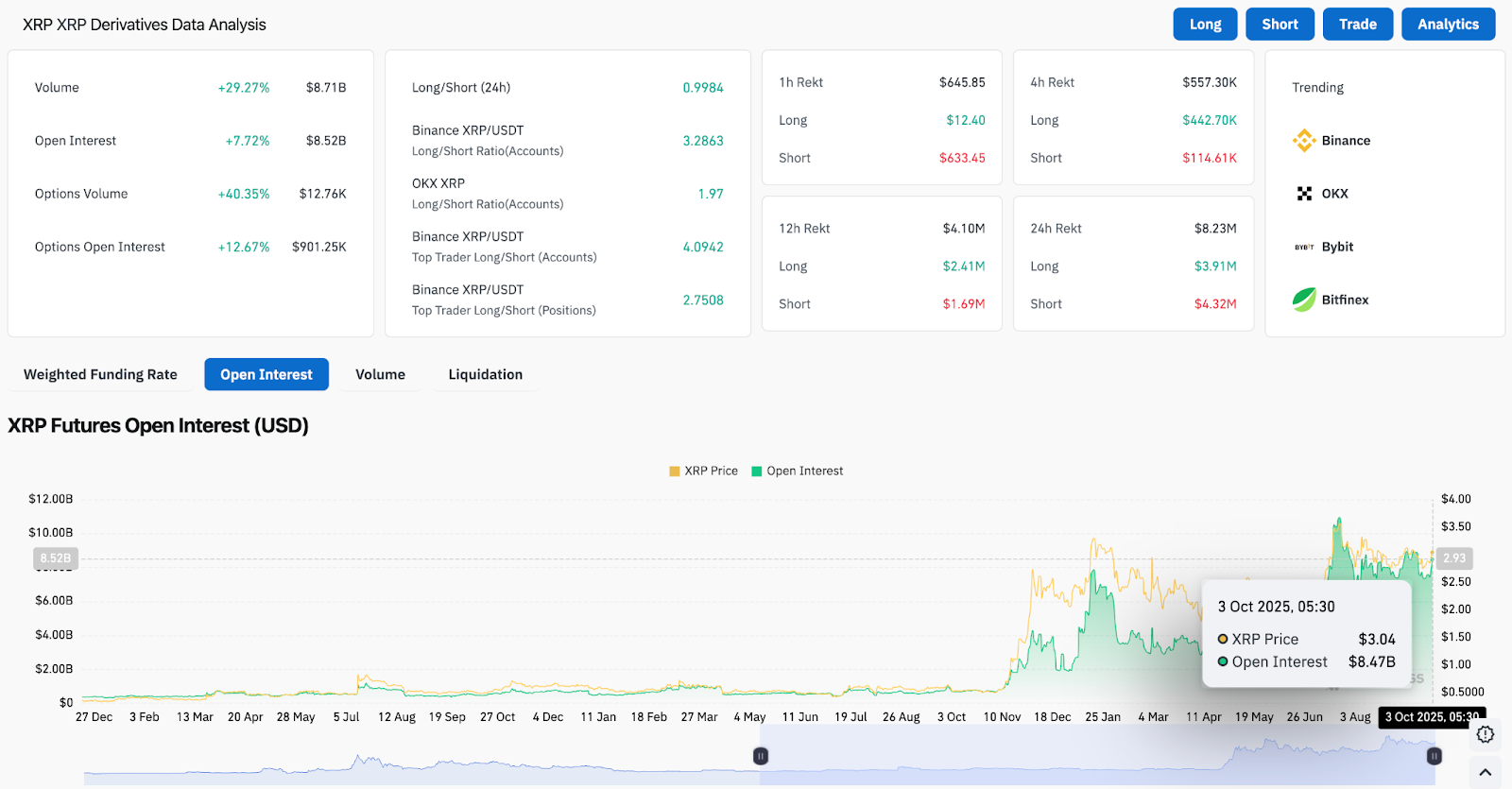

- Derivatives interest rises, with XRP futures OI at $8.52B and options activity climbing over 12%.

- SWIFT replacement rumors boost narrative momentum, reinforcing XRP’s long-term liquidity thesis.

XRP price today is trading at $3.02, facing resistance near $3.04 after testing the upper boundary of its descending triangle. The token has reclaimed the 20-day EMA at $2.92, while holding above the 50-day EMA at $2.93. Traders are watching whether XRP can break through $3.20 or risk slipping back toward its support base.

XRP Price Faces Compression Test

The daily chart shows XRP locked in a compression phase, with lower highs pressing against the descending resistance trendline from July. Price is now consolidating between the $2.92–$3.04 cluster and the $2.84 support zone, which overlaps with the 100-day EMA.

The broader trend remains constructive as long as XRP stays above the rising 200-day EMA at $2.62. Momentum indicators show early signs of improvement, with the RSI near 54 after rebounding from neutral territory. Analysts note that a decisive break above $3.20 would open the door toward $3.40 and $3.60, while failure to hold $2.84 could see a retreat toward $2.62.

Related: Bitcoin Price Prediction: $125K in Sight as MicroStrategy’s BTC Holdings Hit $77.4B

Derivatives Activity Signals Rising Demand

XRP derivatives markets are showing renewed participation. Futures open interest has climbed to $8.52 billion, up 7.7% in 24 hours, while trading volume jumped 29% to $8.71 billion. Options activity also expanded sharply, with open interest rising more than 12% to $901,000.

The long/short ratio across major exchanges reflects growing optimism. On Binance, top traders’ long exposure outpaces shorts by more than 4-to-1, highlighting strong bullish conviction. Analysts caution that such positioning leaves XRP vulnerable to near-term volatility, but the increase in open interest is typically supportive for price action.

Narrative Momentum Builds With Swift Rumors

Speculation around XRP’s potential role in replacing the U.S. SWIFT system has circulated widely this week, drawing market attention. While no official confirmation has been made, the narrative of XRP unlocking access to multi-trillion-dollar payment flows has reinforced optimism among retail investors.

Ripple CEO Brad Garlinghouse has continued to emphasize real-world adoption use cases, with the network positioned as a liquidity bridge for institutions. The broader story aligns with XRP’s long-term thesis as a cross-border settlement token, adding momentum at a time when price sits near a critical breakout level.

Technical Outlook For XRP Price

XRP price prediction in the short term hinges on whether buyers can reclaim the $3.20 zone.

- Upside levels: $3.20, $3.40, $3.60

- Downside supports: $2.92, $2.84, $2.62

- Trend base: $2.62 as the last major line of defense

The broader trend favors buyers as long as XRP maintains price above $2.92. A close beyond $3.20 would validate bullish continuation, targeting $3.60 in the coming weeks.

Related: Ethereum Price Prediction: Analysts Predict Breakout as U.S. Tax Exemption Boosts Confidence

Outlook: Will XRP Go Up?

XRP enters October with momentum shifting back toward buyers. Derivatives positioning has climbed sharply, and speculative narratives are drawing attention, while technicals highlight a breakout point at $3.20.

If XRP sustains price action above $3.04 and pushes through $3.20 with volume, analysts expect upside targets at $3.40 and $3.60 to come into play. However, failure to hold $2.84 could reset the bullish case and shift focus back toward $2.62 support. For now, the balance of flows and positioning favors a potential breakout in the days ahead.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.