- XRP struggles below all EMAs, confirming persistent short-term bearish control.

- Futures open interest hits $3.72B, signaling elevated leverage-driven volatility risk.

- Spot flows show cautious accumulation, keeping XRP range-bound near $2.00 support.

XRP price action shows persistent weakness on the four-hour chart, reflecting cautious sentiment across spot and derivatives markets. As of mid-December 2025, XRP trades near the $2.00 level on Bitstamp, where buyers and sellers remain locked in a narrow range.

Despite periods of demand, sellers continue to control short-term momentum. Technical structure, futures positioning, and on-chain flows together suggest elevated volatility risk ahead.

XRP Technical Structure Remains Fragile

On the four-hour timeframe, XRP continues trading below all major exponential moving averages. Price action remains capped beneath the 20, 50, 100, and 200 EMA levels. This alignment confirms ongoing bearish control in the short term. Moreover, repeated failures near dynamic resistance reinforce seller dominance during intraday rebounds.

The $2.02 to $2.06 range acts as the first recovery barrier. This zone aligns with short-term EMA resistance and a bearish Supertrend structure. Consequently, price rejection here has limited upside follow-through. Above that, the $2.07 to $2.10 area represents a prior breakdown region. Bulls must reclaim this range to shift short-term bias.

Related: Bitcoin Price Prediction: BTC Consolidates Near $90,000 as Traders Await…

However, the 200 EMA near $2.14 remains the broader trend pivot. Failure to reclaim this level keeps downside risks active. On the downside, buyers continue defending the $2.00 psychological level. Hence, any loss of this area exposes $1.96 to $1.98 as the next support band.

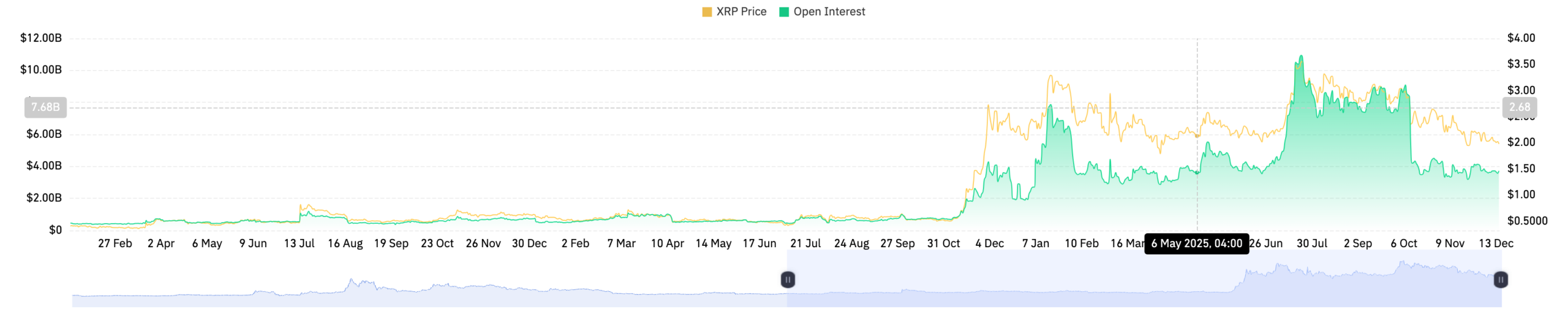

Futures Open Interest Points to Elevated Risk

Significantly, XRP futures open interest has expanded sharply over the past year. Data shows open interest rising from under $500 million in mid-2024 to $3.72 billion by December 15, 2025. This expansion reflects rising trader participation and speculative exposure.

Spikes in open interest aligned with prior price rallies during late 2024 and early 2025. Additionally, sustained elevated levels suggest institutions remain active despite recent price weakness. High open interest near the $2.00 zone increases the probability of sharp directional moves. Consequently, leverage-driven volatility remains a key risk factor.

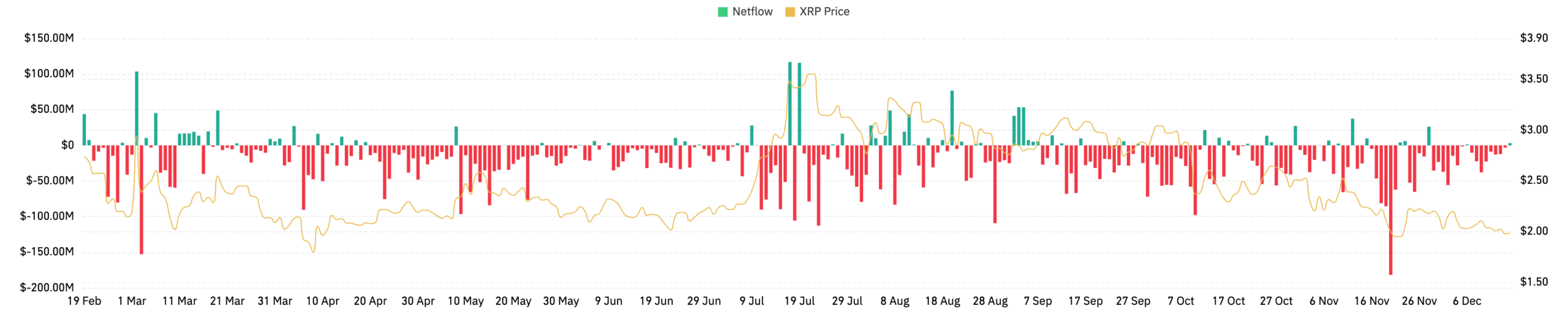

Spot Flow Trends Reflect Cautious Participation

Spot flow data shows consistent net withdrawals for most of 2025. Red outflow periods dominate, indicating more tokens leaving exchanges than entering. Although occasional inflow spikes appear, they remain relatively small. Moreover, intensified outflows during November coincided with price weakness.

Related: Solana Price Prediction: SOL Trades in a Tight Range as Traders Reassess Risk

By mid-December, net flows turned modestly positive near $1.72 million. However, this shift has not driven a sustained price breakout. Hence, the data suggests cautious accumulation rather than aggressive buying. Until inflows strengthen meaningfully, XRP price may remain range-bound.

Technical Outlook for XRP Price

Key levels remain clearly defined for XRP as price trades near a critical inflection zone. On the upside, immediate resistance sits at $2.02–$2.06, where short-term EMAs and trend indicators converge. A confirmed breakout above this band could allow a move toward $2.10, followed by a test of $2.14–$2.15, which aligns with the 200 EMA and broader trend resistance.

On the downside, $2.00 remains a key psychological and structural support. Buyers have defended this level multiple times, but momentum remains fragile. A failure to hold $2.00 could expose $1.98–$1.96 as the next support zone. Below that, downside risk extends toward $1.90–$1.92, where prior demand previously emerged.

The technical structure suggests XRP continues to print lower highs on the four-hour chart. Price also remains below major moving averages, signaling ongoing bearish pressure. However, compression near the $2.00 level points to a potential volatility expansion.

Will XRP Move Higher?

XRP price direction hinges on whether buyers can reclaim the $2.06–$2.10 resistance cluster with strong follow-through. A successful reclaim could shift short-term momentum and open room toward $2.15.

Conversely, repeated rejection and a breakdown below $2.00 would keep the bearish structure intact and increase downside exposure. For now, XRP remains at a pivotal zone where conviction and volume will determine the next decisive move.

Related: Cardano Price Prediction: ADA Holds Support With No Clear Bullish Conviction

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.