- XRP faces strong resistance at $2.62, key for reclaiming bullish momentum.

- Futures open interest above $4B signals sustained speculative engagement and volatility.

- Upcoming November 13 ETF approval could drive institutional inflows and price gains.

XRP is trading near $2.49 as traders weigh its next move ahead of the upcoming ETF launch. After a volatile correction from the $3.10 high, the asset is now attempting to regain traction. Market data suggests cautious optimism as buyers look to defend key Fibonacci support zones while anticipating a possible breakout fueled by institutional catalysts.

Price Structure and Key Levels

The token recently rebounded from the $1.58 base and reached the 0.5 Fibonacci level at $2.34. However, consolidation followed, keeping the price confined between $2.16 and $2.62. The 50-, 100-, and 200-EMA cluster continues to weigh on momentum, signaling that bears remain in short-term control.

Immediate resistance lies at $2.52, where previous support flipped into a ceiling. A successful move above this point could open the path toward $2.79 and eventually retest the $3.10 peak. Conversely, losing support at $2.34 may push the token back toward $2.16 or even $1.94.

Besides, the $2.62 resistance remains a major test for buyers. If price sustains above that level, bullish traders may attempt to reclaim dominance. A failure could instead confirm ongoing consolidation, suggesting that XRP will continue oscillating within its current trading corridor.

Derivatives and Market Participation

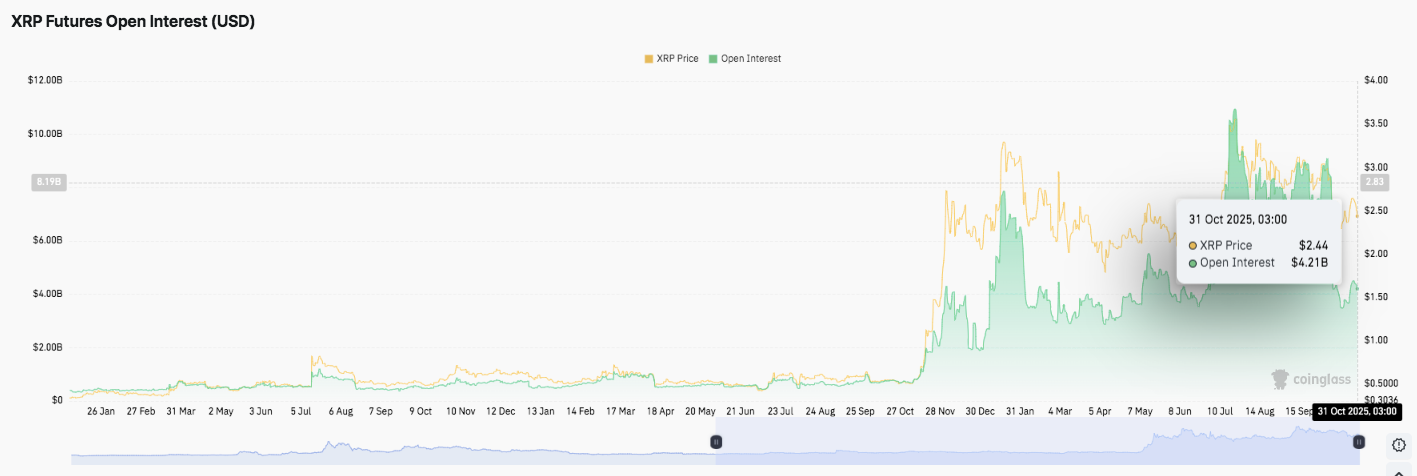

Open interest in XRP futures surged to over $8 billion earlier this year before stabilizing at $4.21 billion in late October. This increase underscores strong speculative activity, indicating that traders are positioning for higher volatility.

Related: Bitcoin Price Prediction: BTC Holds Strong as Market Eyes Breakout

Consequently, even as open interest cooled, it remains above early-2025 averages, reflecting consistent engagement. If the token fails to maintain critical support zones, liquidations could rise, accelerating short-term market swings.

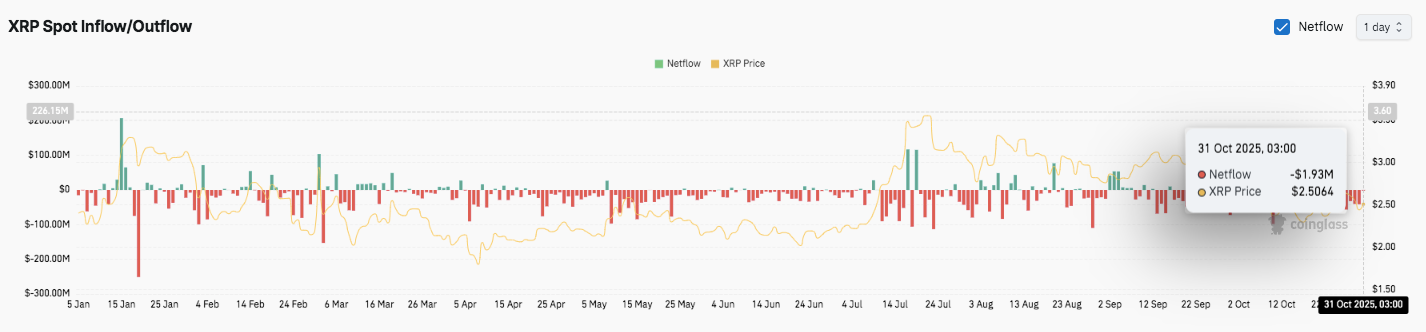

Moreover, inflow and outflow data indicate that investors have been alternating between profit-taking and accumulation. Netflows turned negative in October, showing mild capital outflows despite stable prices. The cautious sentiment implies traders are waiting for new catalysts before committing to larger positions.

ETF Outlook and Market Sentiment

The upcoming XRP ETF approval on November 13 could reshape market expectations. Canary Capital’s S-1 amendment has cleared the final hurdle for automatic activation, pending Nasdaq’s confirmation. Hence, this development may boost institutional participation and expand liquidity for the token.

Related: Solana Price Prediction: Bears Target Key Support Level as Momentum Fades

Technical Outlook for XRP Price

XRP price action remains tightly coiled as the token trades around $2.49, showing signs of range-bound compression ahead of a potential breakout. Key levels remain clearly defined heading into November.

- Upside Levels: $2.52 (Fib 0.618), $2.79 (Fib 0.786), and $3.10 remain the primary hurdles. A breakout above $2.79 could open the path toward $3.10 and confirm renewed bullish momentum. Sustained closes above this zone may further extend upside targets toward $3.50, depending on market participation and ETF-driven sentiment.

- Downside Levels: $2.34 (Fib 0.5) acts as immediate support, followed by $2.16 (Fib 0.382) and $1.94 as deeper fallback zones. A decisive drop below $2.16 could accelerate selling pressure and expose $1.58, where the last major rebound originated.

- Resistance Ceiling: The $2.62 level remains a short-term barrier that XRP must reclaim to shift control back to buyers. It aligns with the 50-, 100-, and 200-EMA cluster, making it a critical inflection zone.

Will XRP Extend Higher?

The technical setup suggests XRP is oscillating between key Fibonacci levels, building pressure for a larger move. Open interest and derivatives data show heightened positioning, hinting that volatility expansion is near. If buyers defend $2.34 and push past $2.62, XRP could retest $2.79 and $3.10 as bullish momentum strengthens into the ETF launch.

However, repeated rejection near $2.52 could invite renewed selling, driving the token back to $2.16 before any meaningful recovery. The coming weeks may define whether XRP transitions into a sustained uptrend or extends its consolidation phase. For now, defending $2.34 remains vital for keeping bullish hopes alive.

Related: Chainlink Price Prediction: $3.6M Inflows And Ondo Deal Boost Confidence

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.