- XRP holds the $2.15–$2.25 zone as buyers counter outflows and stabilize short-term structure.

- Derivatives reset improves market health as open interest steadies near the $3B range.

- Spot outflows persist, yet price resilience shows controlled selling and steady buyer defense.

XRP continues to stabilize above critical support after a sharp pullback that pushed the token toward $2.02 earlier in the week. The asset now trades close to $2.19, showing a steady rebound as traders reassess short-term risks.

The broader market environment has shifted as well, with reduced leverage and declining spot flows shaping sentiment across derivatives and spot markets. Hence, XRP’s recovery depends on how buyers react around the $2.15–$2.25 band, which now anchors the token’s immediate structure.

Price Structure Shows Early Stabilization

XRP trades between the 0.382 and 0.5 Fibonacci levels, forming a tight consolidation zone. This band stretches from $2.15 to $2.25 and has become a decisive region for short-term direction.

A move above $2.25 would show stronger buyer commitment because that area aligns with the 100-EMA and the lower edge of the 200-EMA cluster. Moreover, a clean break could open the path toward $2.36 and possibly the wider resistance near $2.50.

However, the structure remains fragile because the 200-EMA still caps the price. The broader trend stays neutral, yet the rebound from the $2.06 region shows improving momentum.

Related: Bitcoin Price Prediction: BTC Stabilizes Above Support as…

The Supertrend indicator shifted into a Buy phase near that level, which signals renewed interest after the recent correction. Holding the $2.15 support is critical because losing that floor exposes the $2.06–$2.02 demand level again.

Leverage Declines as Open Interest Resets

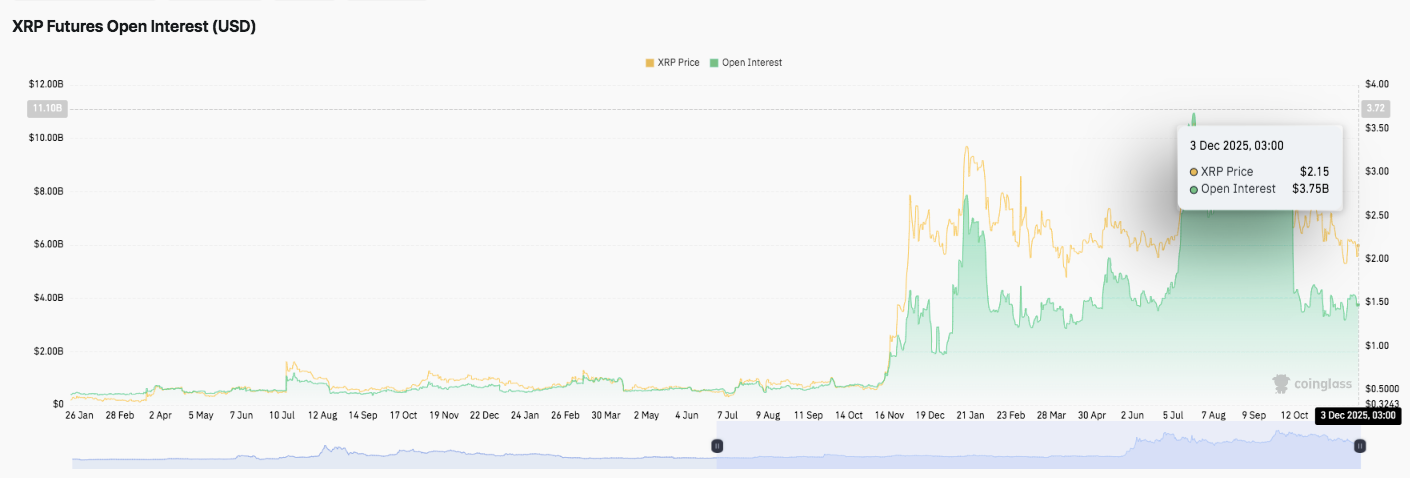

XRP’s futures market has cooled after the November surge that pushed open interest above $7 billion. Values now sit near $3.75 billion, which indicates a meaningful reduction in excess leverage.

This decline follows several weeks of sharp volatility that forced speculative traders out of positions. Additionally, open interest has begun to stabilize above the $3 billion threshold, suggesting that new positions remain smaller and more measured.

Consequently, the derivatives market now mirrors healthier risk behavior. Price and open interest show better alignment, which reduces the chance of aggressive liquidations. This environment supports gradual rebuilding rather than rapid swings.

Spot Flows Show Persistent Outflows

XRP’s spot flows reveal consistent selling pressure through November and early December. Multiple sessions recorded heavy red prints, including a $6.33 million outflow this week.

Besides that, inflows remain limited, showing cautious participation among spot buyers. Significantly, the price has held firm despite these outflows, which suggests controlled distribution rather than panic selling.

Related: Ethereum Price Prediction: Triangle Breakout Attempts As Flows…

A shift in sentiment would require smaller outflow days and more sustained inflows. Until then, XRP remains in a balancing phase with buyers defending key levels.

Technical Outlook for XRP Price

Key levels remain clear as XRP enters a compression phase near the mid-range.

Upside levels include $2.25 as the immediate hurdle, followed by $2.36 and $2.50–$2.58 as the next resistance band. A breakout above $2.69 would signal a major trend reclaim and strengthen medium-term bullish momentum. The 200-EMA near $2.24–$2.25 stands as the critical ceiling that XRP must flip for a sustained move.

On the downside, $2.15 marks the first support, while $2.06–$2.12 forms the next demand zone. A deeper move toward $2.02 would retest the latest trigger region. The major structural support remains at $1.82, which anchors the final Fibonacci floor and protects XRP’s broader trend.

The technical picture shows XRP moving inside a tightening consolidation band between the 0.382 and 0.5 Fibonacci levels. This compression suggests that volatility expansion is nearing, and a decisive move outside this range may guide the next directional shift.

Will XRP Push Higher?

XRP’s next move depends on whether buyers can protect the $2.15 support long enough to challenge the $2.25 resistance cluster. A break and close above this zone strengthens the possibility of testing $2.36 and the larger $2.50–$2.58 supply region. Stronger flows and sustained momentum would be required to attempt a reclaim of $2.69.

Failure to defend $2.15 increases the risk of revisiting $2.06–$2.02, while a loss of $2.02 exposes the broader structure to a deeper drift toward $1.82. For now, XRP sits in a pivotal zone. The next decisive break above $2.25 or below $2.15 will likely determine its trajectory heading into the next cycle.

Related: Solana Price Prediction: Bulls Eye $155 as Breakout Aligns With Rising Net Inflows

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.