- XRP struggles near $1.97 support, signaling buyers remain defensive after recent pullback.

- Key resistance at $2.07–$2.08 must break for bulls to reclaim momentum above $2.42.

- Spot outflows and cooled leverage show ongoing selling pressure around $2.00 zone.

XRP is flashing warning signs on the 4-hour chart after a sharp rally lost steam near $2.42. The token now trades close to $1.97, and recent price action suggests buyers remain on the defensive. After XRP pushed higher into late-peak momentum, trading shifted into a choppy consolidation range that failed to hold.

Consequently, price broke down through key moving averages and triggered a fast selloff. Although XRP bounced from the lows, traders still treat the move as a relief rebound. The structure stays fragile until bulls reclaim major resistance levels.

XRP Price Levels Show a Weak Structure

The latest decline left XRP leaning on the $1.96–$1.97 zone as immediate support. This level holds the current base and acts as the first line of defense. However, a clean break below this range could pull price toward $1.9236 next. That area lines up with the 0.236 Fibonacci level.

Besides this, the $1.84–$1.85 region stands out as a major demand pocket. Traders often watch this band during larger pullbacks. If pressure increases again, XRP could slide toward $1.77. That level marks the broader floor from the Fibonacci range.

On the upside, the first recovery wall sits between $2.02 and $2.05. This zone carries Fibonacci resistance and short-term EMA pressure. Moreover, the toughest barrier remains around $2.07–$2.08. That cluster includes stronger moving average resistance and a mid-range rejection area.

Related: Bitcoin Cash Price Prediction: Ascending Channel Holds As BCH Tests 50 EMA Support

Hence, a decisive move above it could shift momentum. If XRP regains control, the next supply pocket sits between $2.17 and $2.28. Sellers could defend this area heavily. A retest of $2.42 would only follow a strong breakout run.

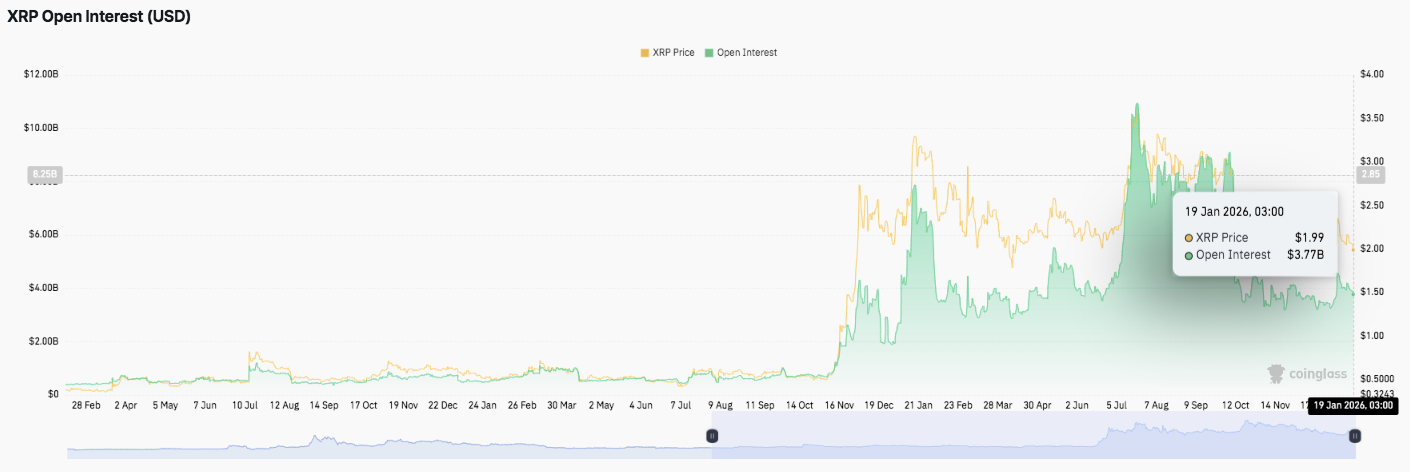

Open Interest Suggests Leverage Has Cooled

Derivatives data shows XRP moved through a leverage expansion and then a reset phase. Open interest surged into late 2025 as price climbed fast. Significantly, the peak above $10 billion signaled crowded positioning and rising risk. After that, open interest declined steadily as traders closed positions.

Recent readings near $3.7 billion show a more balanced market. Additionally, XRP trades near $2.00 during this stabilization phase. This setup suggests leverage cooled, but it has not disappeared.

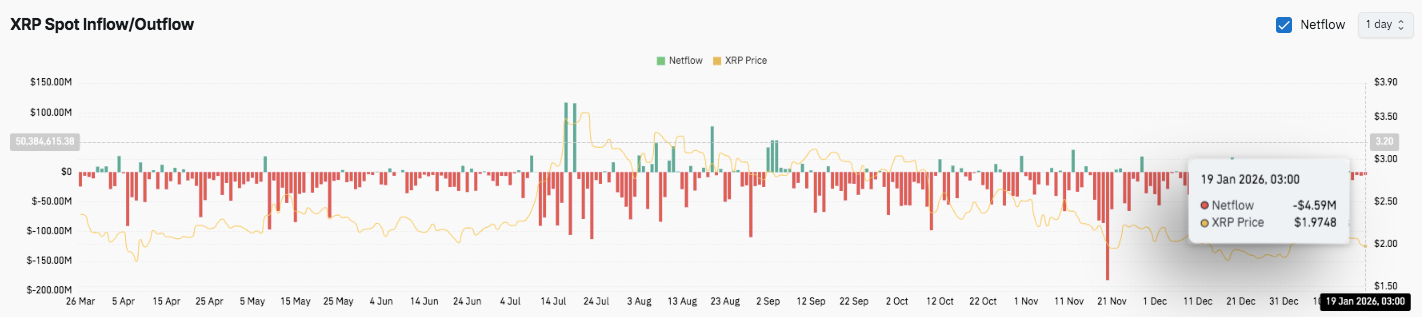

Spot Flows Stay Negative as Selling Lingers

Spot flow data also signals caution. Outflows dominated for long stretches, which points to ongoing distribution pressure. Mid-July saw brief inflow spikes during XRP’s pump above $3.00. However, the surge faded and flows turned negative again.

Related: Ethereum Price Prediction: Triangle Support Faces $119M Liquidation Test

Moreover, heavier outflow bursts appeared during November and December. The latest netflow print sits near $4.59 million. Consequently, sellers still apply pressure near the $2.00 zone.

Technical Outlook For XRP Price

Key levels remain clearly defined for XRP as the token trades near a fragile short-term base.

- Upside levels: $2.02–$2.05 is the first recovery zone, followed by $2.07–$2.08, where heavy resistance and moving average pressure meet. A clean breakout above $2.08 could open the door toward the $2.17–$2.28 supply band, which aligns with the higher Fibonacci cluster. Beyond that, $2.42 stands as the major swing high that would signal a stronger trend continuation.

- Downside levels: $1.96–$1.97 remains the key support area holding the current bounce. A breakdown could send XRP toward $1.9236, then $1.84–$1.85, which marks a deeper demand region. If sellers take control below $1.85, downside risk extends toward $1.77, which sits near the broader range floor.

- Resistance ceiling: $2.07–$2.08 is the key level XRP must reclaim to flip momentum bullish again. The technical picture suggests XRP is still rebuilding after a sharp breakdown, with price attempting to stabilize below resistance.

Will XRP Go Up?

XRP price direction depends on whether buyers can defend $1.96 and force a reclaim above $2.08. If momentum improves and flows turn supportive, XRP could retest $2.17–$2.28 next.

Failure to hold $1.96, however, risks a slide toward $1.92 and $1.85. For now, XRP remains in a pivotal zone where confirmation will decide the next move.

Related: Cardano Price Prediction: ADA Bears Hold Control as Hoskinson Questions CLARITY Act Odds

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.