- XRP’s tight range and low volatility indicate a potential breakout once momentum returns.

- EMA resistance and repeated rejections show sellers maintain control of XRP direction.

- Futures unwinds and weak exchange flows reveal cautious sentiment and limited spot demand.

XRP continues to move inside a narrow range as traders watch for signals that could determine its next major direction. The token trades near $2.00, a level that has attracted buying interest several times in recent sessions. Analysts note that XRP remains trapped under a group of key moving averages, which continue to limit upward progress. Besides, volatility has compressed on the four-hour chart, suggesting that a sizeable breakout could develop once momentum returns.

Support and Resistance Conditions Tighten

XRP trades below the 20, 50, 100, and 200 EMAs, and this alignment reflects persistent selling control. Price rejected the $2.07 to $2.10 region again, which has acted as a strong supply zone. However, the $2.00 level remains stable, and it continues to support short-term activity.

The lower Bollinger Band also sits near this zone, which strengthens its relevance. Additionally, traders watch $1.95 as a key Fibonacci level that could invite deeper losses if broken. The $1.82 area still represents a major structural floor. Hence, bulls need to protect this region to avoid a broader decline.

Related: Bitcoin Price Prediction: BTC Holds Near $90,000 as Market Awaits Direction…

Upside barriers remain well-defined despite recent weakness. XRP must close above the supply band around $2.07 to $2.10 to begin a stronger recovery. Besides, the $2.15 Fibonacci level stands out as the next important checkpoint, while $2.26 offers a more meaningful bullish signal. A push beyond $2.36 would indicate a clearer trend shift.

Derivatives Positioning Turns Cautious

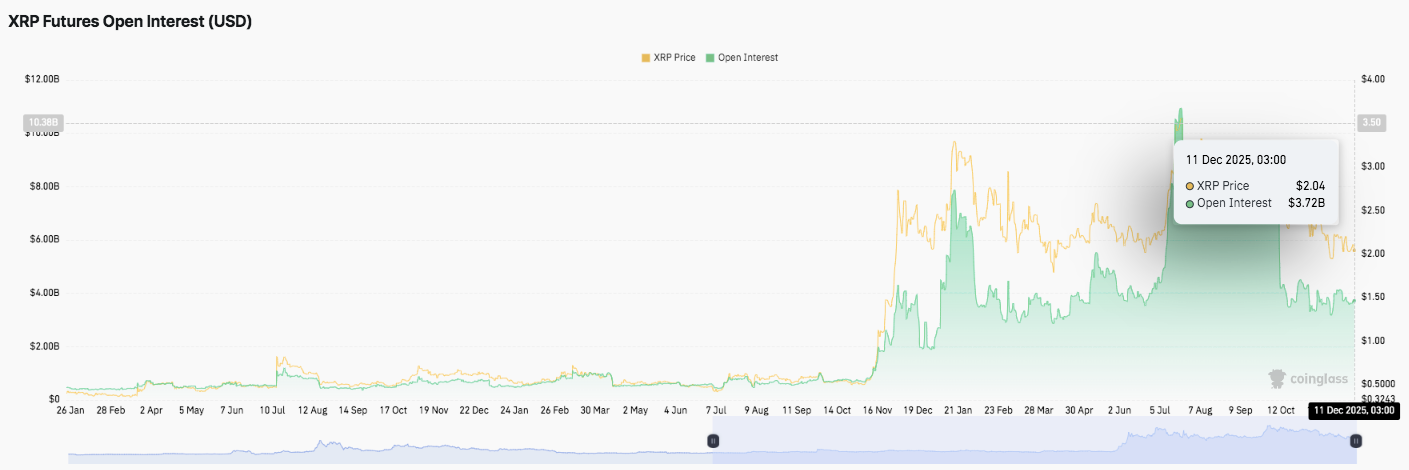

Open interest in XRP futures surged from October into August, climbing from under $2 billion to over $6 billion. This increase signaled heavier speculation as traders positioned around major resistance tests.

However, the later unwind toward $3.7 billion in December shows a move toward caution. Consequently, traders now reduce leverage as they wait for clearer signals.

Exchange Flow Trend Suggests Weak Buying Conviction

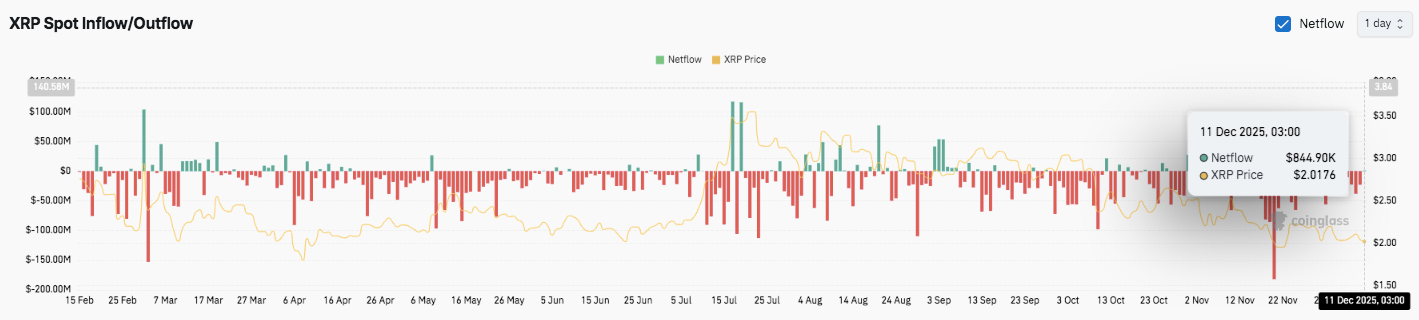

XRP’s inflow and outflow activity reflects steady distribution pressure. Outflows dominated most sessions this year, often reaching tens of millions.

Brief inflow surges in July and August supported short rallies, yet sentiment remained weak. Recent readings show small inflows as XRP trades near $2.02. Moreover, the consistent outflow bias hints at reduced spot demand and cautious participation.

Related: Midnight (NIGHT) Price Prediction 2025–2030

Technical Outlook for XRP Price

Key levels remain clearly defined as XRP continues to compress below major EMAs on the 4H chart.

- Upside levels: $2.07–$2.10 acts as the first hurdle, followed by $2.15 and $2.26. A stronger breakout could extend toward $2.36 if momentum improves.

- Downside levels: $2.00 serves as immediate trend support, followed by $1.95 at the 0.236 Fibonacci retracement and $1.82 as a deeper structural low.

- Resistance ceiling: The $2.07–$2.10 EMA cluster remains the key zone to flip for medium-term bullish momentum.

The technical structure shows XRP compressing inside a tightening range beneath all major EMAs. The pattern signals heavy pressure on buyers but also reduced volatility ahead of a decisive move. A breakout from this squeeze could trigger a volatility expansion that sends price toward the next Fibonacci targets or back toward prior support zones.

Will XRP Break Higher?

XRP’s next direction depends on whether buyers can defend the $2.00 level long enough to challenge the $2.07–$2.10 supply area. A clean break above this cluster could unlock upside toward $2.15 and $2.26, with $2.36 emerging as a high-value target if inflows strengthen.

Technical compression and declining volatility point toward a larger swing developing soon. Additionally, open interest has cooled from its August peak, suggesting reduced leverage and a setup that favors stronger reactions once price escapes consolidation.

Failure to hold $2.00, however, exposes XRP to $1.95 and potentially $1.82 if selling pressure accelerates. These levels define the broader accumulation base that underpins the current structure.

Related: Cardano Price Prediction: Buyers Lose Trend Support as Outflows Rise & Momentum Weakens

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.