- XRP slips below its rising trendline as more than $12M in outflows signal pressure on short-term structure and limit bounce strength.

- Price compresses inside a multi-month triangle with EMAs turning into resistance, keeping $2.22–$2.26 as the first major bullish trigger.

- New OCC and CFTC guidance creates clearer banking and derivatives pathways for Ripple as it seeks a national charter and Fed account access.

XRP price today trades near $2.06 after slipping almost 2% as sellers push the token below a rising intraday trendline. The move comes as spot outflows increase and the broader market waits for clarity from U.S. regulators. Despite the pullback, XRP sits at the edge of a larger multi month triangle where pressure continues to build.

Spot Outflows Rise As Buyers Struggle To Hold Intraday Structure

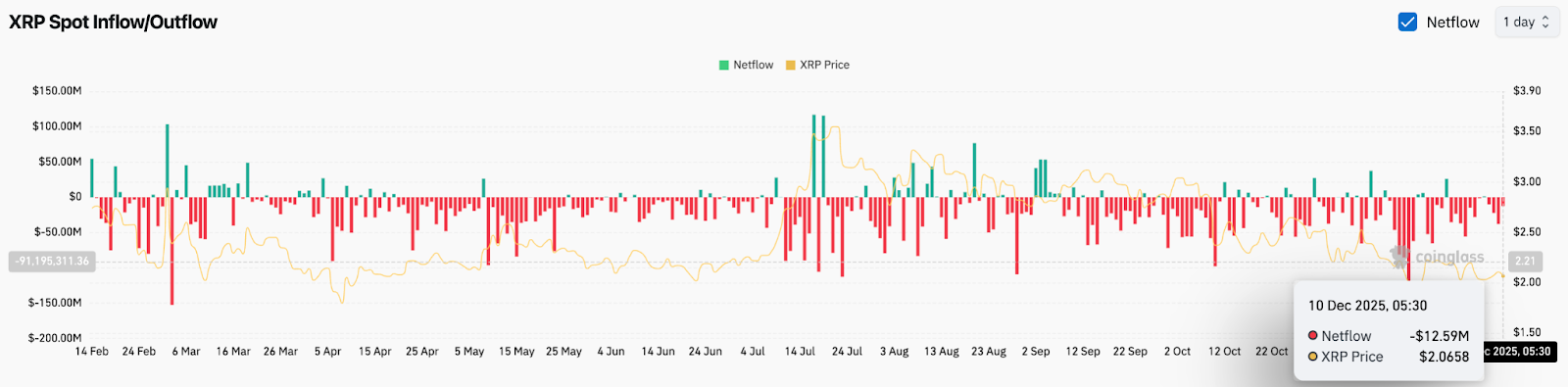

XRP recorded more than $12 million in net outflows today, according to Coinglass. Outflows have dominated the last several sessions and signal that traders continue to move supply back onto exchanges instead of holding.

Intraday action confirms that weakness. The 30 minute chart shows XRP losing its rising trendline after repeated rejection near $2.10. RSI sits near 36, showing declining momentum, while MACD has crossed into negative territory. These conditions typically lead to extended chop or a retest of deeper support.

Related: Ethereum Price Prediction: ETH Shows Renewed Strength as Futures…

Buyers still defend the $2.02 region, but the lack of strong inflows limits the strength of any bounce. The next hours will determine whether XRP stabilizes above this shelf or breaks toward the lower boundary of the triangle.

Daily Chart Shows Compression As EMAs Turn Into Resistance

On the daily frame, XRP trades below the 20, 50, 100 and 200 day EMAs. The alignment of these moving averages reinforces the broader downtrend that has been in place since September. Sellers continue to protect the $2.22 to $2.26 region, which includes the descending trendline that has rejected every breakout attempt for months.

Supertrend resistance at $2.40 remains the primary reversal barrier. A close above it would shift momentum in favor of buyers and signal that XRP can attempt a structure reset. Until then, every push higher remains reactionary.

Key levels to watch:

- Immediate support: $2.02

- Primary support: $1.90

- Upper wedge resistance: $2.26

- Trend reversal trigger: $2.40

- Broader target: $2.91 if strength returns

XRP continues to compress between these levels. Compression phases usually produce decisive directional moves once the coil breaks. With both macro catalysts and regulatory news in play, volatility is likely to increase.

Regulatory Shifts Create A Clearer Path For Ripple

The regulatory landscape in the U.S. shifted this week as two major agencies introduced new guidance that could reshape how digital assets integrate with banking and derivatives markets.

The Office of the Comptroller of the Currency announced that banks can act as intermediaries for crypto transactions through riskless principal activities. This allows banks to temporarily purchase a digital asset and immediately sell it to customers without taking market exposure. The guidance reduces operational friction and gives banks a safer track for offering crypto products.

The Commodity Futures Trading Commission also approved a pilot program that allows bitcoin, stablecoins and select digital assets to serve as collateral in derivatives markets. This signals that regulators are preparing for broader institutional use of digital assets within established financial systems.

Related: Bitcoin Price Prediction: Buyers Hold Channel Support as Fed Decision…

For Ripple, the timing is critical. Earlier this year, CEO Brad Garlinghouse confirmed that Ripple applied for a national bank charter with the OCC. If approved, Ripple would operate under both state and federal oversight, making it one of the first crypto native institutions to hold full U.S. banking permissions.

Ripple also applied for a Federal Reserve master account through Standard Custody. This would allow the company to hold RLUSD stablecoin reserves directly at the Federal Reserve. Direct Fed access is rare and normally limited to fully regulated banks. Securing it would position Ripple as a core infrastructure provider in the digital payments stack.

What A Bank Charter unlocks For Ripple And XRP

A national charter would allow Ripple to custody digital assets, offer lending services and connect directly to FedNow, the instant payments network. This expands the number of payment and settlement use cases that tie back to XRP, particularly in cross border flows.

The charter could also give Ripple access to the Federal Reserve discount window during liquidity stress, a privilege generally held by traditional banks. This would elevate Ripple into a highly regulated tier of financial institutions and improve trust for institutions evaluating RLUSD for settlement.

In parallel, the CFTC updated its cross border swap rules, offering more clarity for institutions that want to settle trades using digital assets. Cleaner rules reduce uncertainty and strengthen Ripple’s position in regulated settlement markets.

Outlook. Will XRP Go Up

A close above $2.22 is required to regain momentum and set up a retest of $2.26. Breaking $2.26 opens the path toward $2.40 and signals a possible trend reversal. Strength above $2.40 targets $2.91.

Failure to hold $2.02 exposes the lower boundary of the triangle near $1.90. Losing $1.90 shifts the structure into a deeper correction.

If buyers defend $2.02 and flows improve, XRP can attempt another breakout. If sellers push price below $1.90, the broader downtrend resumes.

Related: Avalanche Price Prediction: AVAX Attempts a Turnaround as Buyers Test Early Recovery Signals

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.