- XRP trades in a tight range, digesting gains after failing above $2.40 resistance.

- Key support holds near $1.87, with breakdown risking a drop toward $1.77 floor.

- Large wallets increase holdings, signaling quiet accumulation despite spot outflows.

XRP continues to trade in a corrective range after a sharp rally earlier this cycle. Price action now reflects digestion rather than panic selling. After failing to sustain momentum above the $2.40 region, XRP pulled back into a tighter structure. Traders now watch whether consolidation resolves higher or breaks lower.

The 4-hour chart shows defined technical boundaries, while derivatives and spot data point to reduced risk appetite. However, select on-chain signals suggest longer-term holders quietly rebuild positions.

Price Structure Tightens Below Key Resistance

XRP currently holds a compressed range following its recent retracement. Price slipped toward the $1.87–$1.90 zone after rejecting near $2.42. Consequently, the market now trades below mid-range Fibonacci levels, limiting upside follow-through. This behavior suggests cooling momentum rather than a full trend reversal.

Support remains clearly structured. Buyers continue to defend the $1.87 area, which aligns with recent swing lows. A clean breakdown below this level exposes $1.77, a critical technical floor. Hence, failure to hold $1.77 would weaken the 4H structure and favor deeper downside pressure.

Resistance remains layered overhead. Initial supply sits near $1.92–$1.93, followed by a heavier barrier around $2.01–$2.03. Moreover, the $2.17–$2.18 region marks the most important resistance cluster. A sustained break above this zone would restore bullish control and reopen the $2.28–$2.42 range.

Related: Cardano Price Prediction: ADA Holds Fragile Ground as Sellers Retain Control

Momentum indicators reflect equilibrium rather than trend strength. RSI hovers near neutral territory, signaling balance between buyers and sellers. Additionally, MACD trends sideways, reinforcing the consolidation narrative.

Derivatives Show Cooling Risk Appetite

Derivatives data confirms this shift. Open interest surged aggressively during the prior rally, peaking above $10 billion. However, traders later unwound positions as price momentum faded. Consequently, open interest declined and stabilized near $3.4 billion. This level remains elevated historically, yet it reflects more cautious leverage use.

Spot Flows and On-Chain Data Offer Mixed Signals

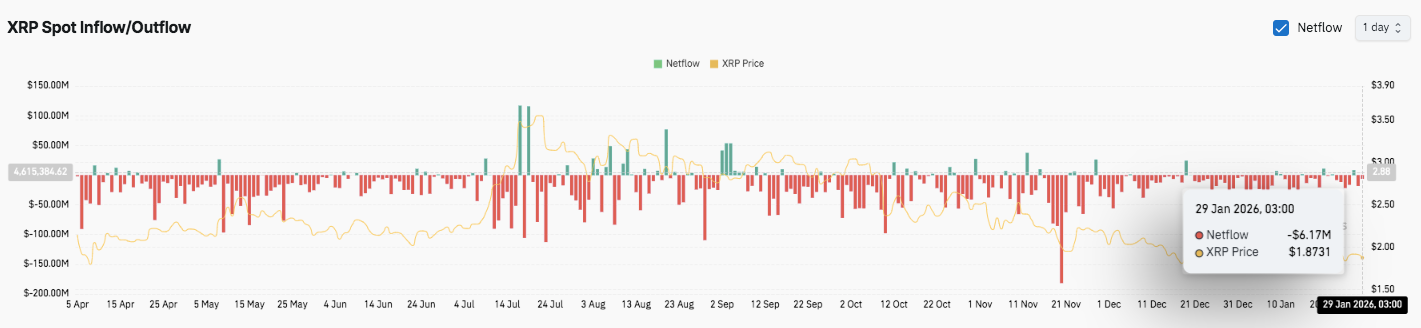

Spot flow data continues to show net outflows dominating activity. Persistent negative flows suggest ongoing distribution pressure. Brief inflow spikes appeared during short-lived rebounds, but they failed to sustain accumulation. Moreover, renewed outflows aligned with XRP’s slide toward the $1.80 region.

Significantly, on-chain data introduces a contrasting signal. Wallets holding at least one million XRP have increased for the first time since September. XRP price remains modestly lower in early 2026, yet large holders quietly returned. This trend hints at strategic accumulation rather than speculative chasing.

Related: Bitcoin Price Prediction: BTC Stuck Below 50 Day EMA as Gold Rally & Dollar…

Technical Outlook for XRP Price

Key levels remain clearly defined as XRP trades through a consolidation phase on the 4H chart.

Upside levels sit at $1.92–$1.93 as the first hurdle, followed by $2.01–$2.03. A stronger breakout zone rests near $2.17–$2.18. A sustained move above this area could reopen the path toward $2.28 and the prior high near $2.42.

On the downside, immediate support holds at $1.87, backed by recent swing lows. Below that, $1.77 stands as the critical level to defend, aligning with the broader retracement base. A clean loss of $1.77 would weaken the structure and tilt the 4H bias bearish. The technical picture suggests XRP is compressing within a defined range after a sharp rally.

Will XRP Move Higher?

XRP’s near-term outlook hinges on whether buyers can defend $1.87 and force acceptance above the $2.03–$2.18 resistance band. A bullish resolution could trigger renewed volatility and a retest of higher levels.

However, failure to hold $1.87 risks exposing $1.77 and extending the corrective phase. For now, XRP remains at a pivotal inflection point, where conviction and volume will likely determine the next decisive move.

Related: Shiba Inu Price Prediction: SHIB Faces Bearish Pressure Despite 1,200% Burn Rate Spike

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.