- XRP is consolidating in a tight range, capped by key resistance at $2.70–$2.77

- This technical barrier must be broken to unlock a potential November rally toward the $3.00 level

- Analysts note weekly Bollinger Bands are squeezing, signaling a decisive, volatile breakout is imminent

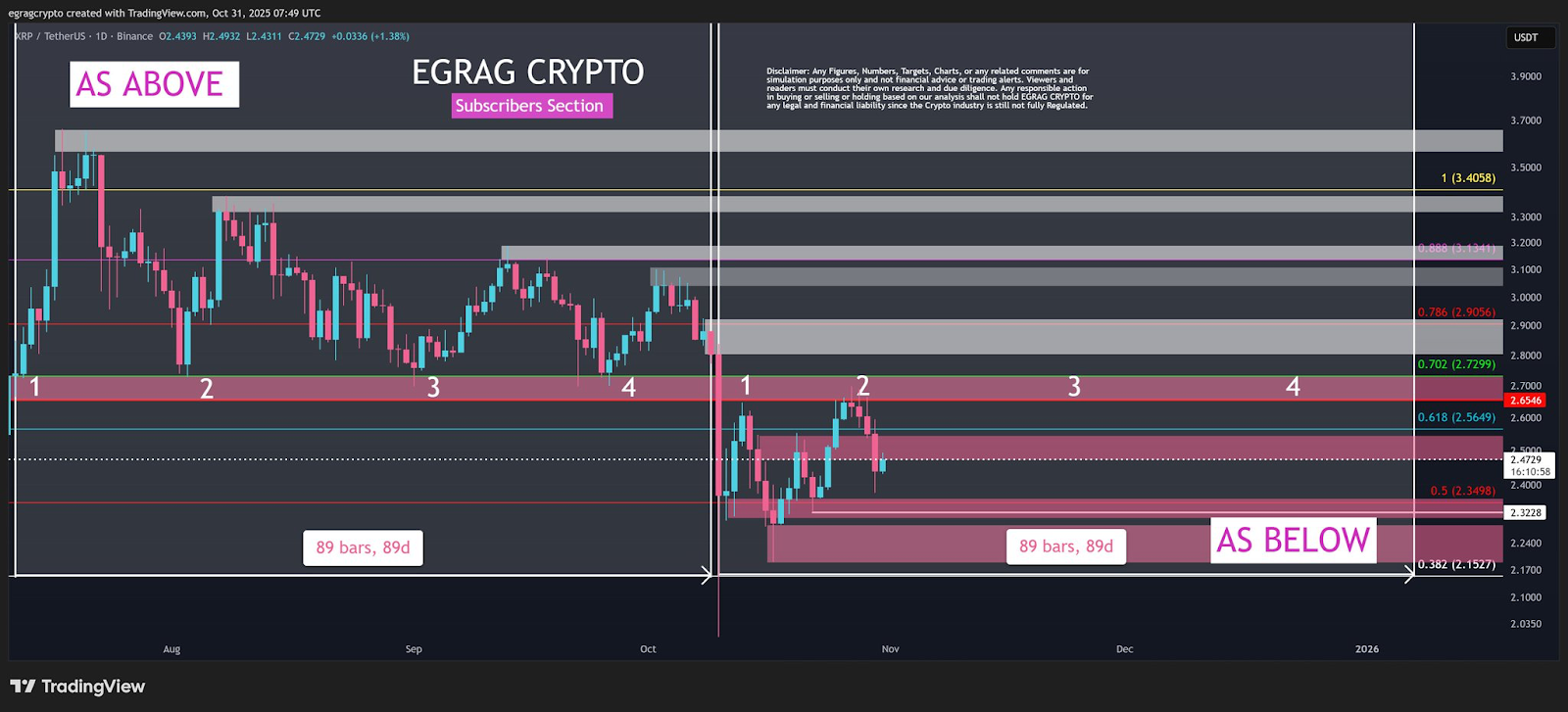

XRP’s price is consolidating in a tight range as the market heads into November. The token’s path to a breakout above $3.00 hinges on its ability to reclaim the critical $2.70–$2.77 resistance zone today. This analysis, from popular analyst Egrag Crypto, focuses on the immediate technical setup.

According to the analyst, the XRP/USD pair lost its crucial $2.77 support level. This level has now turned into a formidable resistance. The price is now building a consolidation pattern based on historical trends.

Related: Ripple CTO Strikes Back After Analyst Says XRP Has ‘No Real Use’

Egrag noted:

“Historically, this setup builds 4 clean touch points, and that 5th touch. That’s the Breakout Moment!”

Why Is XRP Consolidating Below $2.77?

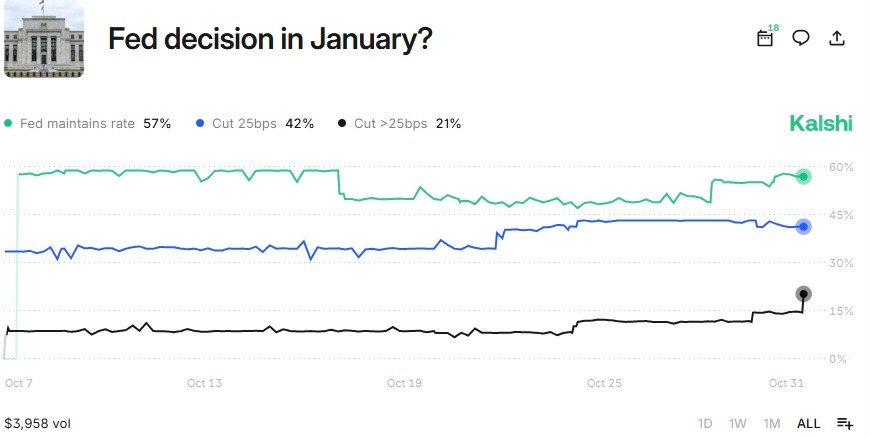

The current consolidation is linked to macro indecisiveness from the Federal Reserve. Due to the ongoing U.S. government shutdown, key high-impact economic data releases have been postponed. Fed Chair Jerome Powell confirmed this will impact the December 2025 policy decision.

As such, the odds of a 25 bps Fed rate cut in December have dropped from 88% to 67%, while the chances of the Fed maintaining its policy have increased from 10% to 29% at press time according to Kalshi traders.

XRP Technicals: $2.77 Barrier and an Imminent Squeeze

The $2.77 level is now the primary technical barrier. The XRP/USD pair has struggled to rally above this price since it broke below during the October 11 crypto crash. This former support has now confirmed itself as strong resistance.

This price level had previously held as support from July until early October. The weekly Bollinger Bands indicator is now squeezing. This technical pattern signals that a volatile, decisive breakout is imminent.

Related: Community Figure Says XRP Price Would “Explode” if IMF Adopts Token as E-SDR

Finally, the market is also weighing the risk of delayed spot XRP ETF listings. With more than a dozen filings pending, bullish anticipation has been building. The recent listings of spot ETFs for Solana, Litecoin, and Hedera suggest XRP may be next. This setup creates a high probability of a “sell-the-news” event, which could lead to further choppy consolidation rather than an immediate rally.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.