- Ripple has filed its Motion for Summary Judgment in the District Court of New York.

- Judge Analisa Torres to make a ruling based on the arguments filed in the documents.

- The documents were posted to a federal court database on Friday, September 16.

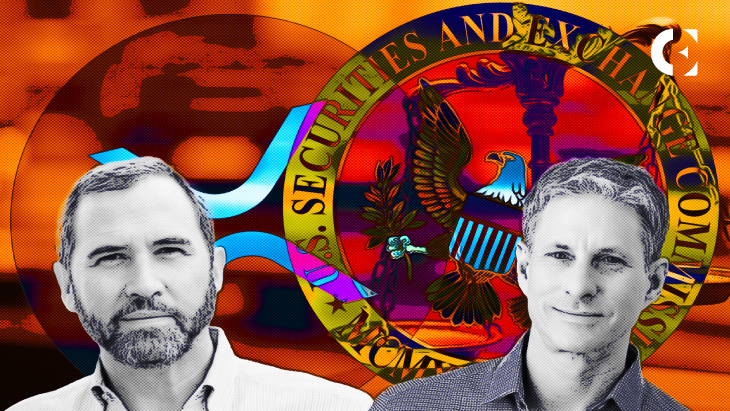

The CEO of Ripple Brad Garlinghouse and Chairman Chirs Larsen filed their Motion for Summary Judgment in the Southern District Court of New York. XRP filed the motions on Saturday, September 17, earlier than the set date.

Subsequently, SEC and XRP filed motions for summary judgment in the southern court, seeking District Judge Analisa Torres to make a ruling based on the arguments in the accompanying documents. The documents were posted to a federal court database on September 16.

Defense lawyer James K. Filan, who is heavily invested in the SEC vs. XRP court proceedings, announced on Twitter the new developments in the endgame.

#XRPCommunity #SECGov v. #Ripple #XRP BREAKING: Ripple Labs, Brad Garlinghouse and Chris Larsen file Motion for Summary Judgment seeking judgment as a matter of law.https://t.co/1BG1MgQu7p

— James K. Filan 🇺🇸🇮🇪 113k (beware of imposters) (@FilanLaw) September 17, 2022

As per the filings, the parties have failed to prosecute whether Ripple violated securities law by selling XRP. Ripple argued that there was no contract between the company and XRP investors and that there was no joint enterprise, per one of the requirements under the Howey Test.

To illustrate, Ripple’s general counsel Stuart Alderoty noted that even after two years of litigation, the SEC has failed to identify any contract for investment and “cannot satisfy a single prong of the Supreme Court Howey test.”

Notably, the motion also argued that the SEC has failed to establish that XRP holders could not “reasonably expect profits” based on Ripple’s efforts as there were no contract obligations between Ripple and XRP token holders.

A statement from XRP in the filing read:

Even if the SEC were to engage in a belated, post-discovery transaction-by-transaction analysis to identify XRP offers and sales with contracts, its claim would still fail as a matter of law. Not one of those contracts granted post-sale rights to recipients as against Ripple or imposed post-sale obligations on Ripple to act for the benefit of those recipients.

In any event, if the court executes the summary judgment, the court ruling will have a stern impact on determining which cryptocurrencies make security under U.S. securities laws.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.