- SEC now has 155 crypto ETF filings, with Solana, XRP, Bitcoin, and Ethereum at the front.

- Government shutdown slowed decisions, pushing final dates and creating a backlog.

- Experts say baskets win as TradFi prefers index or active crypto ETFs over single tokens.

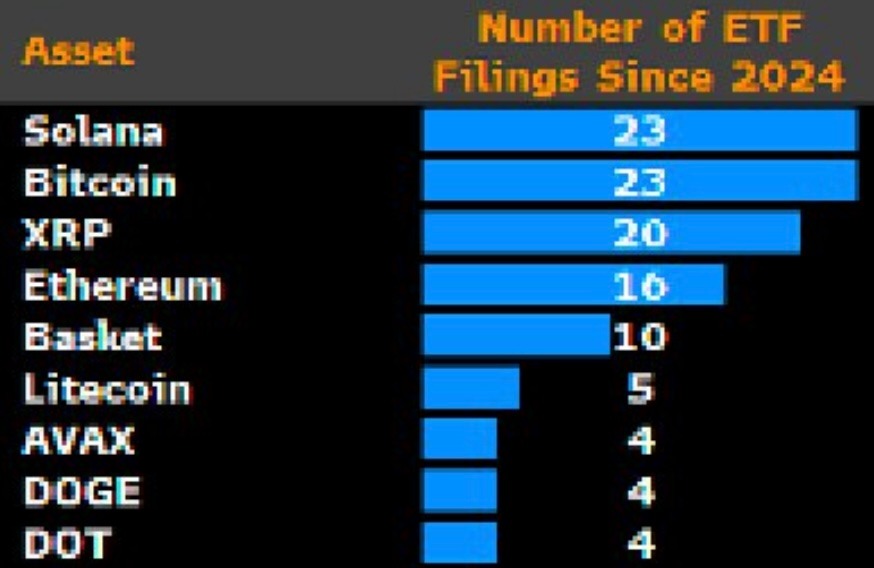

A new compilation from James Seyffart shows 155 crypto ETF applications awaiting SEC action. The pile grew over the past year as issuers chased regulated wrappers for coins beyond Bitcoin and Ethereum.

Since the U.S. government shutdown, now in its third week, has left the SEC with minimum staffing, which delayed decisions and widened the queue. That bottleneck now shapes the next twelve months of approvals and denials.

Solana Leads the Spot ETF Application Rush

Out of the 155 crypto ETFs, different fund managers have filed with the U.S. SEC to offer 23 spot Solana (SOL) ETFs. Some of the notable spot Solana ETF applications include:

- Canary Capital

- VanEck

- 21Shares

- Bitwise Asset Management

- Grayscale Investments

- Franklin Templeton

- Fidelity Investments

Notably, almost all the spot Solana ETF applications, except Franklin Templeton and Fidelity Investments, had their final decision before the end of October 2025. However, the prolonged U.S. government shutdown has caused the SEC to miss its final deadline since it has been operating with a bare minimum of employees.

Related: 21Shares Files INJ ETF as Injective Joins Elite Group With Multiple ETF Bids

Bitcoin has a similar number of ETF applications to Solana in the United States. The XRP ETF applications are 20, and Ethereum’s are 10.

Why baskets may beat single-token funds

According to Eric Balchunas, an ETF expert at Bloomberg, the list of crypto ETF applications in the United States is likely to surpass 200 in the next twelve months. Currently, 35 different crypto assets, including memecoins such as Dogecoin (DOGE) and Pudgy Penguins (PENGU), are in the list of crypto ETF applications.

However, Nate Geraci, President of NovaDius Wealth Management and the host of ETFPrime, noted that TradFi investors are less likely to navigate through all single-token ETFs. As such, Geraci highlighted that he is bullish on index-based and actively managed crypto ETFs.

“No way tradfi investors are ready to navigate all of these single tokens. They’re going to take a diversified, shotgun approach to an emerging asset class,” Geraci noted.

Some of the prominent basket-based crypto ETFs include:

- 21Shares Crypto Basket Index ETP (HODL), which plans to invest in the top 5 digital assets by market cap.

- CoinShares Physical Top 10 Crypto Market ETP (CTEN), which will track the top 10 crypto assets by market cap.

- CoinShares Physical Smart Contract Platform ETP (CSSC), which will focus on crypto assets that are smart contract-oriented.

- Hashdex Nasdaq Crypto Index ETF (HASH11

- 21Shares Crypto Basket Equal Weight ETP

What’s the Expected Market Impact

The crypto ETF rush in the United States is a major turning point for the mainstream adoption of digital assets. Under President Donald Trump, the odds of all spot crypto ETFs getting approved are high, especially after the U.S. SEC approved the generic listing standards for commodity-based ETFs.

As such, capital inflow to the crypto market will accelerate in the coming months, thus coinciding with the anticipated parabolic rally in the near term.

Related: XRP Price Prediction: Analysts Warn of Downside Risk as ETF Delay Extends Amid U.S. Shutdown

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.