- XRP led Thai markets with 5× gains and $8.2B in trading volume through August

- Shanghai court sold 90K FIL tokens, raising concerns over undervalued disposals

- FIL retests long-term support as AI demand boosts decentralized storage tokens

Asian markets are leaning deeper into crypto, both in spot and perpetual futures. A new monthly report from Thailand’s SEC showed XRP has been the best-performing asset in the country through August, outpacing every other regulated class this year.

Meanwhile, in China, a Shanghai court sold seized Filecoin (FIL) tokens at what may have been the bear market floor.

XRP Tops Thailand Gains

Ripple’s expanding partnerships and climbing exchange volumes have translated into standout returns for Thai investors. The SEC report shows XRP delivered a 5× rally over the past 12 months, cementing it as the top-performing major asset. Trading activity rose as well: August volumes were up 2.06% month-over-month to $8.2 billion.

Related: First Spot XRP ETF Goes Live, XRPR Structured Under 1940 Act; XRP Holds $3.10

XRP to Lead in Asia?

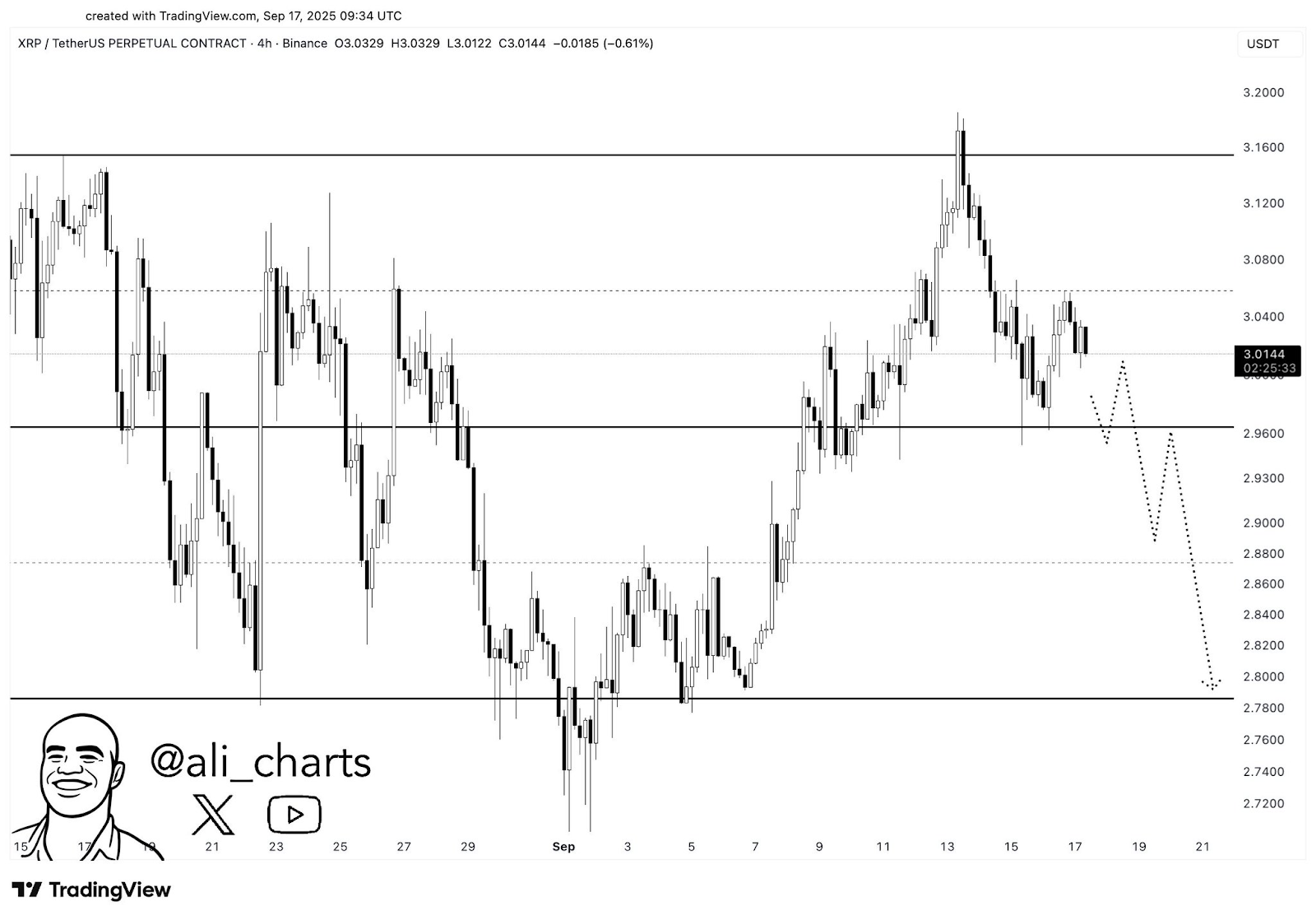

In the near term, crypto analyst Ali Martinez warned XRP could slip toward $2.78 if it fails to hold support near $2.96.

Longer term, he projects a macro bull run that could take XRP beyond $10, especially if an altseason plays out before year-end.

With an anticipated parabolic altseason before the end of this year, XRP is well-positioned to be the best-performing major asset in Thailand.

Shanghai Court Offloads 90K FIL

Meanwhile, in the Shanghai court, the Baoshan District People’s Court, announced that it has successfully disposed of 90,000 Filecoin (FIL) tokens seized in a criminal case.

The court located on the eastern coast of China noted that the move to offload the assets was motivated by cutting losses for the victims or the state.

“Compared to traditional property, the anonymity, cross-border circulation, and technical complexity of virtual currency present multiple challenges to existing disposal methods. How to achieve effective recovery of stolen property and mitigate losses in criminal cases while adhering to relevant regulations remains a challenge facing the People’s Courts in their criminal property enforcement work,” the People’s Court noted.

Selling Too Soon?

The notion that the People’s Court may have been forced by stringent crypto regulations to sell a more valuable and undervalued asset cannot be fully dismissed. Furthermore, the German government sold its Bitcoin holdings when BTC price hovered around $50k, missing out on a 2x return in less than a year.

Related: AI Crypto Sector Leads Market With NEAR, TAO, FIL, and Story Among Best Buys

FIL Market Context

From a technical analysis standpoint, it is evident that FIL price has been retesting a multi-year support level ahead of the anticipated parabolic altseason before the end of this year.

Moreover, FIL token is used to facilitate decentralized global data storage amid increasing demand from the Artificial Intelligence (AI) space.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.