- State Street says stablecoins and tokenized real-world assets anchor institutional allocations, and it expects tokenization to reach roughly 16% of institutional portfolios within three years.

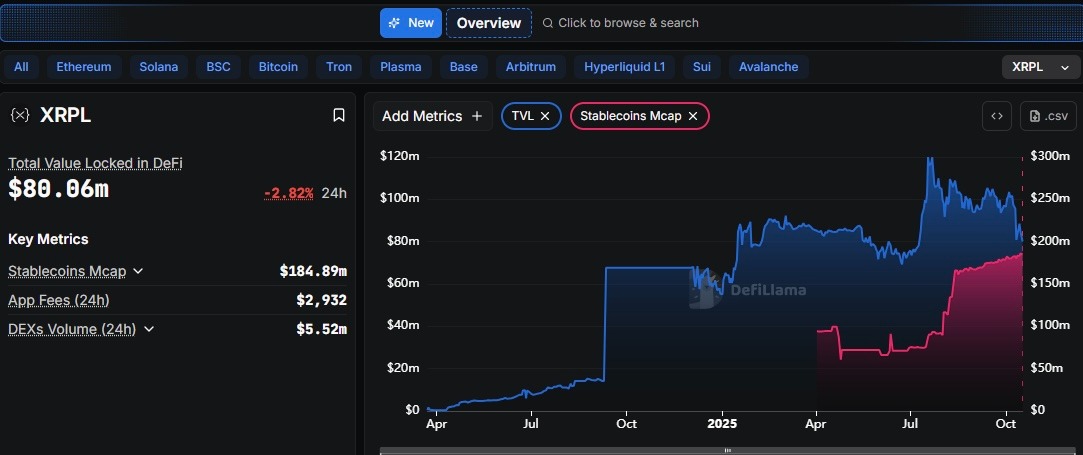

- Ripple pushes XRPL’s utility stack with RLUSD and acquisitions, while XRPL stablecoin value more than doubles to about $185 million since April 2025.

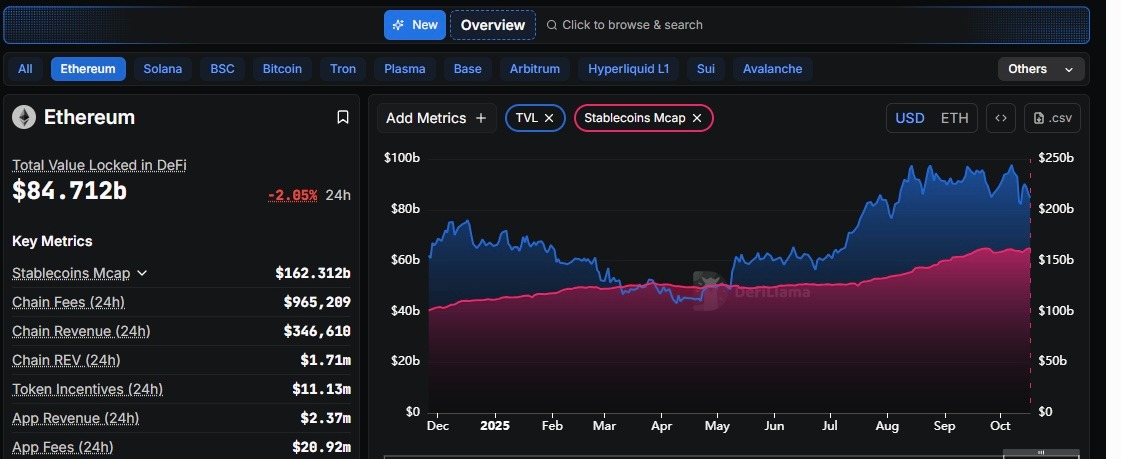

- Ethereum still commands the tokenization lane, with stablecoins growing from about $124 billion to roughly $163 billion as Wall Street pilots scale on ETH.

Wall Street tokenization keeps moving from pilots to production, and State Street projects tokenized assets could reach about 16% of institutional portfolios within three years.

Ethereum (ETH) still anchors the market with roughly $163 billion in stablecoins and the deepest RWA liquidity. XRPL (XRP Ledger) is building share with RLUSD, Ripple’s stablecoin, and new treasury rails. Ripple Labs has added Hidden Road, GTreasury, and Rail to tighten payments, custody, and cash management on XRPL.

Wall Street TradFi Bets on Continued Adoption of Tokenization

According to State Street, an asset manager with over $5 trillion in assets under management, Stablecoins and tokenized RWAs are the largest component of institutional digital asset allocations.

Last week, BlackRock’s CEO Larry Fink predicted that RWA tokenization will help the crypto market grow rapidly in the near future. While commending the Donald Trump administration for enacting the GENIUS Act, Fink noted that clear crypto regulations in the United States are needed to help in the mainstream adoption of crypto and RWA tokenization.

Ethereum vs XRPL: Same Destination, Different Roads

XRP Outlook on Tokenization

According to Digital Perspective, an X account dedicated to amplifying Ripple’s expansion into treasury payments and stablecoins, the XRPL network will claim a significant share of global smart contracts via XRP and RLUSD.

Since the official launch of the RLUSD, the XRPL chain has seen its stablecoin market cap more than double to $185 million since April 2025.

XRPL’s Push: RLUSD Growth and Deal-Driven Buildout

In a bid to accelerate RWA tokenization growth on the XRPL network, Ripple Labs has made strategic acquisitions in the recent past. For instance, Ripple Labs announced on Thursday that it acquired GTreasury, a global leader in treasury management systems, for a whopping $1 billion.

“Ripple’s and GTreasury’s capabilities together bring the best of both worlds, so treasury and finance teams can finally put their trapped capital to work, process payments instantly, and open up new growth opportunities,” Brad Garlinghouse, Ripple CEO, noted.

Related: Ripple, DTCC, and the “Public Network” Debate: Why Has XRP Searches Spiked Today

Earlier this year, Ripple Labs acquired Hidden Road for $1.25 billion to help in the mainstream adoption of RLUSD. The company also recently completed the acquisition of Rail, a stablecoin payment infrastructure, for $200 million.

Ethereum Defends Top Position in Stablecoin and RWA Tokenization

The Ethereum network has defended the top position in Stablecoin mints and RWA tokenization in the past years. According to Joe Moglia, the former CEO of TD Ameritrade, the Ethereum network has become the favorite RWA tokenization ecosystem for Wall Street’s investors.

According to market data analysis from DeFiLlama, the Ethereum network has seen its stablecoin market grow from around $124 billion to about $163 billion at press time.

Related: Ripple Labs Targets $1 Billion SPAC to Seed an XRP Treasury

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.