- XRP powers fast, low-cost cross-border payments, boosting global trade efficiency.

- Robinhood listing and regulatory clarity fuel XRP’s 50% price surge.

- XRP Ledger enables tokenization and stablecoin innovations, driving institutional adoption.

XRP is rapidly gaining traction in the financial world. Known for its fast and affordable cross-border payments, XRP is being recognized for its innovative uses across various industries.

XRP was designed to fix inefficiencies in traditional payment systems. It acts as a bridge currency for global transactions. Ripple’s On-Demand Liquidity service allows financial institutions to avoid pre-funding accounts in multiple currencies, reducing costs and improving liquidity management.

The XRP Ledger also supports a decentralized exchange, enabling users to trade various digital assets. XRP’s low transaction fees and flexibility make it attractive for small transactions and international trade.

XRP’s Price Surge: Key Catalysts

XRP recently experienced a price increase of nearly 50%, driven by several developments. Its listing on Robinhood raised its availability to retail investors.

Additionally, regulatory clarity has strengthened investor confidence. Organizations like the European Corporate Governance Institute have recognized XRP as a utility token rather than a security. Ongoing legal battles with the SEC that sly the outcome in favor of Ripple have also been a positive sentiment shifter.

Expanding Applications: A Focus on Trade Finance and More

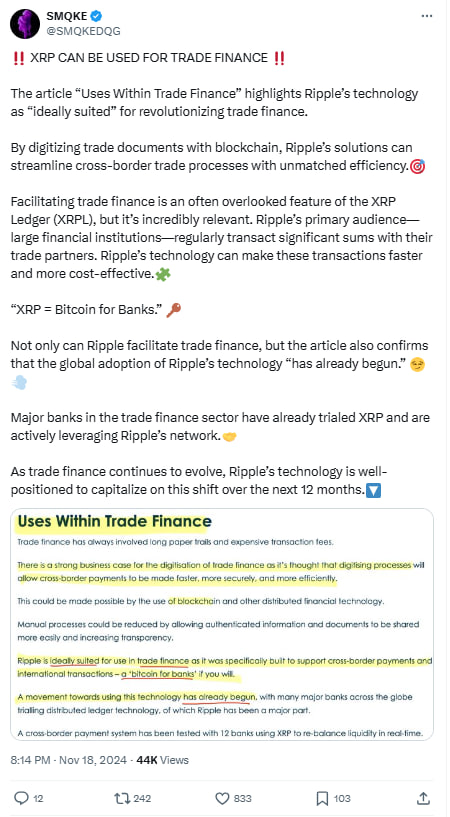

Ripple’s technology is finding increasing use across industries. Crypto analyst SMQKE highlights XRP’s potential in trade finance. SMQKE notes that Ripple’s blockchain solutions are well-suited for digitizing trade documents, improving efficiency in cross-border trade.

RippleNet, powered by XRP, is used by institutions like SBI Remit to provide affordable remittance services in countries like the Philippines, Vietnam, and Indonesia. Major players like Santander and American Express also use Ripple’s network to improve liquidity in international payments.

Tokenization and Stablecoin Integration

The XRP Ledger’s tokenization capabilities allow financial institutions to create digital representations of real-world assets. A common initiative is Societe Generale-FORGE’s plan to launch a MiCA-compliant stablecoin on the XRP Ledger by 2025.

Read also: XRP Ledger Activity Spikes as Ripple’s SEC Fight Continues

This highlights the ledger’s efficiency for cross-border payments. Markus Infanger from RippleX emphasizes the importance of stablecoins like EURCV in driving institutional adoption.

Ripple’s secure custody solutions further enhance the ability to tokenize and manage real-world assets alongside cryptocurrencies. This opens up new opportunities for asset-backed tokens and financial products.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.