- XRP has stayed in the top 15 cryptocurrencies for eight years

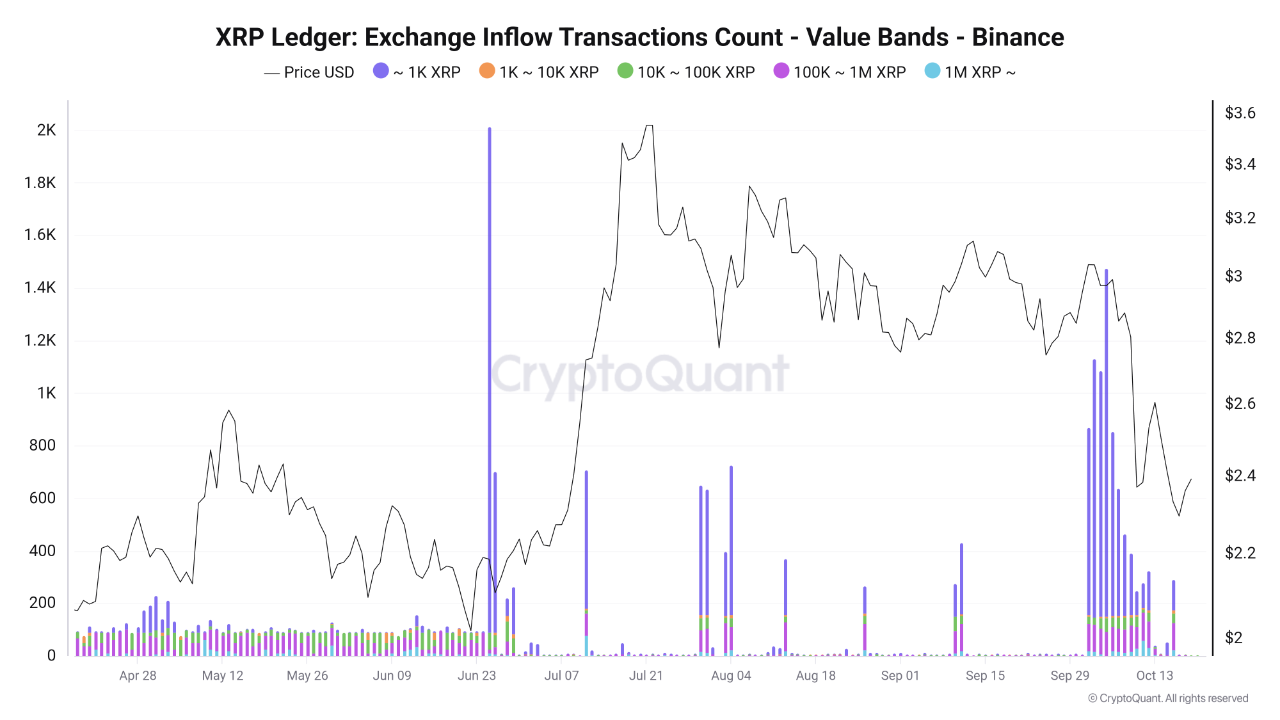

- Recent whale inflows on Binance caused short-term price pressure

- On-chain data shows retail deposited during dip, while whales sold near highs

XRP boasts an unmatched run among altcoins, holding its position within the top 15 digital assets by market cap for eight consecutive years.

XRP’s resilience persisted even through the SEC lawsuit and the 2022 crypto winter. Now, after rallying from sub-$0.50 lows last year to a multi-year high of $3.65 in 2025, that long-term strength faces a crucial test as the price consolidates near $2.38 support.

How Did Retail and Whales Trade XRP Differently During the Dip

According to CryptoQuant data, October saw an increase in XRP deposit transactions on Binance, the highest since June. The inflows were mainly from smaller tranches of around 1,000 XRP, indicating active participation from retail investors.

These inflows came alongside a drop in XRP’s price from near $3 to around $2.30–$2.60 mid-month and $2.38 at the time of writing. Larger deposits in the 10K–1M XRP range were also observed.

Whale Activity and Short-Term Pressure

CryptoQuant also noted a sharp increase in whale transactions early in October. From October 1 to October 17, Whale-to-Exchange transactions on Binance rose sharply, peaking at 43,000 on October 11.

The spike represents a wave of large holders transferring XRP to exchanges, a common sign of profit-taking or risk management during volatile markets. Following this surge, XRP’s price saw a notable correction from above $3 to around $2.30.

What Key Levels Must XRP Hold to Maintain Its Structure?

Based on the weekly XRP chart, the token is trading near $2.38 after a correction from $3.65. The chart shows a clear rising wedge breakdown followed by a bounce from the support zone around $2.30.

Meanwhile, the Bollinger Bands suggest price compression as the MACD remains slightly bearish but close to a potential bullish crossover. Also, the Chaikin Money Flow (CMF) stays positive, showing continued capital inflows.

However, the Balance of Power (BoP) is negative, indicating short-term selling dominance.

If XRP holds above the $2.30 support level, it could retest resistance at $2.76 and $3.54. A break above $3.65 could set the stage for a push toward its all-time high of $3.84. On the other hand, failure to hold the $2.30 support could see XRP retesting the $1.97 level.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.