- On-chain investigator ZachXBT criticized SBF’s pardon bid, highlighting the misuse of $40M in customer funds.

- SBF, in turn, has accused the current FTX administration (Debtors) of withholding funds and mismanagement.

- FTX has distributed $7.1B of $16B recovered; creditors await the next $9B, which is expected in January 2026.

Sam Bankman-Fried (SBF) is facing heavy criticism for seeking a presidential pardon. On-chain investigator ZachXBT, in particular, has slammed the convicted FTX founder for his arguments regarding the misuse of customer funds.

The investigator argued against SBF receiving a pardon similar to the one granted to Binance founder Changpeng Zhao. ZachXBT noted the court should have convicted SBF for the alleged bribery of Chinese officials, in addition to the other charges.

ZachXBT: Pardon Bid Ignores Misuse of Customer Funds

ZachXBT’s criticism centered on the protection of user funds. He highlighted that FTX used $40 million of customer funds to pay Chinese officials in an attempt to retrieve $960 million in frozen assets.

The investigator argued that FTX should have used its own profits for the payment, not customer deposits. He directly criticized SBF’s rationale that it was “better” to use $40 million in customer funds to retrieve $960 million than to lose the full $1 billion.

“A Bahamian exchange stole $8B and offered to give users only a % back. What should we have done—said ‘nah, pardon the founder’?” ZachXBT noted.

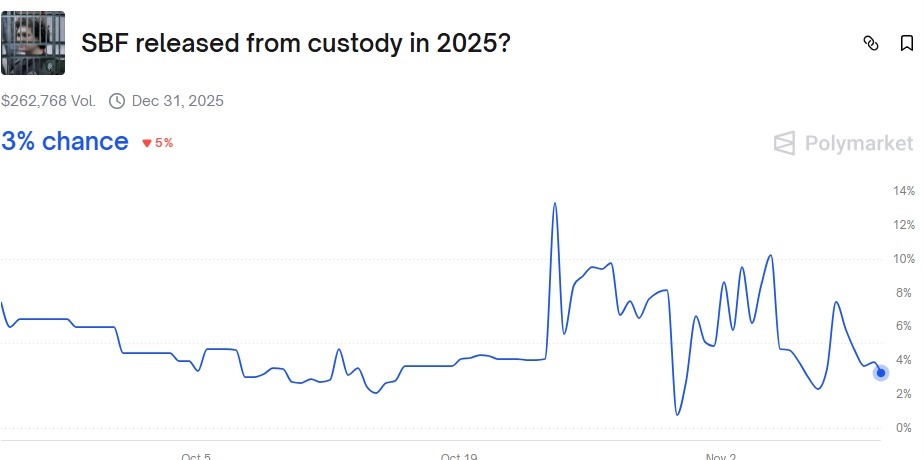

The market appears to agree with this skepticism. Polymarket data shows traders assign only a 3% chance to SBF being released from custody in 2025.

SBF Blames Debtors as Creditors Await $9B

The criticism from ZachXBT comes as SBF, while serving his 25-year sentence, accuses the current FTX administration of harming creditors. SBF alleges the “Debtors” are withholding funds for their own benefit.

“I’m not saying FTX’s solvency or the Debtors’ mismanagement are the reasons I’m innocent (although it’s a piece of the story!). But the Debtors are still withholding funds,” SBF noted.

The FTX creditors have missed a huge chunk of the ongoing bull market, especially since the Solana (SOL) price has already rallied 10x since the onset of the bankruptcy proceedings. Furthermore, the current FTX administration began its funds distribution in February 2025 and has since released a total of $7.1 billion out of the $16 billion recovered.

The FTX creditors, who had an account balance of less than $50,000, were paid a total of $454 million during the first funds distribution. Beginning on May 30th, 2025, FTX distributed $5 billion to creditors.

Potential date for the next funds distribution

The third FTX’s funds distribution happened on September 30 involving $1.6 billion. As such, FTX has yet to distribute nearly $9 billion to creditors globally, mostly due to legal technicalities

The defunct crypto exchange has yet to give a definitive official date for its next planned funds distribution. According to Sunil Kavuri, a popular FTX creditor activist, FTX is likely to begin its next funds distribution in January 2026, with the record date possibly in December.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.