- Zcash price trades near $488, reacting strongly at the ascending trendline and 20-day EMA around $450–$480.

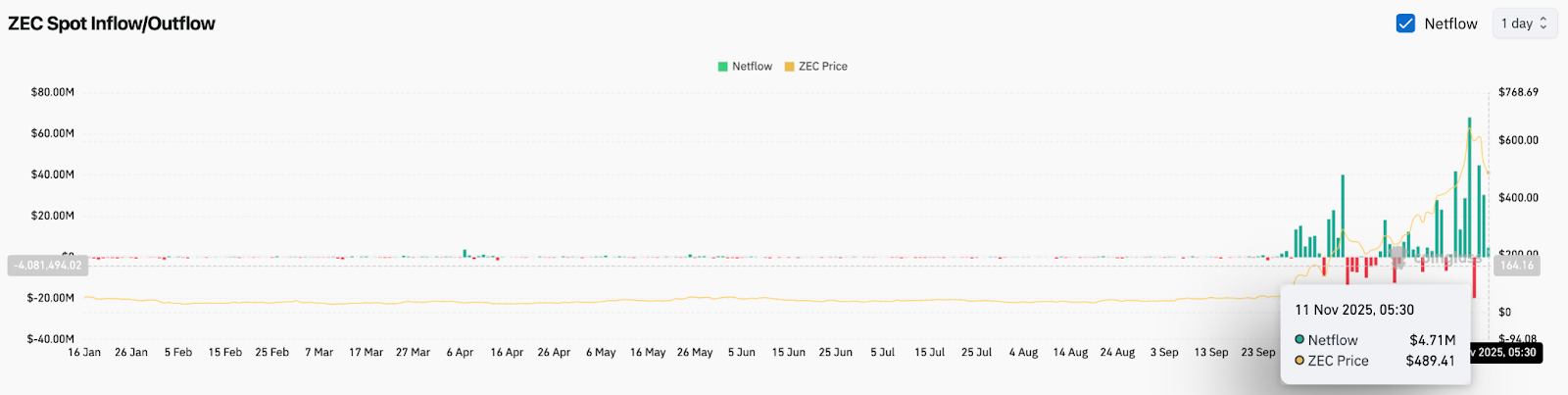

- Spot flow data shows $4.71 million in inflows, signaling accumulation as buyers move tokens off exchanges.

- A close above $552 reclaims momentum, while losing $442 opens downside toward $350.

Zcash price today trades near $488, stabilizing after a sharp pullback from last week’s peak near $760. Price is reacting at a confluence of support where the ascending trendline from September meets the 20 day EMA near $442–$450. The reaction at this zone decides whether ZEC resumes its aggressive uptrend or forms a deeper correction.

Spot Inflows Return As Sellers Lose Momentum

Recent spot flow data shows a shift in behavior. After multiple sessions of distribution earlier in the week, ZEC printed $4.71 million in spot inflows today according to Coinglass. This signals that participants are moving tokens back off exchanges rather than positioning for further selling.

When inflows stack at support, market behavior shifts from distribution to accumulation. The recent drop attracted buyers rather than panic sellers, indicating that the pullback is seen as a retest of trend support, not a trend reversal.

The flows matter here because ZEC has been one of the highest performers in the privacy category during the past sixty days. High momentum assets often attract liquidity during pullbacks, especially when trend support is tested for the first time.

Buyers Hold the Higher Timeframe Structure

On the daily timeframe, ZEC continues to trade above the rising trendline that has guided the parabolic advance since early October. The 20-day EMA sits near $442, and the price has not closed below it since the rally began. As long as ZEC remains above this band, the macrostructure favors continuation.

EMA alignment reinforces this bias. The 20, 50, 100, and 200-day EMAs fan upward at $442, $312, $214, and $140. This is a classic trending layout supported by higher lows, strong volume expansion, and sustained demand.

RSI on the daily chart cools from overbought levels near 76 and is now sitting near 60. Momentum has reset without breaking the uptrend, a healthy condition after a vertical move. The current pullback has not violated any key bullish level. Instead, price is retesting structure and shaking out late longs.

Intraday Trendline Still Capping Upside Attempts

Shorter timeframes show the other side of the battle. On the 30 minute chart, ZEC remains below a descending trendline that has rejected every attempt to rebound from the $630 to $650 zone. Each bounce forms lower highs, and Supertrend on the same timeframe is still red. VWAP sits above current price near $523–$552, creating a magnet level for intraday liquidity.

Buyers are attempting to build a base at $480–$470, a green demand zone marked by multiple touches during the week. This is the same zone where inflows appeared today.

These conditions define the fight:

- Bulls are defending $480 with spot inflows supporting the zone.

- Bears still control short term momentum below $523–$552 resistance.

The intraday trend flips back to bullish only if ZEC clears the descending trendline and closes above VWAP.

Outlook. Will Zcash Go Up?

The path forward depends on how ZEC behaves at the $480–$450 support zone.

- Bullish case: A sustained close above $552 reverses intraday momentum and signals continuation toward $625 and $700. Inflows support this scenario.

- Bearish case: A daily close below $442 breaks the trendline and opens downside risk toward $350.

The trend remains intact until proven otherwise. Buyers held trend support, inflows returned, and momentum indicators reset without losing structure. ZEC only needs a close above $552 to reassert trend strength.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.