- ZEC’s sustained uptrend and strong supports keep buyers firmly in control this month.

- Rising futures open interest shows heavy speculation and growing volatility risk.

- Fresh institutional accumulation boosts confidence in ZEC’s long-term privacy vision.

Zcash is attracting renewed market attention as traders intensify activity across spot and derivatives markets. The asset continues to show firm strength on the four-hour chart, even after a brief pullback earlier this week.

Besides holding above critical support levels, ZEC is also receiving strong backing from institutional buyers, reinforcing confidence in its long-term narrative. This combination of chart stability, futures expansion, and fresh accumulation places ZEC among the most closely watched privacy assets heading into late November.

Market Structure Supports Further Upside

ZEC maintains a consistent uptrend that started in early October. The market keeps forming higher highs and higher lows, showing buyers remain in control.

Price cooled near the 1.618 extension around the $717 region but stayed above local trend support. Moreover, short-term support around $647 continues to limit downside pressure, while structural support near $620 strengthens the broader trend.

Immediate resistance remains at $683 to $690, creating an area traders monitor for continuation. A sustained move above that zone may clear the path toward the $717 extension. Consequently, ZEC could test new cycle levels if buyers defend current support levels.

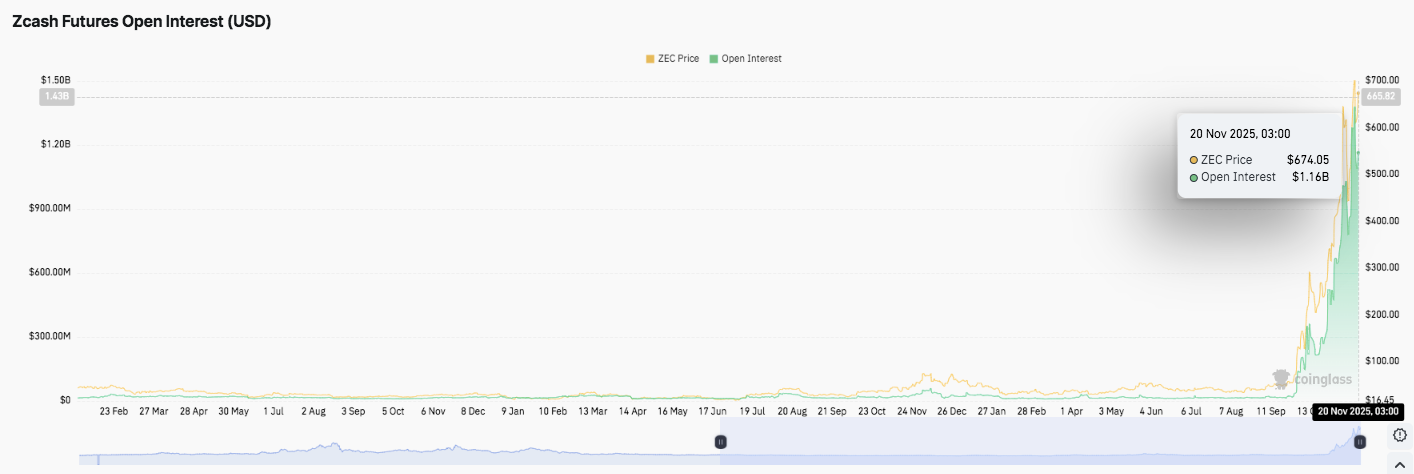

Derivatives Activity Signals Rising Speculation

Open interest in ZEC futures climbed sharply in November. It rose toward $1.16 billion by November 20 as traders increased exposure. This rise coincided with ZEC’s surge toward the $670 region. Hence, leverage appears elevated across the board, signaling stronger conviction and greater volatility risk.

The recent growth suggests that traders expect continued movement following ZEC’s rapid price expansion. Additionally, the steep increase shows both long and short positions building aggressively, making the market more sensitive to liquidation spikes.

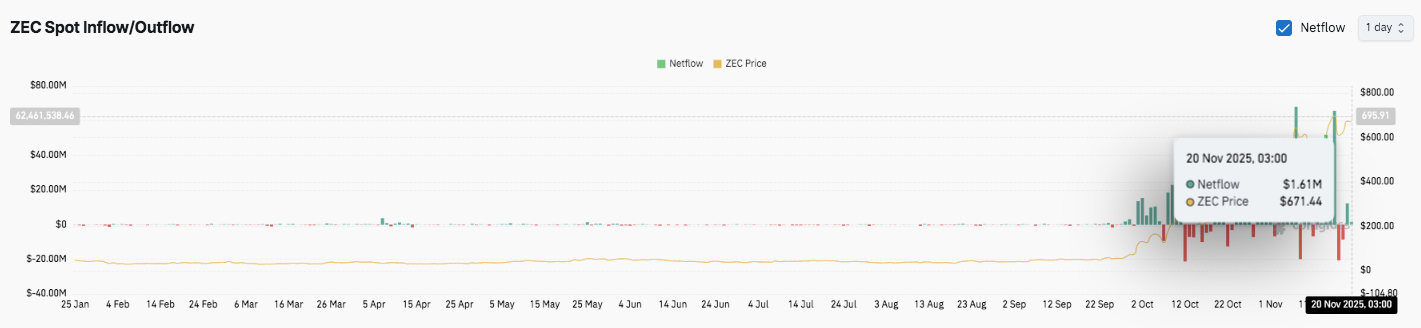

Spot Flows Reveal Active Rotation

Spot inflow and outflow trends turned more volatile in recent weeks. Activity remained quiet through much of the year but changed sharply in late October. Large inflows appeared during price dips, signaling traders were repositioning during corrections.

However, several strong outflows also emerged, showing ongoing accumulation. The latest $1.61 million net inflow on November 20 reflects this heightened rotation.

Institutional Accumulation Adds a New Catalyst

Cypherpunk Technologies increased its ZEC holdings after acquiring nearly 30,000 additional tokens. The firm now controls more than 1.43% of the network supply.

Moreover, new leadership joined its board, signaling broader commitment to the privacy sector. The company views ZEC as a strategic asset that aligns with rising interest in digital privacy.

Technical Outlook for Zcash (ZEC) Price

Key levels remain well-defined as Zcash moves deeper into its current trend cycle.

- Upside levels: $683–$690, followed by the $717–$720 Fibonacci extension zone as the next major hurdle. A breakout above this area could extend toward higher trend projections and signal renewed momentum.

- Downside levels: $647–$650 serves as immediate short-term support, with $620 marking the stronger structural base. The $555 region, aligned with deeper retracement support, anchors the broader bullish structure if volatility expands.

The technical picture suggests ZEC is compressing between the $650 support band and the $690 resistance shelf. This tightening range often precedes a decisive expansion phase, especially when aligned with rising open interest and rapidly shifting inflow patterns. Traders now watch for a clean push through $690 to confirm continuation toward the $720 resistance ceiling.

Will Zcash Break Higher?

ZEC’s near-term path depends on whether buyers can maintain the $647–$650 zone during ongoing consolidation. Holding this level may allow price to retest the $683–$690 cluster, where a breakout could revisit the $717–$720 extension. Historical trend behavior and recent derivatives growth suggest elevated volatility ahead.

If momentum strengthens alongside fresh inflows, ZEC could attempt a move toward new cycle highs beyond $720. Failure to defend $620, however, risks deeper retracement toward $555, where strong historical demand previously emerged. For now, ZEC trades in a pivotal zone as market conviction and structural confirmation shape the next direction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.