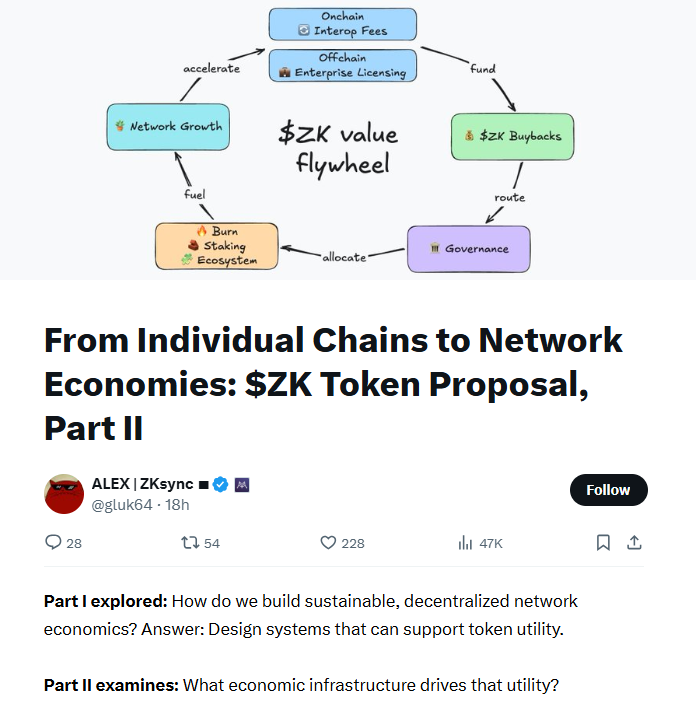

- The Pivot: Founder Alex Gluchowski proposed shifting $ZK from governance to a fee-capturing utility token.

- The Model: Revenue from cross-chain messaging and enterprise licenses would fund token buybacks.

- The Goal: To monetize the “ZK Gateway” as a unified settlement layer for institutional finance.

ZKsync founder Alex Gluchowski has proposed a new utility token model for the innovative Ethereum-based protocol. In his latest post on X, the renowned innovator highlighted various aspects of digital finance that he believes need to be improved upon, while outlining a proposed solution to those needs.

Gluchowski noted a coordination problem in the financial sector, particularly the incompatible messaging networks upon which global finance runs.

According to him, messages that facilitate financial transactions across the globe are trapped in incompatible silos, thus needing the services of expensive trusted intermediaries.

Related: ZKsync, Starknet, Linea Rip Higher as U.S. Shutdown Deal Spins Back Crypto Liquidity

The ‘ZK Gateway’ Revenue Model

After outlining the various stages in the messaging process and their associated costs, Gluchowski resolved that streamlining financial messaging can unlock enormous economic value. According to him, the lack of a shared, verifiable coordination layer forces them to reconcile data across many systems, driving operational cost, risk, and delays. These are the problems that he is aiming to resolve through the newly proposed ZK token utility model.

Gluchowski’s latest proposal, ZK Interop, aims to become the foundation for direct institutional connectivity. The renowned innovator describes it as a game-changer, with implications that extend far beyond payments. For instance, the solution can synchronize multi-bank instructions and acknowledgments in treasury and express authorization and clearing messages as verifiable receipts in card networks.

According to Gluchowski, the ZK Interop can collapse costly, multi-step post-trade confirmations and settlement processes into verifiable, near-atomic events between chains when dealing with securities, and coordinate ISO-20022 messages and eventually PvP settlement in cross-border transfers.

Industry Validation

In the meantime, Circle’s CEO, Jeremy Allaire, while describing the importance of messaging in the financial industry, noted that money velocity will expand in step with information velocity. He believes that economic throughput will scale non-linearly as soon as message coordination between systems approaches near-zero latency.

Gluchowski’s goal is to use the proposed innovation to collapse the latency for institutions, turning the current fragmented, slow message chains into instant, verifiable coordination.

Related: ZKsync Price Prediction: Traders Turn Bullish as Tokenomics Proposal Boosts Sentiment

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.