- On Tuesday, BTC exchange-traded funds saw a positive net flow of over $631 million.

- On the previous day, ETF inflows hovered around $493 million.

- The positive inflow coincided with Bitcoin’s reclaiming of the $50k threshold.

The research team at the BitMEX exchange has called attention to the considerable amount of funds that flowed into Bitcoin exchange-traded funds (ETFs) yesterday as Bitcoin reclaimed the $50k threshold.

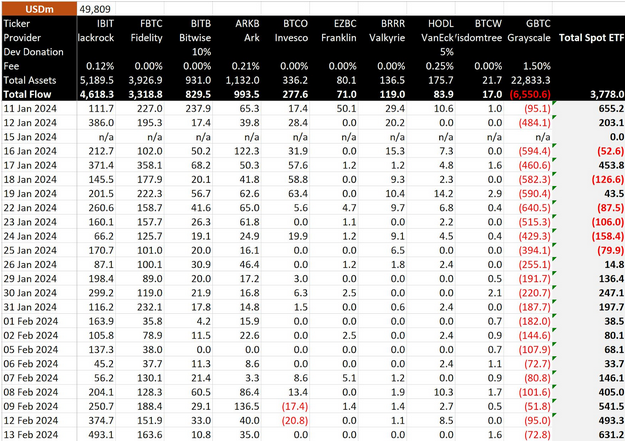

In a post on X, BitMEX Research noted that February 13 saw a positive net flow of $631 million to BTC-based investment vehicles across all ETF issuers. Among the U.S.-listed ETFs, BlackRock’s IBIT experienced the most significant influx. Specifically, BlackRock recorded over $493 million on Tuesday, followed by Fidelity at $163.6 million.

Similarly, Bitwise Bitcoin ETF witnessed an inflow of $10.8 million, and Ark Invest recorded $35 million. However, other funds, such as Invesco, Franklin, Valkyrie, and VanEck, registered zero inflow. Concurrently, Grayscale experienced a significant negative growth of $72.8 million.

Overall, the net influx of $631 million into Bitcoin-based investment vehicles on Tuesday reflects a 21% growth from the $493.3 million figure recorded on Monday. Notably, in BTC figures, the disclosure suggested that the spot exchanged traded funds consumed 12,735 Bitcoin tokens.

This uptrend coincided with Bitcoin cracking the $50k range yesterday, with the asset trading at $51,254 at press time.

Meanwhile, a separate report by crypto asset manager CoinShares outlined the weekly movement of funds through cryptocurrency-based investment products. The report revealed inflows of $1.115.9 billion over the past week. CoinShares mentioned that the figure contributed to year-to-date inflows amounting to $2.7 billion.

Significantly, Bitcoin accounted for nearly 98% of the inflows, totaling $1.089 billion, according to CoinShares. Additionally, minor inflows were observed in Avalanche (AVAX), Polygon (MATIC), and Tron (TRX), which collectively recorded approximately $1.3 million.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.