- Bitcoin worth $668.07 million left exchanges on September 30, indicating a spike in traders’ confidence in Q4 2022.

- Bitcoin’s social mention is on a decline, despite the negative sentiment the asset sustained above the psychological barrier at $19,000.

- Bitcoin’s uptrend relies on the price sustaining above the $19,000 level, there is a likelihood of a rally to $20,000.

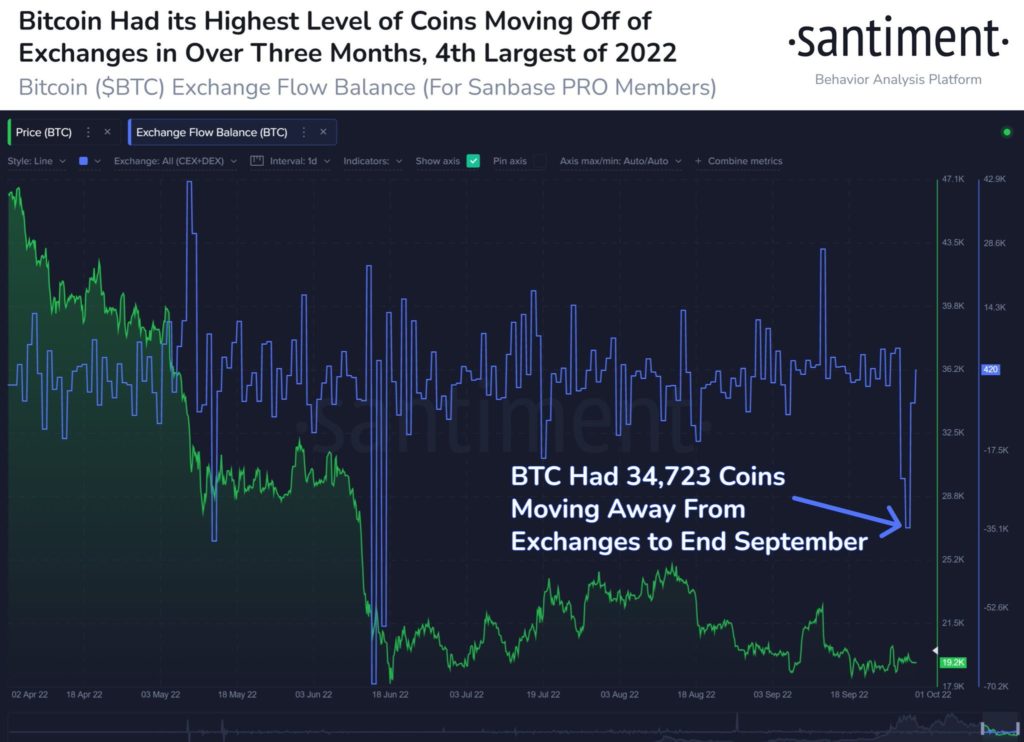

Bitcoin is leaving exchanges at a rapid pace. On September 30, 34,723 BTC worth upwards of $668.07 million left crypto exchanges.

This movement of Bitcoin out of exchanges is indicative of trader confidence in the asset. Heading into Q4 2022, large wallet investors are bullish on BTC.

According to data from crypto intelligence tracker Santiment, the last time large quantities of Bitcoin left exchanges, there was a 22% spike in the asset’s price.

Exchange reserves have consistently declined in the last three days. According to CryptoQuant, Bitcoin held on exchanges has plummeted by 60,000 within three days. This is the highest amount of BTC pulled out of exchanges in months and this indicates the return of buyers and demand for Bitcoin after months of a downtrend.

Net positive BTC exchange outflows are considered indicative of diminishing selling pressure by market participants. This is a bullish indicator of Bitcoin price.

Bitcoin price has sustained above the psychological barrier of $19,000. The $19,000 level is key to Bitcoin’s recovery.

Bitcoin price needs to hold above the current support at $18,210. In the event of an increase in selling pressure, the support at $18,210 will be retested. If Bitcoin preserves its uptrend, the asset could hit the $20,000 target.

The late phases of a Bitcoin bear market are characterized by the sale of BTC by holders. CryptoQuant’s Exchange Inflow SOAB is a metric used to track the aggressive selling behavior of Bitcoin holders. BTC purchased between April 2021 and April 2022 at prices above $30,000 was recently sold. These investors exited the market at a nearly 50% loss. However, this is an indicator that the bottom of the cycle is close and Bitcoin is ready to recoup its losses.

Disclaimer: The views and opinions expressed in this article are solely the author’s and do not necessarily reflect the views of Coin Edition. No information in this article should be interpreted as investment advice. Coin Edition encourages all users to do their own research before investing in cryptocurrencies.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.