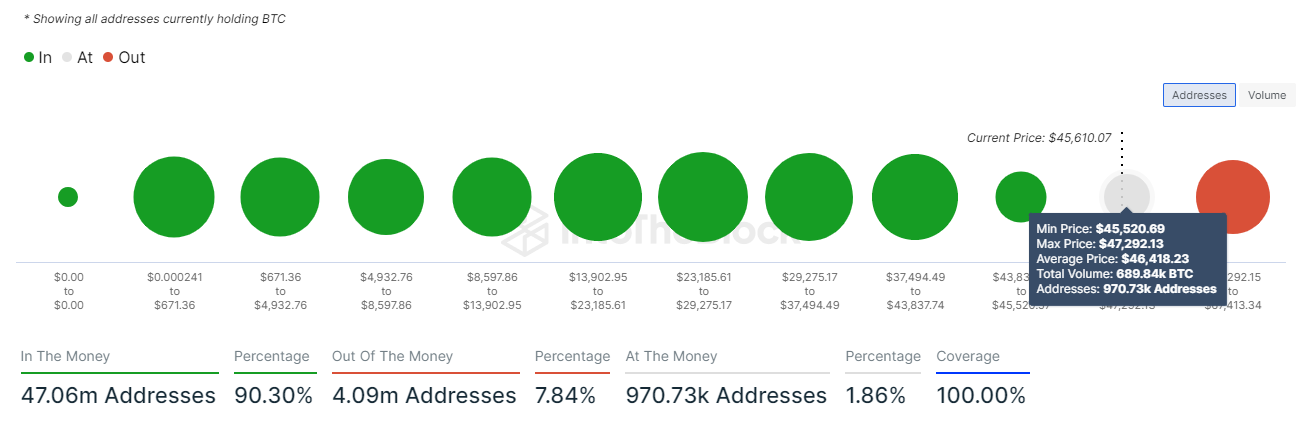

- 90% of Bitcoin holders (970K addresses) are currently in profit, despite market turbulence caused by fake spot Bitcoin ETF approval news.

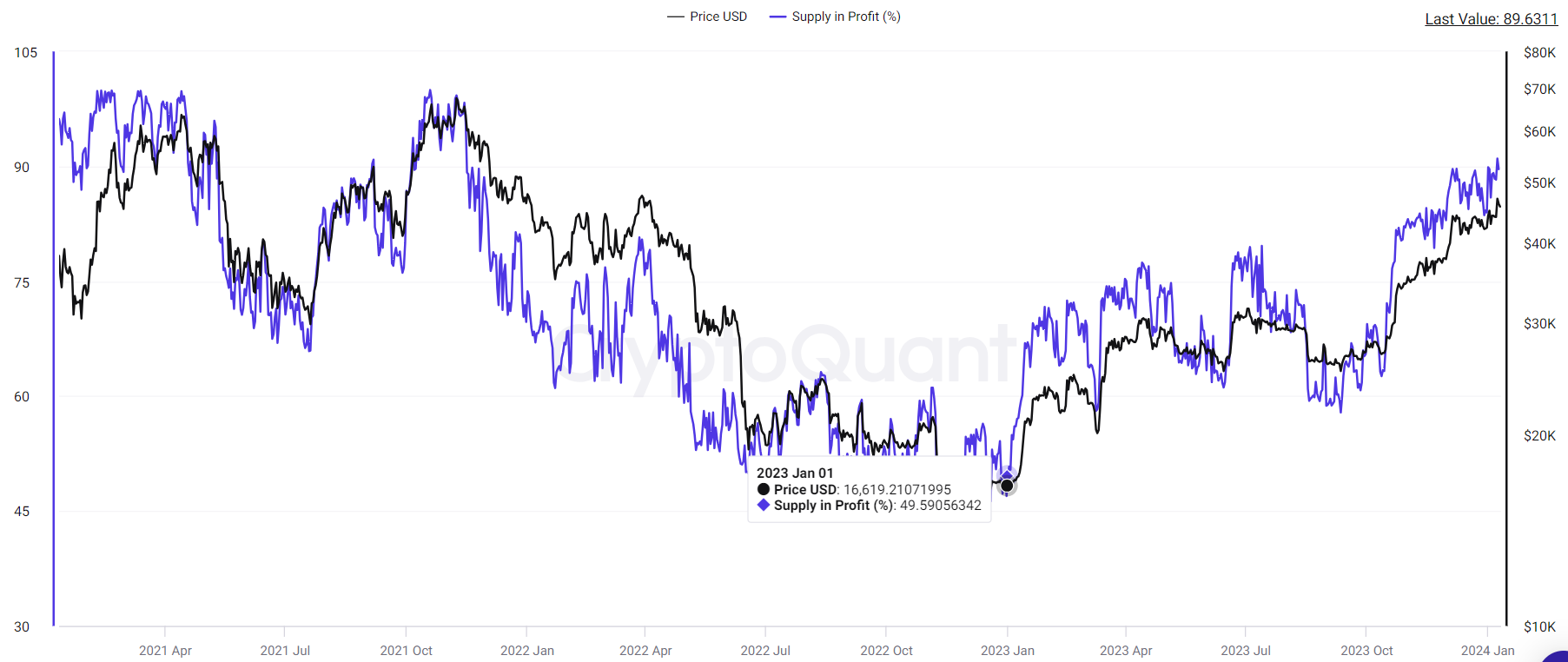

- Less than half of Bitcoin holders were in profit at the start of 2023, CryptoQuant reveals.

- A report warns that Bitcoin reaching $48,500 could trigger a market correction, with support levels at $34,000 and $30,000.

A wave of optimism has swept through the Bitcoin market, with 90% of holders now sitting comfortably in profit territory. This surge comes amidst rising anticipation for the approval of a U.S. spot Bitcoin exchange-traded fund (ETF), a potential catalyst for further price appreciation.

Following the false announcement of a spot Bitcoin ETF approval posted on a hacked U.S. SEC Twitter account, Bitcoin prices surged to a 19-month high, reaching $47,900, only to experience a brief dip to $45,100. Despite this brief market turbulence, more than 970K addresses are currently in profit, with BTC trading at around $45,600 at the time of writing.

Notably, data from CryptoQuant reveals a dramatic shift in investor sentiment compared to the start of 2023, when less than half of Bitcoin holders were in the black. The price rally, which saw Bitcoin climb almost 160% in 2023 and 50% in the past six months, has effectively brought many long-term investors (HODLers) into profitable positions.

However, amidst the euphoria, a note of caution emerges from CryptoQuant analysts. Their recent report highlights the potential dangers associated with the high concentration of unrealized profits among Bitcoin holders. This, they argue, creates fertile ground for a sharp price correction, even as strong demand for the Grayscale Bitcoin Trust (GBTC) and increasing trading volumes point towards continued optimism for the ETF’s approval.

One scenario outlined by CryptoQuant posits that a Bitcoin price reaching $48,500, the average unit price for holders with a 2-3 years investment horizon, could trigger a market correction. In such an event, potential support levels lie between $34,000 and $30,000, marking a potential decline of 10-20%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.