- SEC Twitter account compromised, falsely announces Bitcoin ETF approval.

- Lawyers suggest investigating the SEC for potential market manipulation and violations of its own cybersecurity rules.

- Rejecting pending applications after expediting the process could be unprecedented, as per securities lawyers.

The U.S. Securities and Exchange Commission (SEC), tasked with upholding market integrity, finds itself in the position of possibly having to investigate itself for market manipulation following a chaotic Tuesday in the crypto world.

Lawyers are suggesting an investigation into the SEC by the SEC after a fake spot Bitcoin ETF approval news on the regulator’s X account sent Bitcoin’s price soaring, only to plummet when declared a hack. Aside from potential market manipulation, the SEC could also be facing violations of its own rules on “cybersecurity risk management.”

The saga began early Tuesday morning when a seemingly official SEC post proclaimed the greenlighting of the first-ever spot Bitcoin ETF. This sent shockwaves through the crypto market, with Bitcoin’s price surging from $46,700 to nearly $48,000 before crashing back down to $45,695 as the SEC and Chair Gary Gensler quickly clarified the SEC’s X account was compromised and the message was fraudulent.

ETF Analyst James Seyffart noted, however, that the price swing may not have been significant. “Everyone was mostly expecting an approval,” Seyffart emphasized. He believed the manipulator screwed up and could have made way more money tweeting about rejection and going short.

Adding to the controversy is the SEC’s historical stance on Bitcoin ETFs. Despite numerous applications, the agency has yet to approve a single one, citing concerns about market volatility and investor protection. This history makes Wednesday’s scheduled ruling on several pending ETF applications even more intriguing.

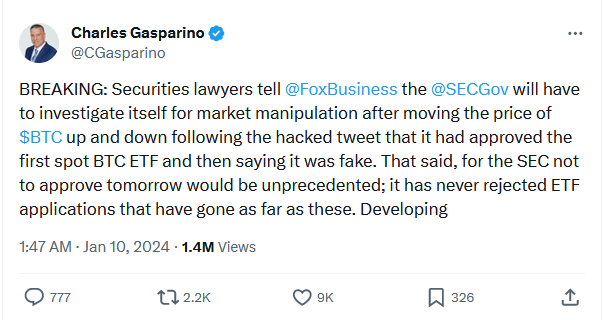

Industry experts believe the SEC is now in a bind. As Fox Business correspondent Charles Gasparino pointed out, citing lawyers involved in the matter, rejecting these applications after expediting the process with applicants would be unprecedented.

Despite this, fears of a Bitcoin crash have intensified due to the looming possibility of a denial of spot Bitcoin ETF filings. Crypto analyst Scott Melker has highlighted the risk of a potential Bitcoin pump-and-dump scenario as investors anxiously await the SEC’s decision.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.