- Zcash’s delisting risk from Binance raises deeper concerns over crypto privacy norms

- Despite active development, Zcash faces pressure as privacy coins lose exchange favor

- Bearish RSI and MACD suggest ZEC may struggle if $30 support level fails to hold

Zcash (ZEC), an early privacy-focused cryptocurrency, faces potential delisting from Binance. Its inclusion in the exchange’s second “Vote to Delist” program triggered strong community backlash and renewed discussion about privacy’s role in crypto.

While voting remains open until April 16, 2025, but Binance’s final decision rests on internal checks like liquidity and development activity.

Including Zcash for vote raised concerns, voiced by figures like Gemini Co-Founder Tyler Winklevoss, about exchanges sidelining privacy tech. Crypto advocate Zooko tagged Binance CEO Richard Teng, arguing Zcash’s inclusion is unjustified.

What’s the Community’s Case for Keeping Zcash Listed?

Zooko, a crypto enthusiast, suggests Zcash stands out for its pioneering role in privacy technology. It introduced zk-SNARKs, a zero-knowledge proof protocol now used in many blockchain applications, including Binance itself.

He argues that removing Zcash would be ironic, if not hypocritical. Supporters highlight that while other exchanges like Coinbase, Gemini, and Kraken continue to list ZEC, Binance appears to be sidelining privacy-oriented projects.

Besides its technical contributions, supporters stress Zcash defends digital rights by offering transaction privacy in an era of growing surveillance, arguing its delisting sends a negative signal about valuing privacy.

What Do Zcash (ZEC) Price Charts Show

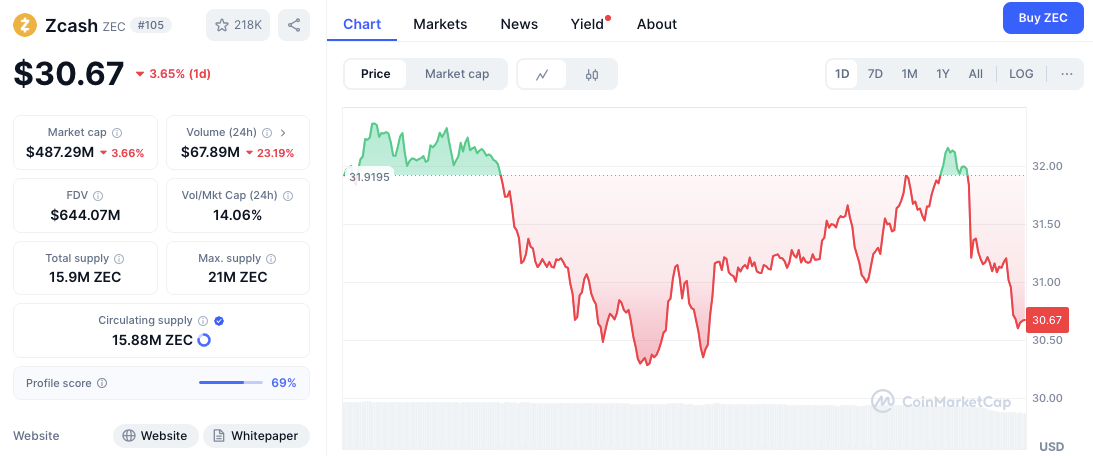

Despite strong community support, Zcash’s price action reflects investor uncertainty. As of press time, ZEC trades around $30.90, down 2.86% over the past 24 hours. The token saw intraday highs slightly above $32 but couldn’t sustain them. That failed breakout signals persistent bearish pressure.

Support has formed near the $30.20 level, which held up several times throughout the day. Another psychological support sits at $30. If that level breaks, more downside could follow. Resistance is clearly marked at $31.50 and again near the $32.10 range, where bullish attempts were previously rejected.

Looking at indicators, the Relative Strength Index (RSI) is currently at 35.37, which leans bearish. It’s above oversold territory but below neutral, indicating weak buying pressure. Meanwhile, the MACD has produced a bearish crossover. The histogram also turned negative, confirming fading momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.