- 52,410 addresses bought 4.81B MATIC in the $0.9 to $1 range recently.

- A strong support zone that could protect MATIC from new lows has formed.

- MATIC is currently trading hands at $1.09 after a 3.29% price increase.

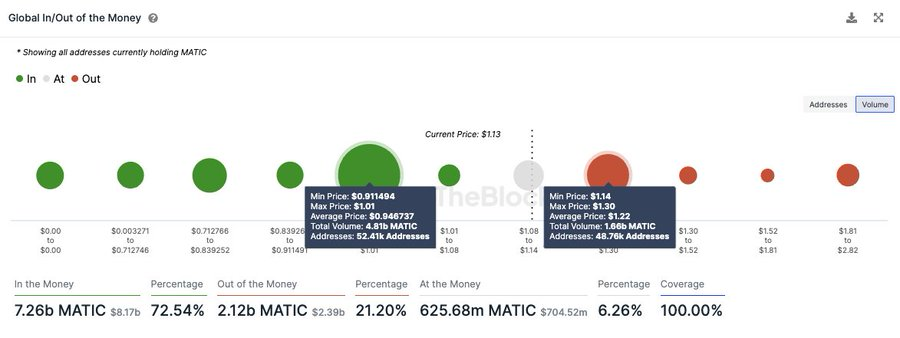

The well known crypto trader, Ali (@ali_charts), took to Twitter this morning to share some new insights about Polygon (MATIC). According to the analyst’s tweet, about 52,410 addresses bought 4.81 billion MATIC in the $0.9 to $1 range. This resulted in a strong support forming which could prevent MATIC’s price from reaching new lows in the immediate future.

The analyst added in the post that in order for MATIC to break out, the altcoin will have to tackle the next resistance level between $1.14 and $1.30. Data included in Ali’s tweet indicated that about 48,760 addresses hold 1.66 billion MATIC around this resistance.

At press time, MATIC is one of the many top 10 cryptocurrencies trading in the red. CoinMarketCap shows that MATIC is currently trading hands at $1.09 after a 3.29% price increase over the last 24 hours. During this time period, MATIC was able to reach a high of $1.13, but at press time, the altcoin is trading at its 24-hour low of $1.09.

Looking at MATIC’s weekly performance, the altcoin’s 24-hour price drop has dragged its negative weekly performance further into the red. Currently, MATIC’s price is down by more than 5% over the last seven days. MATIC’s 24-hour trading volume is currently in the green zone, and stands at $262,743,802 after a more than 1% increase.

The crypto’s market cap of $10,086,794,591 means that MATIC is ranked as the 9th biggest crypto. This places it right behind Dogecoin (DOGE) in the 8th position and in front of Solana (SOL) which is ranked 10th.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.