- Sub-Saharan Africa’s crypto market received a $117.1 billion influx amid historically low transaction volume.

- Chainalysis reveals Nigeria leads crypto adoption in the African market.

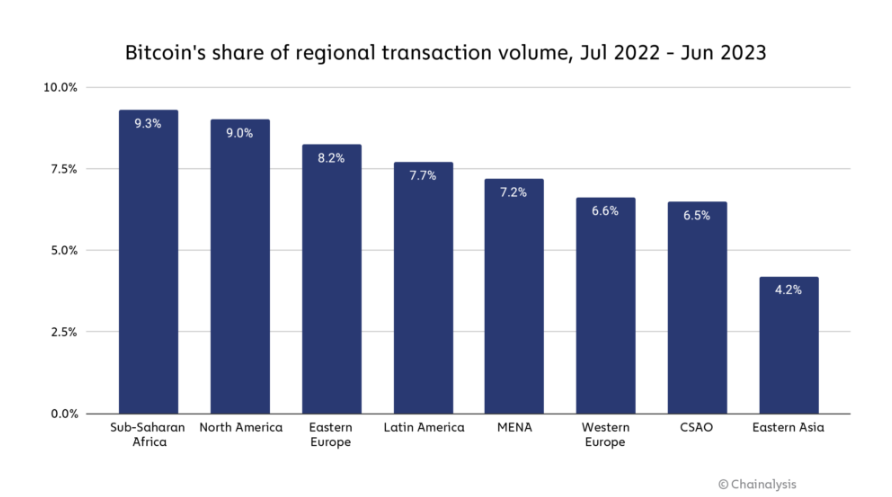

- The report disclosed that the African market led Americans, Europeans, and Asia in Bitcoin regional transaction volume.

A recent report by blockchain security research firm Chainalysis revealed that crypto has made significant inroads into key markets in Sub-Saharan Africa, emerging as both an inflation mitigation strategy and a popular trading vehicle.

Chainalysis noted that the region witnessed an influx of approximately $117.1 billion in on-chain value between July 2022 and June 2023. Meanwhile, it argued that the influx was despite Sub-Saharan Africa historically having the smallest crypto economy among all regions, accounting for just 2.3% of global transaction volume.

Chainalysis disclosed that Sub-Saharan Africa led North America, Eastern Europe, Latin America, the Middle East, Western Europe, and Eastern Asia in Bitcoin regional transaction volume.

Furthermore, the report highlighted that centralized exchanges were the dominant trading platforms, facilitating over half of all transaction volume across the entire region. Moreover, it stated that Sub-Saharan Africa’s crypto market appeared predominantly driven by retail investors. Unlike other regions, a higher share of transaction volume occurs in transactions valued under $1 million.

However, a deeper analysis revealed that crypto had firmly embedded itself in key markets within Sub-Saharan Africa, with Nigeria being a standout example. In particular, Nigeria ranked second on Chainalysis’ Global Crypto Adoption Index and led the region in raw transaction volume.

Other countries in the region that feature on the adoption index include Kenya, Ghana, and South Africa.

The report delved into the reasons behind the surge in crypto adoption in Sub-Saharan Africa, emphasizing the role of Bitcoin as a dominant player. It argued that Sub-Saharan Africa had the highest proportion of Bitcoin transaction volume compared to other regions. According to Chainalysis, the situation suggested that residents were turning to Bitcoin as a digital store of value.

Besides, the research firm highlighted that the region grappled with rising inflation and debt levels, making cryptocurrencies appealing for preserving savings and achieving greater financial autonomy.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.