- Pantera Capital plans to invest $200M in AI-blockchain projects by 2030, highlighting confidence in the sector’s growth.

- Despite Nvidia’s recent market cap drop, AI-crypto continues to attract major investments, signaling market potential.

- NEAR Protocol shows a bullish bias among top traders, although increased long position liquidations suggest market risks.

AI-crypto projects are set to surpass their $25 billion market cap, demonstrating resilience amidst market volatility. CoinMarketCap’s research lead, Alice Liu, highlighted the sector’s strong growth potential, dismissing concerns of an AI bubble. According to DL News, the market has attracted $750 million in investments this year. Projections suggest AI and crypto could contribute $20 trillion to the global economy by 2030.

Pantera Capital’s Bold Bet on AI-Blockchain

Pantera Capital plans to invest over $200 million in AI-blockchain projects by 2030. This move underscores the industry’s long-term growth potential. Despite recent market fluctuations, the AI-crypto market remains a key focus for major investors, signaling continued interest in this innovative space.

However, recent tech stock sell-offs, led by chipmaker Nvidia, sparked renewed fears of an AI bubble. Nvidia’s market capitalization dropped by $250 billion, reflecting broader investor concerns. Nevertheless, Liu maintains that the AI-crypto sector still “has a lot of room for growth,” suggesting that the market’s potential far outweighs short-term setbacks.

NEAR Protocol Faces Mixed Market Signals

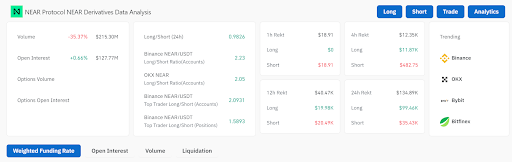

NEAR Protocol’s price is $3.79, with a 24-hour trading volume of $157.2 million. It has declined by 2.07% in the last 24 hours, with a market cap of $4.25 billion. The circulating supply is 1.12 billion NEAR coins. The derivatives market shows a 35.37% decrease in trading volume, although open interest rose slightly by 0.66%.

Long/short ratios on Binance and OKX show a bullish bias, with top traders favoring long positions. Despite this, liquidation data reveals heightened risks for long positions, with $99.46K in liquidations in the past 24 hours. The key trading platforms include Binance, OKX, Bybit, and Bitfinex.

Internet Computer (ICP) Trading Activity Declines

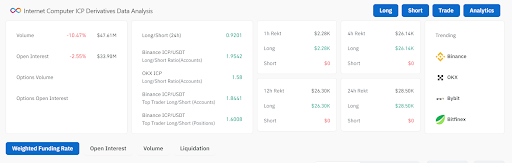

Internet Computer (ICP) trades at $7.33, experiencing a 3.86% decline in the past 24 hours. Its market cap is $3.44 billion, with a circulating supply of 469.8 million ICP coins. Derivatives data shows trading volume down by 10.47%, and open interest fell by 2.55% to $33.9 million.

Long/short ratios indicate a slight bullish sentiment. Binance’s long/short ratio stands at 1.9542, while OKX’s is at 1.58, suggesting more traders are betting on price increases. Liquidations of $28.5K were recorded in long positions, indicating market volatility. Leading trading platforms include Binance, OKX, Bybit, and Bitfinex.

Fetch.ai Market Remains Volatile Amid Decreased Trading Volume

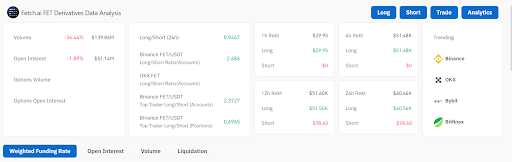

Artificial Superintelligence Alliance (FET) is priced at $1.09, with a 4.27% drop in the last 24 hours. It has a market cap of $2.73 billion and a circulating supply of 2.52 billion FET coins. The derivatives market shows a 36.44% decline in trading volume, with open interest dropping by 1.89%.

The long/short ratio is balanced at 0.9467, although Binance traders display a bullish bias. However, liquidation data reveals $60.56K in longs and $98.60 in shorts were liquidated, highlighting some volatility. Binance, OKX, Bybit, and Bitfinex remain the top exchanges for FET trading.

Render Token (RNDR) Lacks Clear Market Sentiment

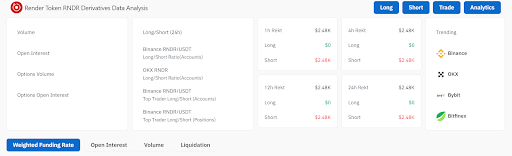

Render Token (RNDR) is valued at $4.77, with a 24-hour trading volume of $50.7 million. The token is down 2.45% in the last 24 hours, with a market cap of $1.87 billion. The circulating supply stands at 392.5 million RENDER coins.

Derivatives data shows shorts being squeezed, with $2.48K in short liquidations across various time frames. However, key metrics like trading volume, open interest, and long/short ratios are missing, complicating market sentiment analysis. Binance, OKX, Bybit, and Bitfinex are the primary exchanges for RNDR trading, though further data is required for a comprehensive market overview.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.