- Algorand’s potential alliance with Cardano strengthens security and cross-chain value transfer.

- Mutual benefits and shared rewards are vital for the Algorand-Cardano partnership.

- ALGO’s price surge, backed by RSI and ROC indicators, suggests sustained market optimism.

The crypto community is buzzing with the prospect of a partnership between Algorand and Cardano. Such an alliance could see Cardano’s L1 pool operators doubling up as validators for Algorand. Moreover, Algorand might then relay settlement transactions onto Cardano’s L1 for chain validation.

Hence, the idea is not just about partnership but the potential benefits for both networks. By maintaining its quick transaction processing speed and consensus mechanism, Algorand could benefit from additional security. Additionally, with the joint validator force, both chains could witness enhanced security. Their shared interest in upholding the chain’s integrity could be a vital unifying factor.

Besides, if both networks decide to create bridges, Cardano could see increased liquidity. Using L1 validators, such bridges could seamlessly transfer value between both ecosystems. Therefore, the combined strengths and enthusiasm of the Algorand and Cardano communities might lead to a united crypto space, driving innovation across the board.

Concerns and Optimism

However, every proposal comes with its set of challenges. Some members of the Cardano community express concerns regarding the potential added responsibilities for Cardano’s stakeholders. Ensuring that economic benefits remain balanced is critical. Hence, to address these concerns, a distinct reward mechanism seems necessary. Such an approach would incentivize stakeholders from both sides to actively participate, making the partnership mutually beneficial.

Additionally, while the concept promises enhanced security through shared validation, the reliability of validators across the networks remains a point of contention. Skeptics underline the need to ensure honesty and dependability to prevent potential vulnerabilities.

The primary goal remains clear as discussions continue: maximizing the partnership’s benefits while addressing concerns. Such a partnership signifies how blockchain ecosystems can come together for shared innovation.

Algorand’s Market Momentum

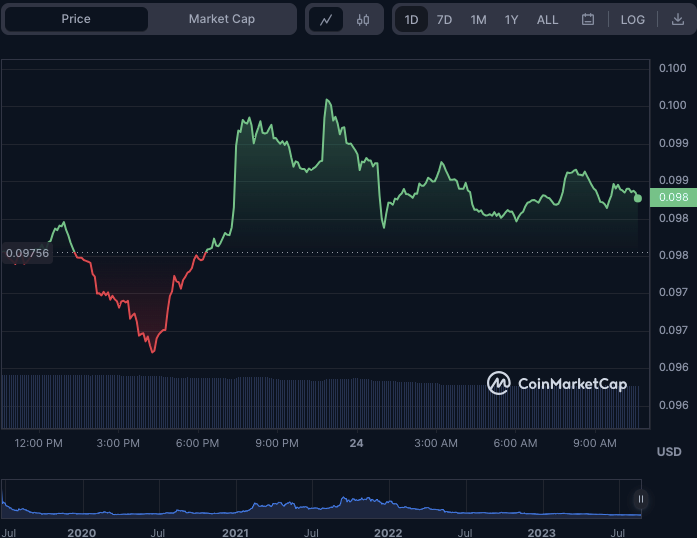

Algorand (ALGO) has witnessed significant market momentum in light of these discussions. Despite a brief dip, bullish sentiments pushed ALGO’s price to a high of $0.09959 before encountering resistance. At the time of reporting, ALGO stands at $0.09839, marking a 1.07% increase from its intra-day low.

If the bullish momentum persists and surpasses the $0.09959 resistance, the next mark to watch could be around $0.102. Conversely, any downward push below the $0.09619 support could point toward the next support level at $0.093.

During this bullish phase, Algo’s market capitalization saw a 1.11% jump to $769,781,016. However, its 24-hour trading volume experienced a 20.63% dip, settling at $23,311,849.

The ALGO’s bullish momentum persists with the Relative Strength Index (RSI) at 54.20. This RSI level indicates that buying pressure remains in the market. However, traders should exercise caution since a plunge below the RSI’s 50 level might signal a move towards negative sentiment.

Adding to the bullish momentum trajectory, the Rate of Change (ROC) is heading higher with a value of 3.90, indicating that the ALGO’s price is experiencing strong momentum. This movement suggests that the pace of price increases is accelerating.

As a result, traders may view this as evidence of the market’s sustained bullishness. However, if the ROC begins to fall and go into negative territory, it might indicate a possible reversal in the current trend.

In summary, Algorand’s soaring momentum, fueled by the potential Cardano partnership, highlights the power of collaboration in blockchain. Despite challenges, a united innovation could reshape the crypto landscape.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.