- The year 2023 has proved to be a positive one for all cryptocurrencies.

- Altcoins have shown a surge of 64% whereas BTC’s dominance has been down by 16%.

- Bitcoin (BTC) has been up by 4.4% in the last 24 hours.

The beginning of 2023 has proved positive, with Bitcoin being up by 3.9% and Ethereum being up by 0.9% in the last 24 hours. According to CoinGecko, the global cryptocurrency market cap has increased by 1.9% in the last 24 hours.

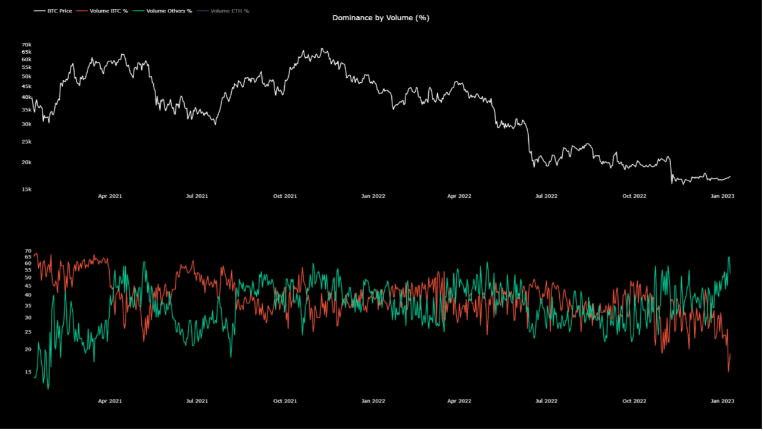

Apart from the increase in BTC and ETH, the market has also seen a surge in altcoin volume dominance. The volume has hit the highest of 64%, which has not been noticed since 2021.

The altcoin volume dominance is an indicator that calculates the proportion of a specific coin’s trading volume to the overall volume on the cryptocurrency market.

However, as compared to altcoins, Bitcoin’s dominance has decreased. It means that people are losing interest in trading Bitcoin. In other words, people find trading in altcoins more lucrative than in Bitcoin, which can be concerning for Bitcoin leading to its fall.

According to CryptoQuant’s valuation metrics, BTC and ETH started the year within an undervalued territory. BTC’s dominance has been at its lowest point at 16%, which is the lowest point since 2021.

The chart above shows the dominance by volume, and it can be seen that Bitcoin has seen a downtrend of 16% compared to altcoins.

A CryptoQuant analyst states, “That’s impressive on its own, but please notice how Altcoin Dominance usually leads to lower prices, while sustainable rallies start with high Bitcoin Dominance. The chart included is a high-timeframe one, where this principle is very well shown.”

However, it is important to note that any price movement which starts will altcoins can be unstable. Whereas a rally with Bitcoin being first followed by Ethereum and altcoins proved to be more stable and healthy.

A massive fall in Bitcoin can be expected if this trend continues, leading to its bear run. However, it is also true that it may not be as intense as the market has witnessed in the past.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.