- Chainalysis released the yearly analysis of the illicit crypto transaction volume.

- The platform declared that the illicit transaction volume has reached an all-time high of $20.1 billion.

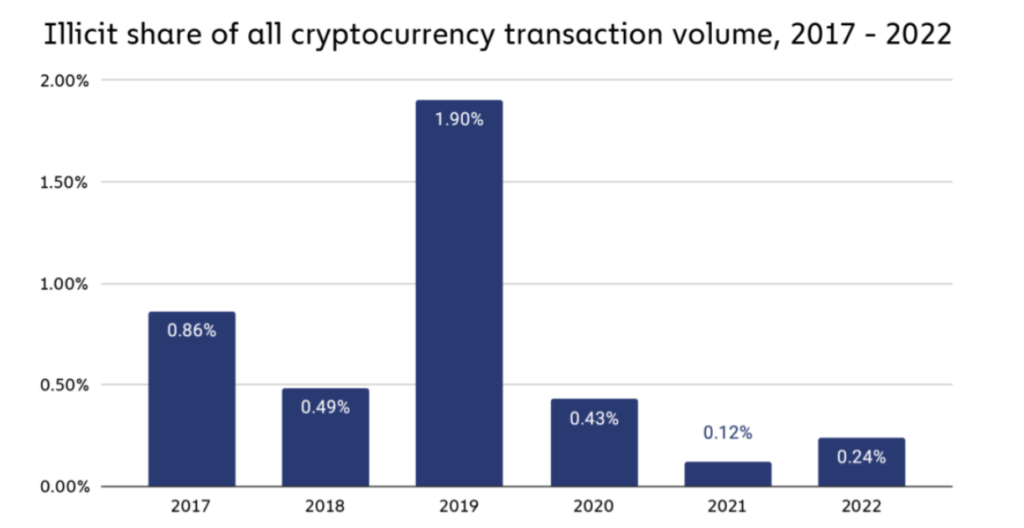

- All the shares of activities related to crypto illicit activity have risen to 0.24% in 2022.

The blockchain data analyst platform, Chainalysis published its yearly analysis of illicit activities declaring that the illicit transaction volume rose to an all-time high of $20.1 billion in 2022. The platform added that the crypto activities connected to illicit activity have “risen for the first time since 2019, from 0.12% in 2021 to 0.24% in 2022.”

Chainalysis tweeted that the illicit activity in crypto remains a small share of overall volume at less than 1%.

Notably, the platform invited the attention of the crypto community to the 44% of 2022’s illicit transaction volume that came from the activities associated with sanctioned entities, citing the example of the crypto exchange Garantex.

Chainalysis also addressed the role of new crypto scams in the rise of illicit activity, commenting:

Last year we published that we found $14 billion in illicit activity in 2021 — we’ve now raised that figure to $18 billion, mostly due to the discovery of new crypto scams.

In previous years, the crypto scams took “in less revenue during bear markets,” mainly because of the pessimistic nature of the users. In addition, they were less confident in the scammers’ promises of high returns at times of crypto winters.

However, the rate of the crypto scams through which the scammers stole huge amounts of funds rose 7% year over year, indicating a more vulnerable state of the crypto space.

Further, the platform shared a chart representing the yearly analysis of the illicit share of all cryptocurrency transaction volume from 2017 to 2022. From the chart, it’s clear that “crime as a share of all crypto activity is still trending downwards”.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.