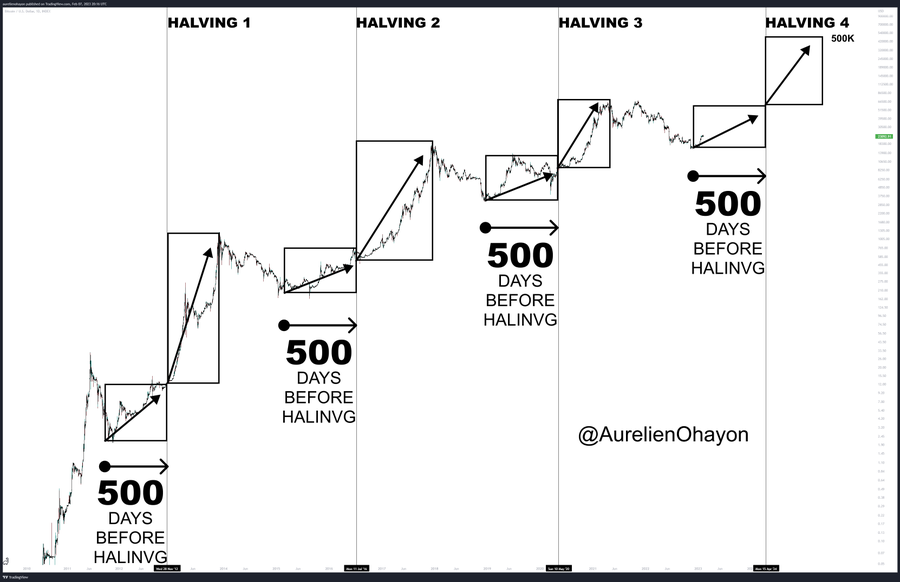

- Historical data indicates that 500 days before a BTC halving, the price of the crypto goes up.

- Many believe it is still way too early to tell what exactly will happen to the BTC price.

- BTC is trading hands at $24,040.47 after a 3.77% decrease in price.

The crypto market leader Bitcoin (BTC) is one of the many cryptocurrencies in the red for today. On the other hand, a crypto analyst confidently took to Twitter earlier this month to share his thoughts on BTC and what the price of the crypto king could do soon.

In the post, the analyst stated that the “Bitcoin bull run begins.” He based his beliefs on historical data that indicates that 500 days before a BTC halving the price of the crypto goes up. He then continued by stating that after the halving, BTC’s price has increased even more.

Since it was posted, there have been some mixed responses to the post. Some people adamantly agree that the price of the crypto king will surely go up, but one Twitter user believes people should be a bit more cautious when it comes to the BTC price going up. The crypto enthusiast is of the belief that it is still way too early to tell what exactly will happen to the BTC price before the halving.

CoinMarketCap indicates that BTC is trading hands at $24,040.47 after a 3.77% decrease in price over the last 24 hours. BTC also reached a high of $25,126.85 and a low of $23,959.81 over the same time period. The crypto is, however, still in the green by more than 8% over the last week.

BTC’s 24-hour trading volume is in the green zone and currently stands at $33,284,881,505 after a more than 19% increase since yesterday. In terms of market cap, BTC stands at $464,042,923,881.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.