- An analyst shared DOGE’s key support and resistance levels on Twitter.

- The demand wall at $0.075, where 44 thousand addresses hold more than 34 billion DOGE, is still holding.

- The memecoin is currently worth about $0.07582 after a 6.20% drop in price.

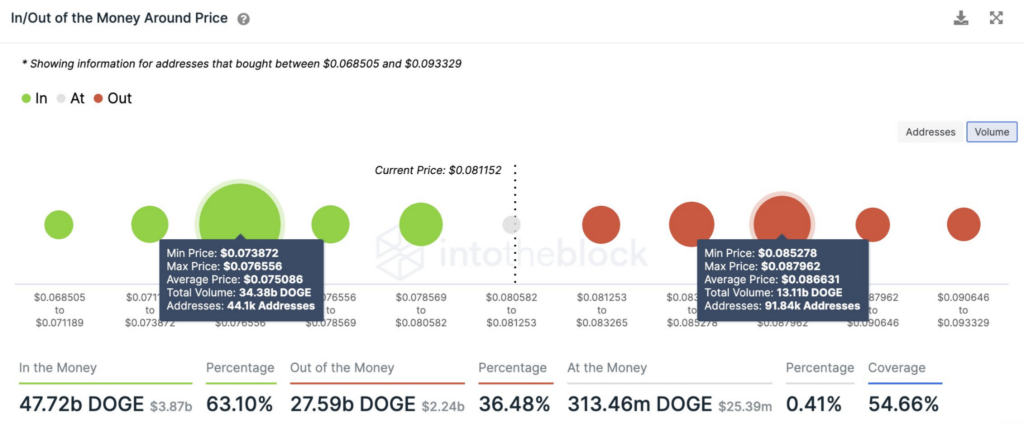

On March 2, a crypto analyst took to Twitter to share the key support and resistance levels for the meme coin Dogecoin (DOGE). According to this post, the support level for DOGE was at $0.075, where 44k addresses held about 24.40 billion DOGE coins. The most significant resistance area was around $0.086, where 92k addresses hold 13 billion DOGE tokens.

Earlier this morning, the same analyst posted on Twitter once again to update the crypto community about these important levels for DOGE. According to the most recent post, the demand wall at $0.075, where 44 thousand addresses hold more than 34 billion DOGE, is still holding.

CoinMarketCap indicates that DOGE is currently one of the many cryptos trading in the red heading into the weekend. The meme coin is currently worth about $0.07582 after a 6.20% drop in price over the last day. DOGE also managed to reach a low of $0.07424 and a high of $0.08084 over the same time period.

In addition to this, DOGE also weakened against Bitcoin (BTC) and Ethereum (ETH) by about 1.82% and 1.66% respectively over the last day. The meme coin’s poor performance over the past day impacted its weekly performance as DOGE is in the red by more than 10% over the last seven days.

DOGE’s 24-hour trading volume is in the green zone at the moment and now stands at $545,409,515 after a more than 130% increase since yesterday. DOGE’s market cap of $10,061,206,521 makes it the 9th biggest crypto.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.