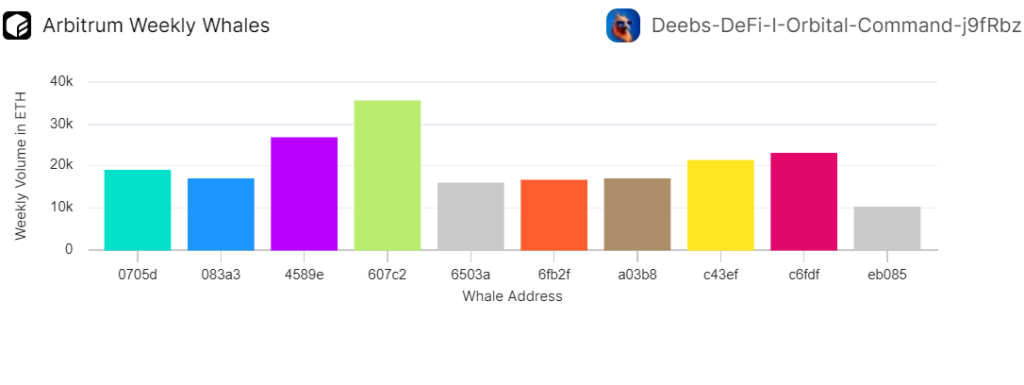

- The ETH whales exhibited a massive increase in trading volume by 120%.

- The hike resulted from the whales’ tendency to increase their activities, as they are nearing the ARB airdrop.

- Arbitrum’s trading volume also surged by almost 32%, reaching $4.34 billion.

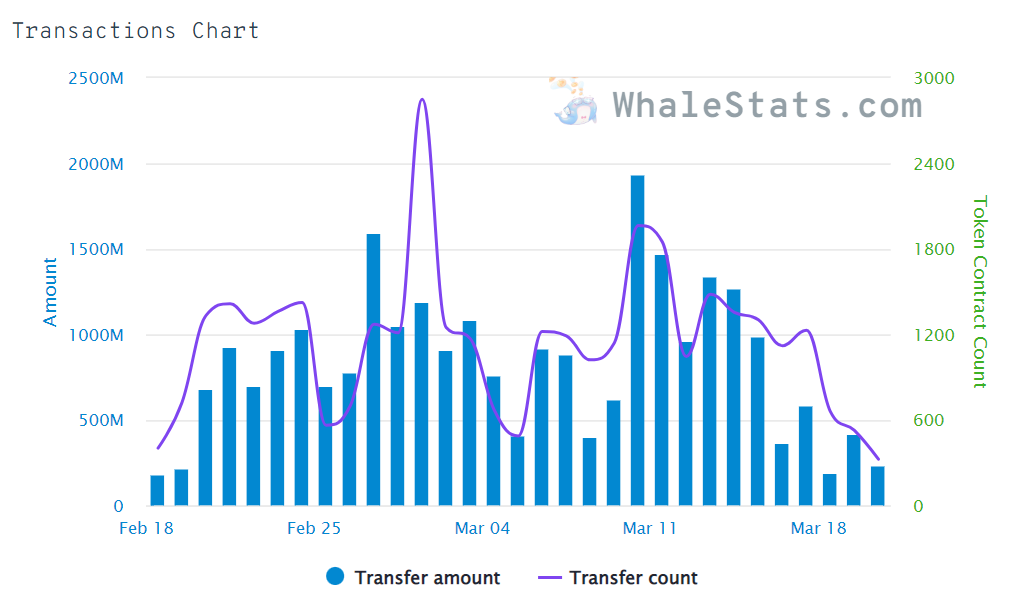

According to a recent analysis, the transaction volume of the Ethereum whales has increased following the popular Ethereum scaling solution Arbitrum’s announcement on the airdrop of its new token ARB.

Notably, the data from the analytical platform WhaleStats, the ETH whales transaction volume had undergone a massive surge of almost 120%, with a sudden hike from $185.7 million to $408.8 million.

Previously, on March 16, the Arbitrum Foundation announced in a post that the $10 billion ARB tokens of the platform would be airdropped to the community’s wallets as scheduled on March 23.

Following the announcement, the Arbitrum Decentralized Exchange (DEX) trading volume exhibited a substantial increase of almost 32% reaching currently at $4.34 billion. The current trading volume of the DEX is at a new two-week high, overpowering the trading volume of the leading platform BNB Chain.

Supposedly, the increasing trading volume resulted from the tendency of the large whales to increase their trading activities, corresponding to the airdrop announced by the Arbitrum. As predicted by the experts, there is a significant probability of massive liquidity following the airdrop.

Miles Deutscher, an on-chain analyst shared a Twitter thread commenting that the ARB token airdrop would “act as a stimulus for the Arbitrum ecosystem,” with an outcome of accessing additional liquidity.

It is noteworthy that the blockchain creator Offchain Labs’ CEO Steven Goldfeder commented that the most exciting part of the platform’s new move is decentralization. He pointed out that the Offchain Labs would “no longer have any control over the future of this chain.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.