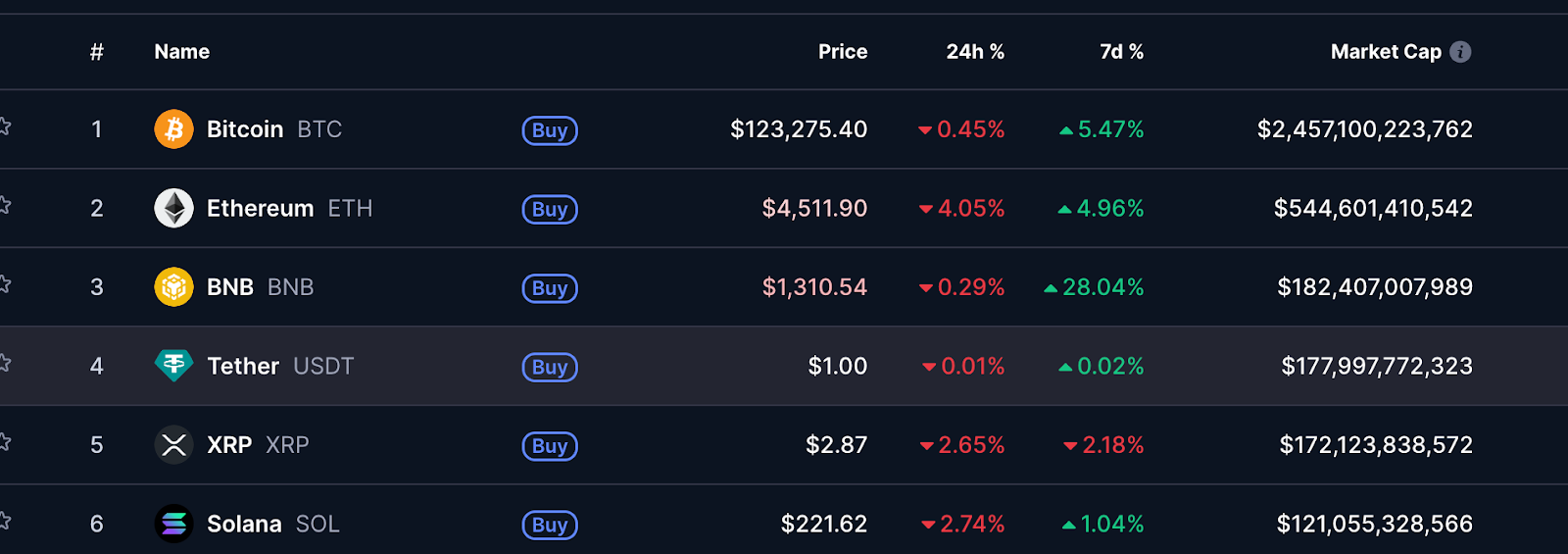

- BNB hit a record $1,330, flipping XRP and leading the market higher.

- Altcoins cooled while Bitcoin slipped 1.4% to $122,732 as derivatives overheated.

- Analysts expect a brief pullback before another leg up toward $130K.

BNB extended its strong rally on Tuesday, soaring to a new all-time high above $1,330 and surpassing XRP to become the third-largest cryptocurrency by market capitalization.

The Binance-backed token has climbed 27% in the past week and is now up 129% over the last year, driven by increased institutional participation and rising activity on the BNB Chain.

Related: Crypto Rally Alert: ETH and SOL Lead While Bitcoin Eyes $200K

Corporate Buying Adds Fuel

The latest surge was amplified by CEA Industries Inc., a publicly traded firm that disclosed holdings of 480,000 BNB tokens worth approximately $611 million. The company acquired the tokens at an average cost of $860 each, representing a total investment of about $412.8 million.

CEA, which aims to own 1% of the total BNB supply by the end of 2025, has become the largest corporate holder of the asset. CEO David Namdar described the milestone as a sign of growing market validation. “BNB’s all-time highs show that global markets are waking up to the value and scale of this ecosystem,” he said.

Institutional Demand and BNB Chain Growth Fuel Momentum

Analysts credit BNB’s rise to both institutional buying and growing on-chain engagement. The BNB-based perpetual futures exchange Aster has seen a surge in trading volumes, attracting new users to the BNB Chain.

“BNB’s recent rally has been largely driven by increased on-chain activity and institutional interest,” said Illia Otychenko, lead analyst at CEX.IO. The token’s strong fundamentals, combined with Binance’s ecosystem expansion, have positioned it as a leading driver of the current crypto cycle.

Broader Market Cools as Bitcoin Pulls Back

While BNB keeps climbing, the wider crypto market saw a pause in momentum. Bitcoin briefly touched a new high above $126,000 before slipping 1.4% to trade at $122,732. Other major altcoins, including XRP, Dogecoin, ADA, and Avalanche (AVAX), recorded losses between 3% and 5%.

Market watchers pointed to a familiar pattern. After every major breakout, Bitcoin tends to face a rapid correction. Analysts noted that the derivatives market has become overheated following a 16% jump in Bitcoin prices since late September.

According to Jean-David Péquignot of Deribit, Bitcoin could retest the $118,000–$120,000 range before another leg up toward $130,000 later in the year.

Vetle Lunde of K33 Research added that last week’s trading data showed the largest Bitcoin accumulation of 2025, with over 63,000 BTC, worth about $7 billion, added across ETFs and futures markets, signaling short-term market froth.

Long-Term Confidence Remains Strong

Despite short-term volatility, long-term sentiment remains positive. Cosmo Jiang, General Partner at Pantera Capital, said over 60% of global investors still do not hold cryptocurrency, suggesting significant room for adoption.

He believes the focus is now shifting from Bitcoin legitimization to altcoin expansion, with Ethereum and Solana leading the next phase of growth.

Related: Bitcoin Analyst Sees $175K as Only a ‘Blip’ Before $400K Cycle Peak

Analyst Benjamin Cowen predicts the global crypto market capitalization, currently around $4.29 trillion, could approach $10 trillion within a few years. Morgan Stanley analysts recently advised investors to allocate up to 4% of their portfolios to cryptocurrencies, citing their growing legitimacy and adoption.

FAQ

Q1: Why is BNB surging right now?

BNB’s surge is driven by institutional accumulation, increased activity on the BNB Chain, and broader recognition of its ecosystem value.

Q2: What does this mean for Altcoins?

Altcoins are experiencing a short-term cooldown following recent gains, but analysts expect renewed momentum as institutional and retail adoption expands.

Q3: Could Bitcoin (BTC) rise next?

Yes. Analysts expect a dip to $118K–$120K before a rally toward $130K as funding settles and flows rebuild.

Q4: Is it too late to invest in Altcoins?

Experts say it isn’t too late, as adoption remains relatively low and new regulatory clarity could support long-term growth.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.