- ATOM’s price dropped 7.26% over the last 24 hours.

- The price of ATOM has dropped below the daily 9 and 20 EMA lines.

- The relative positions of the daily 9, 20 and 50 EMA lines suggests bullish sentiment.

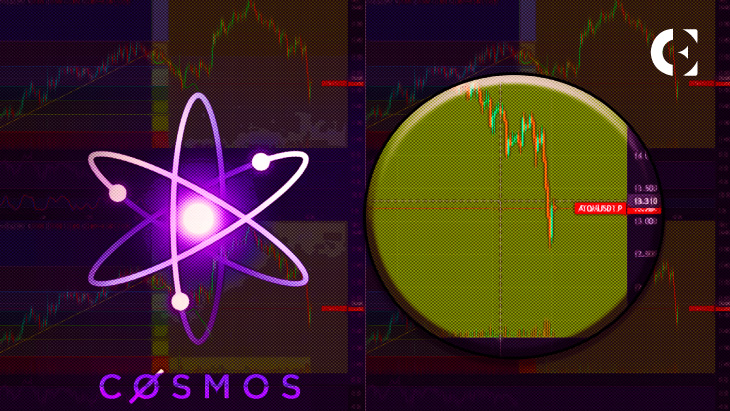

Cosmos (ATOM) is trading at $13.23 at press time after a 7.26% drop in price over the last 24 hours according to CoinMarketCap. It has also weakened against the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH) by 2.66% and 2.14% respectively.

After reaching a daily high of $14.63, ATOM’s price retraced down to $12.73 before recovering slightly. Daily trading volume for the altcoin has risen 46.42%, taking the total volume for the last 2 hours to $407,993,923 at press time.

The price of ATOM entered into a bullish move around the 21st of October that saw its price rise from a low of $10.917 to a high of $15.814 on November 5th. Shortly thereafter it was met with some resistance that brought its price down to close at $15.380.

Since then, ATOM’s price has been in a 3-day negative sequence that has forced its price to break below the daily 9 and 20 EMA, then briefly below the daily 50 EMA before searching for, and receiving, support from the daily 50 EMA.

The positioning of the daily 9, 20 and 50 EMA relative to each other is a bullish sign that investors should take note of. Currently, the 9 EMA is above the 20 EMA, and the 20 EMA is above the 50 EMA. The positioning of these EMA lines suggests that this retracement is a brief liquidity accumulation move before another leg up will take place.

This bullish thesis is valid as long as ATOM’s price is able to maintain its current placement above the daily 50 EMA. Additional confirmation will be if ATOM’s price is able to close above the daily 20 EMA line today.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.