- AVAX’s collaboration with Amazon Web Services fuels more demand, driving up prices.

- The price of AVAX is up to $16.38 a new monthly high, thanks to bullish pressure.

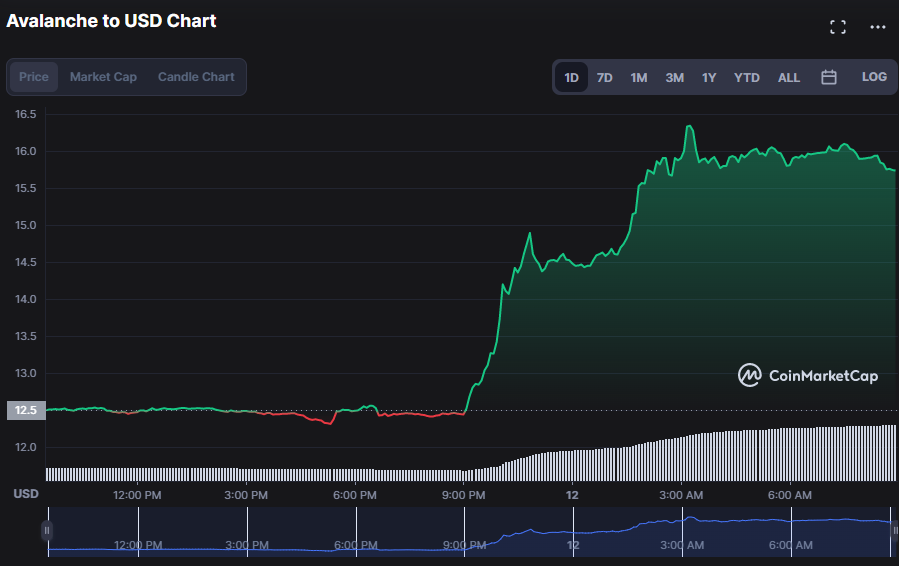

- As the market finds support at $12.32, the force of the bears is neutralized.

The Avalanche (AVAX) market has witnessed a positive uptick due to the company’s recent partnership with the cloud-computing platform Amazon Web Services (AWS), which aims to increase the widespread usage of blockchain technology.

As of press time, the strong trend in the Avalanche market had successfully lifted the AVAX price by 22.60% to $15.30.

As a result of the partnership, AWS will provide support for Avalanche’s infrastructure and decentralized apps, which will enhance demand for AVAX and boost the cryptocurrency’s popularity. It was due to this excitement that the market capitalization surged by 25.96% to $4,907,422,927 and the 24-hour trading volume jumped by 350.62% to $1,055,828,197.

The bullish trend on the AVAX market has bulls aiming to breach the $16.38 resistance level. As this is the most bullish jump so far this month, it is likely at its greatest point now. The next levels of resistance might be around $16.75 and $17.25 if bullish dominance holds, with $15.50 and $15.00 serving as possible support levels. If bullish sentiment were to wane, however, and bears gained control of the market, prices may drop to $14.00 and $13.50 in a descending pattern, forming a bearish flag.

The stochastic RSI’s drop below its signal line to 79.16 alarms traders since it suggests AVAX is overbought and may reverse. As traders expect prices to fall, this might cause a sell-off.

The trend has been growing for 78.57% of the study period, while the trend has been falling for 42.86% of the sample time, according to the Aroon up. This indicates that the AVAX market now has a strong positive signal, and that this trend is likely to continue. To profit from this potential trend, an investor should consider going long.

The Bull Bear Power (BBP) value of 2.09 indicates bulls dominate the AVAX market, but its trend is south, indicating a market correction. BBP 2.09 indicates significant but declining purchasing demand. Investors should keep an eye on the market and be ready to react fast if the bears take over and prices fall.

Ultimately, in order to extend the positive trend, AVAX bulls must boost prices in order to reinforce support and attract new investors.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.