- Axie Infinity released 21.5 million AXS tokens during the token unlock event.

- The tokens were released on 24 October, after the vesting period.

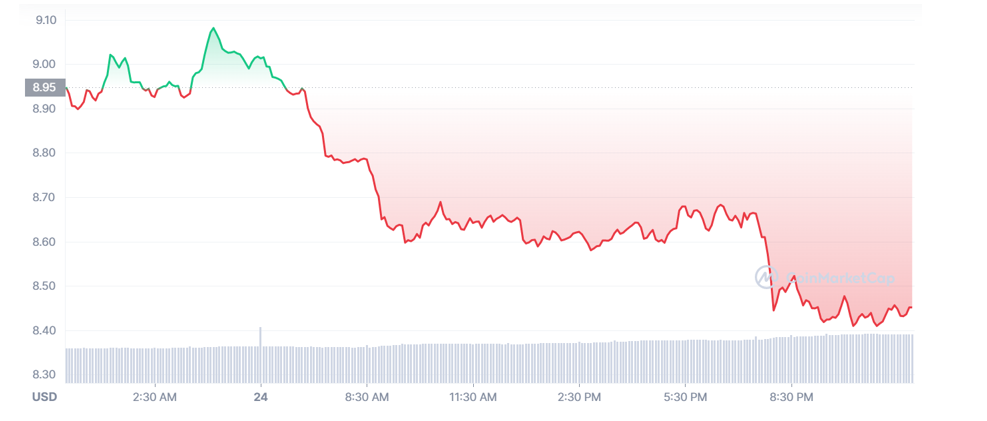

- The market movements following the token unlock led the company to serious selling pressures.

Axie Infinity, the NFT-based video game platform, released 21.5 million AXS tokens regarding the token unlock event, which led to considerable sell pressure on the token.

According to the data released by TokenUnlocks, 21.5 million tokens were released on 24 October, after the vesting period. These tokens were released as inflationary tokens, taking into account the losses the company had faced during its bearish period.

As per the details provided by TokenUnlocks, almost half of the unlocked tokens were released for providing to the members of the developer team, advisors, and early investors. The rest of the tokens, almost 11 million, were intended for future staking rewards, play-to-earn rewards, and ecosystem funds.

As during the vesting period, the early investors and insiders are required to hold their funds without selling them for a reasonable period of time, there arise serious selling pressures when the tokens get unlocked and investors sell their holdings.

Following the prior unlocking event, the AXS price dropped as pointed out by a community member in a tweet. According to Etherscan, Arca, the digital asset firm, received $4 million while taking part in an AXS private sale on October 24.

Similarly, another investor received an amount of $1.7 million and moved it to the Binance account. Consequently, the platform had been struggling through these market movements by which AXS fell to a 90-day low of 8.21 on October 24.

Though after the fall of the price, the coin managed to bounce back slightly, with the current trading price of $9.16, it had not been able to show a significant rise. Notably, the current price of the coin depicts a 26% fall from its last month’s price.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.