- Bitcoin ETFs saw inflows of 5,572 BTC, led by ARK21Shares, indicating rising institutional interest in the asset.

- Ethereum ETFs received 22,921 ETH in capital inflows, with Grayscale contributing the largest portion, signaling cautious optimism.

- Bitcoin’s futures markets showed increased activity with higher open interest and liquidations, reflecting market volatility.

Institutions are piling into Bitcoin and Ethereum, with fresh capital flooding into ETFs. Analyst Lookonchain flagged the massive inflows, a bullish signal that suggests big players are feeling confident despite the market’s recent choppiness.

From data, ten Bitcoin ETFs added a net inflow of 5,572 BTC, valued roughly $370 million. ARK21Shares led the pack, with an inflow of 1,743 BTC worth $115.7 million, bringing its total holdings to 47,599 BTC, valued at $3.16 billion.

Similarly, nine Ethereum ETFs saw inflows totaling 22,921 ETH, valued at $61.66 million. The Grayscale Ethereum Mini Trust contributed 10,365 ETH, worth $27.88 million, bringing its total to 390,385 ETH, valued at $1.05 billion.

Bitcoin Gains as Investors Seek a Hedge

Bitcoin’s price stands at $66,050.66, reflecting a 1.16% increase over the past 24 hours. Trading volume surged to $35.97 billion, with a market cap of over $1.3 trillion. The circulating supply of Bitcoin is 19,759,646 BTC, inching closer to its maximum limit of 21 million.

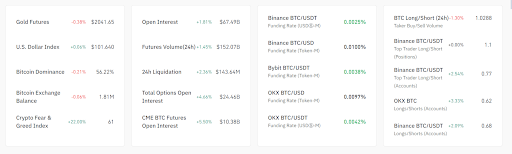

Bitcoin’s dominance in the market decreased by 0.21%, and exchange balances fell by 0.06%. This suggests that more users are withdrawing their BTC from exchanges to hold it themselves. Meanwhile, the Crypto Fear and Greed Index jumped 22 points, indicating rising optimism among traders.

Traditional assets like gold futures dipped by 0.38%, while the U.S. Dollar Index rose slightly by 0.06%. These shifts suggest that investors may be increasingly turning to Bitcoin as a hedge.

Bitcoin’s futures markets showed increased activity, with trading volumes up by 1.45% and open interest rising by 1.81%. Also, a 2.36% increase in liquidations points to higher market volatility. Binance, Bybit, and OKX showed varying funding rates, reflecting mixed sentiment toward long positions.

CME Bitcoin futures open interest also rose by 5.50%, signaling increased participation from institutional investors. This uptick underscores Bitcoin’s growing appeal among larger market players, even with uncertain market conditions.

Ethereum Sees Cautious Market Movements

Ethereum’s price also climbed 1.44% over the last 24 hours to reach $2,686.63. Its trading volume hit $16.93 billion, with a market cap standing at $323.37 billion. Ethereum’s circulating supply totals 120,363,208 ETH coins.

Read also: Ethereum ETF Shows Bullish Signs, Inflows Near 3-Day Streak

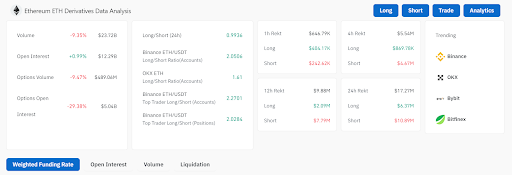

However, Ethereum’s derivatives market showed more mixed results. Trading volume dropped by 9.35% to $23.72 billion, and open interest only increased slightly by 0.99% to $12.29 billion. And options trading saw significant declines, with volume dropping 9.47%, and open interest falling by 29.38%.

Liquidations Hint at a Possible ETH Price Turnaround

Ethereum’s liquidations in the past 24 hours amounted to $17.27 million, with short positions taking the biggest hit, totaling $10.89 million. This indicates an unexpected upward price movement in Ethereum.

Looking at the long/short ratio, it stands balanced at 0.9936 across the market, though Binance’s data shows a stronger bias toward long positions among top traders, with ratios exceeding 2.0. This suggests cautious optimism among traders, who are getting ready for possible price recoveries despite decreased trading volumes.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.